[ad_1]

On this article

Everyone knows that one one who purchased a property for a worth that appears unfathomably low-cost by right now’s requirements, reminiscent of $50,000, and it’s now value $350,000. It’s loopy to suppose that simply 50 years in the past, median residence costs had been proper round $24,000.

Right now, the median residence worth is over $456,000, in keeping with the Division of Housing and City Improvement. In 50 years, property costs have elevated by almost 14x.

This is sufficient to get anybody to purchase actual property and to turn out to be rich, proper? Nicely, not precisely. The numbers I’ve proven you to this point are nominal residence costs, that means they haven’t been adjusted for inflation. However as buyers, we wish to perceive how our cash is rising relative to our spending energy, and for that, we have to use actual housing costs.

Adjusting House Costs for Inflation

On this context, “actual” simply means “inflation-adjusted.” Whenever you modify actual property costs for inflation, the expansion seems a lot much less spectacular. Property values are nonetheless going up however in a a lot much less dramatic method.

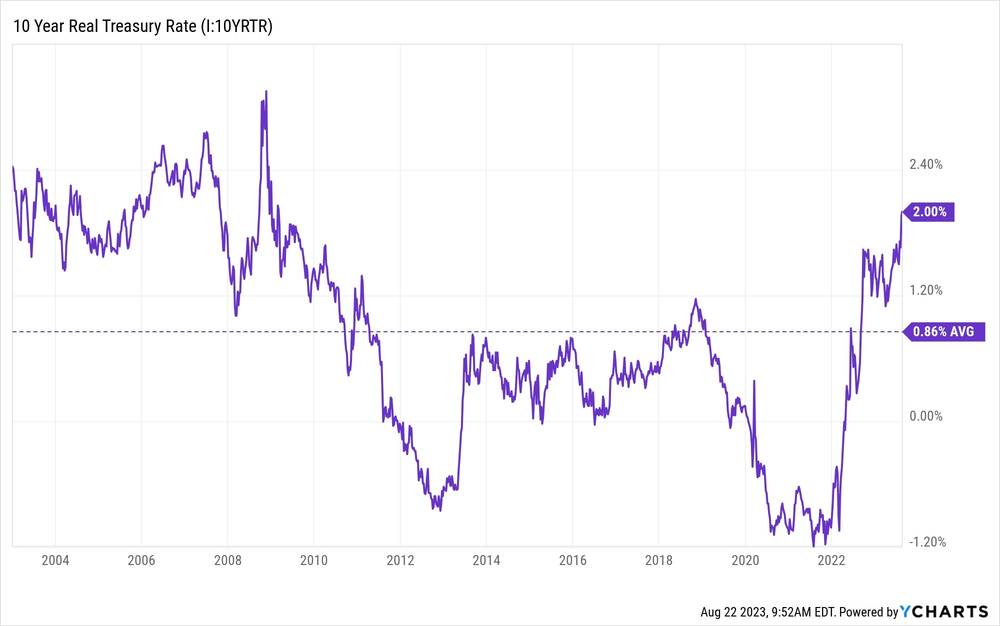

Regardless of the impressive-looking run-up in housing costs during the last 50 years, the typical actual progress fee of property values is simply 1.8%. Getting 1.8% in your cash above inflation just isn’t dangerous, nevertheless it’s not nice both. Think about the truth that Over the past 20 years, the true yield on 10-year U.S. Treasuries is 0.86%. This implies you might do just about nothing together with your cash and get comparatively near the true progress fee of property values.

After all, this straightforward evaluation of residence costs doesn’t paint the complete image of returns that you just get from investing in actual property. It doesn’t think about leverage, amortization, money stream, value-add, or lots of the tax advantages that come from actual property investing.

Value Development is Not as Vital as We’re Led to Imagine

To me, all of this knowledge exhibits that property costs will not be what drive actual returns for actual property buyers. This knowledge underscores the significance of not relying on appreciation to make your offers work. That is significantly true in right now’s unsure financial local weather. In case you have a look at this graph of actual property worth progress charges over time, you’ll be able to see that there are a lot of durations of destructive progress.

Actual property progress is way from sure! Over the past a number of years, in an ultra-low rate of interest atmosphere, it was affordable to imagine worth appreciation above and past inflation, at the very least for a number of years. Personally, I believe these days are behind us. Given excessive charges and excessive ranges of financial uncertainty, appreciation is falling again to what it was traditionally: a superb inflation hedge, a flooring to your returns, and a possible bonus for those who spend money on the suitable areas.

Ultimate Ideas

Don’t get me flawed, I search for offers which have robust appreciation potential, nevertheless it’s not smart to rely on appreciation to drive your returns. You want money stream, value-add, and amortization to function your fundamentals, and for those who expertise some actual appreciation in your property, that’s simply gravy. As this knowledge exhibits, appreciation just isn’t at all times as highly effective because it seems.

Prepared to reach actual property investing? Create a free BiggerPockets account to study funding methods; ask questions and get solutions from our neighborhood of +2 million members; join with investor-friendly brokers; and a lot extra.

Be aware By BiggerPockets: These are opinions written by the writer and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]

Source link