[ad_1]

Nastassia Samal/iStock through Getty Photographs

The pivotal labor market knowledge

The payrolls knowledge reported on the primary Friday of every month is at all times essential, and it often units the tone for the remainder of the month. Thus, the inventory market often has a major response to the payrolls report.

The payroll report for April, final month, was actually a pivotal report, which units the stage for the Might payroll report. The S&P 500 entered the month of Might in a 5% dip territory, and the expectations have been that the Fed wouldn’t be chopping rates of interest considerably in 2024 as a result of beforehand robust labor market knowledge and the “scorching” inflation readings in 2024.

The precise payroll knowledge for April was nicely beneath expectations, with 175K jobs new jobs created in opposition to the expectations of 243K. Additional, the wage progress was additionally beneath expectations at 0.2% MoM. Thus, the market began to cost the Fed reduce sooner than beforehand anticipated, as rates of interest fell, and the S&P 500 roared again to new all-time highs in early Might.

Technically, the 2Y Futures (US2Y), the 10Y futures (US10Y), and the S&P 500 (SPX) all breached the 20-day shifting common on Might third when the payrolls have been reported. Right here is the chart of 2Y Treasury futures, with the set off to the upside on the job’s day, Might third. The height was reached proper after the Might fifteenth CPI knowledge, and the breakdown was reached after the surprisingly robust flash PMIs on Might twenty third.

2Y Futures (Barchart)

The 2Y Treasury futures at the moment are on the 20-day DMA stage ready for the Might payrolls report, and this stage particularly implies that there’s about 60% chance that the Fed will reduce in September.

The Might labor knowledge expectations

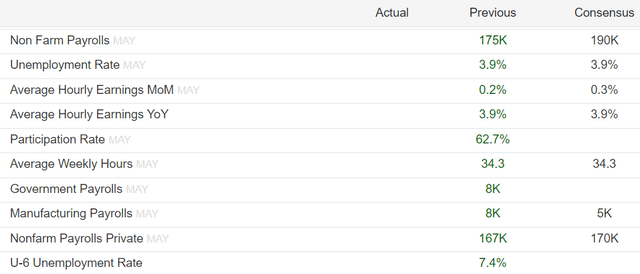

The consensus market expectations are that the labor market will likely be barely stronger in Might, in comparison with April, however nonetheless weaker than what it was in the course of the first quarter of 2024.

Particularly, the market expects that there will likely be 190K new jobs created, with the unemployment fee staying at 3.9%, however with stronger wage progress at 0.3% MoM.

The Might expectations (Buying and selling Economics)

Let’s attempt to predict the quantity

Clearly, the flexibility to foretell the precise quantity, versus the expectations, could be an amazing benefit in buying and selling the S&P 500 over the close to time period.

So, what do we all know in regards to the latest state of the labor market, that may assist us predict the precise quantity? First, let’s return to the April report and consider the place the weak spot was.

Authorities jobs: The federal government created solely 6K in April, which was nicely beneath the extent in earlier months (72K in March, 55 in February). This quantity alone accounts for the distinction between the precise and anticipated. Leisure and Hospitality: This cyclical sector created solely 5K new jobs in April, nicely beneath the 53K new jobs created in March.

So, the query is whether or not the weak spot in these two sectors may also proceed in Might?

Second, let us take a look at some key early knowledge that would predict the Might payrolls knowledge.

Weekly claims for unemployment: the preliminary claims spiked to 232K on Might 4th, however this was the height, because the numbers declined the next weeks, suggesting that there’s some weak spot within the labor market, however typically the labor market stays tight. The S&P International US Composite PMI was launched on Might twenty third, and this can be a flash report, or the primary knowledge estimate for Might. The PMI quantity got here very robust at 54.4, nicely above expectations, suggesting that each service and manufacturing exercise picked up in Might. With respect to the employment state of affairs, the reported famous:

Regardless of ongoing job cuts, the tempo of employment decline slowed as companies confirmed elevated confidence within the coming 12 months and noticed higher order e book intakes.

Be aware, as beforehand mentioned, the S&P International US Composite PMI launch on Might 23 was the important thing set off, as this steered that the Might knowledge will likely be stronger than the April knowledge, which brought on rates of interest to extend, and the inventory market to fall.

With respect to the employment state of affairs, the S&P International US Composite PMI additionally suggests that there’s some weak spot within the labor market, however the state of affairs is bettering.

Thus, given what we all know from these studies, it’s affordable to count on the payroll quantity to come back barely above 175K.

Nonetheless, the theme of “robust Might” is already going through a severe problem. Particularly, the ISM manufacturing for Might declined greater than anticipated, and the brand new orders fell to 45 – that is recessionary. But, the employment quantity got here at 51, nicely above expectations. Be aware, the 2Y yield spiked after the ISM manufacturing report, because the market is beginning to worth a potential recession, as steered by the brand new orders.

Thus, for my part, there’s a higher chance of a detrimental shock or a sub-175K precise quantity – given the wealth of weaker than anticipated knowledge. In consequence, my prediction for payrolls is 150K, and an uptick within the unemployment fee to 4%.

Implications

The primary a part of the problem is to foretell the precise payroll knowledge. The second half is to foretell the inventory market response.

Let’s begin with the idea that the precise quantity will likely be barely weaker than anticipated, probably at 150K. On this state of affairs, the 2Y Treasury futures will rise, that means short-term rates of interest will fall. The long-term rates of interest will fall as nicely, because the bond market would begin pricing a slowdown, and finally a recession.

The S&P 500 (SP500) may on this state of affairs 1) sharply fall resulting from the next chance of a recession, or 2) rise as rates of interest fall, in expectations of Fed cuts.

My opinion is that on this state of affairs is that the S&P 500 would fall. Normally, the inventory market falls with the primary rate of interest reduce, if it alerts an imminent recession, which I feel is the case within the present state of affairs.

This thesis is supported by the response to the ISM manufacturing report on June third, the place the economically delicate Russell 2000 (IWM) reversed the opening positive factors and fell, in addition to the Dow Jones (DIA). The S&P 500 (SPY) additionally fell however closed greater as a result of meme-mania spreading to megacaps, and particularly Nvidia (NVDA). Nvidia can not preserve the whole market up endlessly, and finally this bubble will burst as nicely.

There may be loads of knowledge till Friday, and the state of affairs may change. Extra importantly, the payrolls will likely be adopted by the CPI report, and the worst-case situation is that the labor market weakens (as I count on), however inflation fails to reasonable, which is at present a consensus given the 0.3% anticipated improve in core CPI for Might. Sadly, the information is pointing on this course – stagflation.

[ad_2]

Source link