[ad_1]

The “brief strangle” (to not be confused with the “strangle” or the “lengthy strangle”) is an choices commerce the place the dealer sells a name choice and sells a put choice of the identical expiration.

Each the decision choice and the put choice are out-of-the-money.

It’s known as the brief strangle when these choices are being bought.

It’s known as the lengthy strangle when these choices are being purchased.

The expiration danger graph of the brief strangle and lengthy strangle are flipped pictures of one another.

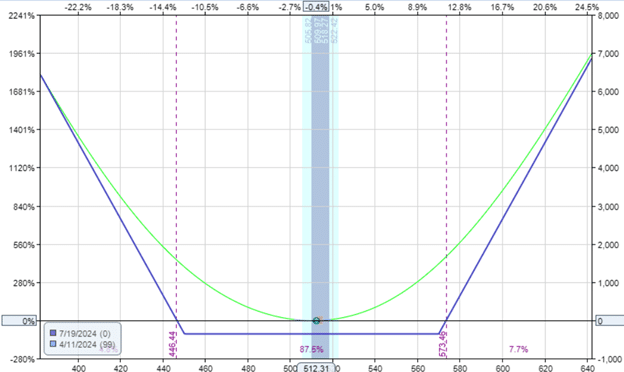

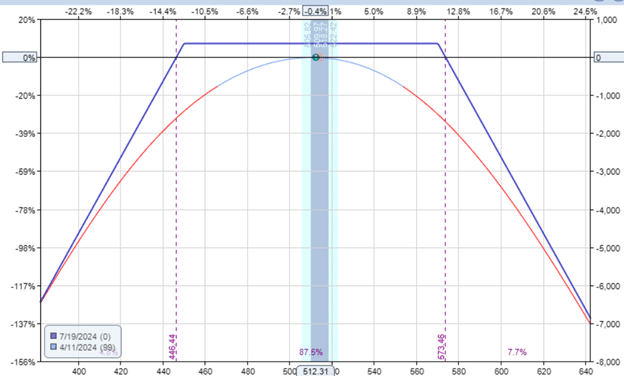

It is a graph of the lengthy strangle:

The next is a graph of the brief strangle:

Contents

Immediately, we’re speaking in regards to the brief strangle, which I choose over the lengthy strangle.

The reason being that I usually like to promote choices to gather on the premiums moderately than shopping for choices.

The choices vendor has the advantage of time decay of the choice, whereby if the choice decays in worth over time, the choice vendor income.

This attribute is famous by the commerce having a optimistic theta.

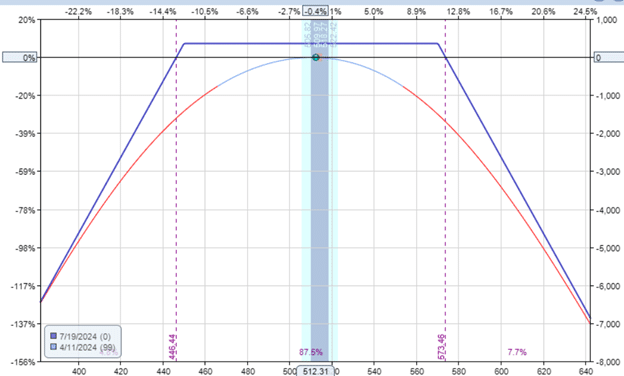

Take a look at the danger graph of the brief strangle. It’s harking back to the form of the iron condor.

This expiration graph of the iron condor reveals that the P&L (indicated on the vertical axis) doesn’t go under the -$1850 loss degree.

The iron condor is an outlined danger commerce with a most loss.

The brief strangle is an undefined danger commerce the place the graph slopes down into destructive P&L on either side with out finish.

For that reason, undefined danger trades are usually not one thing that starting merchants ought to begin with, because the commerce can transfer in opposition to them very quick.

Iron condors would possible be extra appropriate.

The brief strangle consists of a unadorned brief name, requiring a excessive option-level privilege in an account to commerce it.

We are able to, nevertheless, make the brief strangle extra conservative by going additional out in time, like 90 days to expiration.

And plan to exit the commerce earlier than expiration.

Maybe maintain the commerce just for 30 out of these 90 days.

This retains the gamma of the commerce low in order that we’re much less affected by massive market strikes.

As well as, we are going to promote far out-of-the-money on the ten delta on the choice chain.

So, the underlying worth wants to maneuver quite a bit earlier than it reaches our brief strikes.

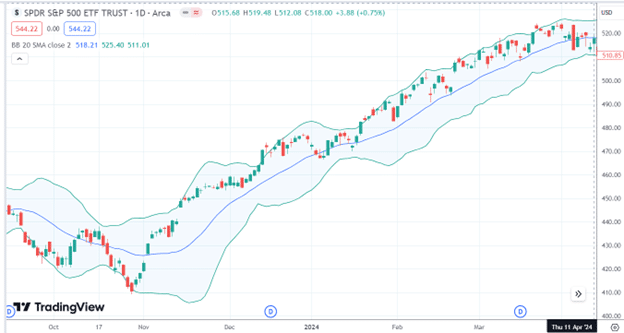

As a result of this can be a non-directional commerce, we wish an underlying that doesn’t make massive swings up or down in worth.

We are going to use the SPY ETF, which consists of 500 shares, and provoke the commerce when the 20-day shifting common is horizontally flat, and the worth is in the course of the Bollinger Bands, similar to on April 11, 2024, for instance:

Supply: TradingView.com

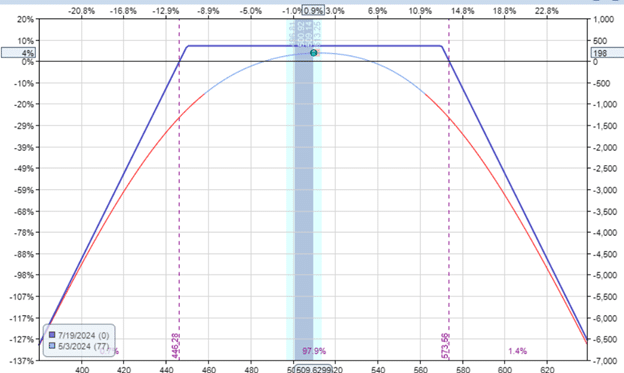

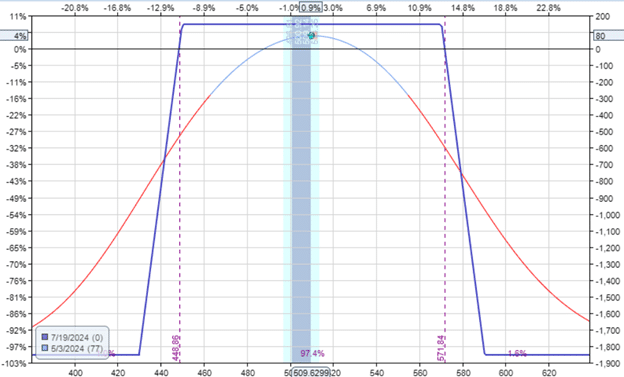

An instance commerce is likely to be the next with 99 days until expiration:

Date: April 11, 2024

Value: SPY @ 512

Promote one July 19 SPY 570 name @ $0.82Sell one July 19 SPY 450 put @ $2.74

Credit score: $355

Delta: -1.5Theta: 8.13Vega: -92Gamma: -1.17Theta/Delta = 5.42

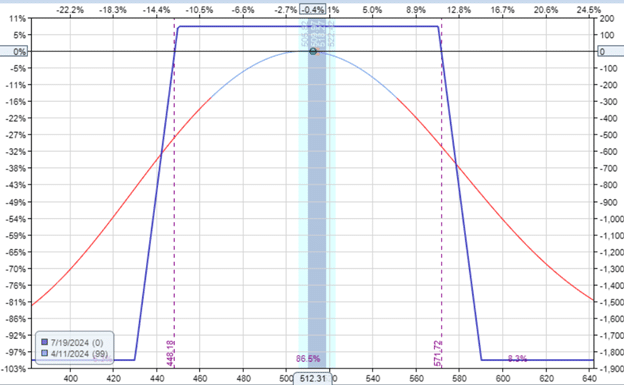

The Greeks of the Iron Condor, with the brief choices on the identical strike and with 20-point huge wings, are:

Delta: -1.36Theta: 2.7Vega: -35Gamma: -0.44Theta/Delta = 2

As anticipated, the iron condor has much less theta, vega, and gamma.

Entry The High 5 Instruments For Possibility Merchants

As a result of the brief strangle has no lengthy choices to cease its potential loss, we have now to mentally decide our cease level earlier than getting into the commerce.

For instance, we’d say that if our greenback loss exceeds twice the {dollars} initially collected, then we exit the commerce – no questions requested.

Since we collected $355 initially if our P&L turns into -$710, we exit the commerce.

For the revenue goal, if our P&L reaches $178 (half of the credit score collected), we take revenue and exit the commerce.

Which means one loss would cancel out 4 successful trades.

For this technique to be worthwhile, we have to win at the least 80% of the trades. So out of ten trades, if we win eight and lose 2, we find yourself even cash.

Merchants who commerce the brief strangle would discover their cease degree, take their revenue degree, and report their win charges to find out what mixture of parameters would work finest for them.

That is when backtesting would turn out to be useful.

Different merchants may additionally add some adjustment methods, similar to closing or rolling one of many choices primarily based on sure triggers.

This instance commerce turned out fairly effectively. At 22 days into the commerce, the revenue goal was reached.

Maybe this commerce received fortunate as a result of SPY ended up practically on the identical spot it began with.

Throughout the identical time-frame, the iron condor made $80.50, or 4.35%, with $1852 of capital in danger.

Have you ever ever puzzled why they name it the “strangle”?

Look once more on the danger graph.

It tapers to turn out to be extra slim – as if somebody squeezed or strangled the graph at that time.

We hope you loved this text on the brief strangle choice commerce.

When you’ve got any questions, please ship an electronic mail or depart a remark under.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who are usually not aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link