[ad_1]

cassp/E+ through Getty Photos

Introduction

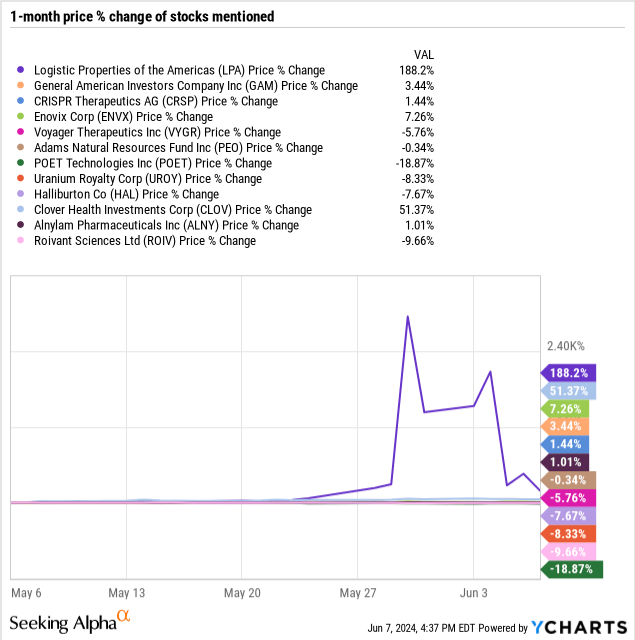

There’s heaps to love in our first weekly version of The “Undercovered” Dozen. We’ll be presenting concepts that have been revealed throughout June 1st – sixth.

Up to now, now we have revealed these articles on a month-to-month foundation, together with:

Shifting ahead, we’re aiming to publish these “undercovered” options weekly to supply extra well timed data and a recurring supply of doubtless new concepts to sift via for our group. So preserve an eye fixed out for these on Fridays, and comply with SA’s Undercovered Dozen Collection to be sure you do not miss a factor.

Right now we lead with a Sturdy Promote article on a ticker receiving first-ever protection. A variety of biotech concepts are referenced, three Sturdy Buys are included, a microcap tech and uranium firm are mentioned, and quite a few tickers included as we speak have not been lined in months on the location.

Check out what a few of these undercovered shares and concepts would possibly maintain for you. And tell us what you suppose under: any of those value following up on?

Click on to enlarge

“Shares of Logistic Properties of the Americas (LPA) skilled excessive volatility after information that it was being added to the Russell Microcap Index. The corporate controls 7.3 million sq. ft of Class A logistics actual property, primarily centered on the e-commerce market. Regardless of potential for development, the inventory is at the moment overvalued and the corporate has excessive leverage and potential points with property in Colombia.

“Odds are, there may be quite a lot of confusion concerning Logistic Properties of the Americas proper now. That is virtually definitely as a result of the corporate is a brand new participant within the public markets. Previous to March twenty seventh of this 12 months, the operations that Logistic Properties of the Americas controls have been beneath a privately held firm often called LatAm Logistic Properties, S.A. Nonetheless, that firm, in addition to two, a Cayman Islands SPAC, whereby each enterprises merged with newly fashioned subsidiaries beneath the brand new enterprise often called Logistic Properties of the Americas.”

Click on to enlarge

“Basic American Buyers Co. Inc. (GAM) is a closed-end fund that invests in a diversified pool of equities of largely large-cap U.S. listed shares. The GAM CEF makes use of practically 12% leverage within the type of most well-liked shares, for which it pays 5.95% in distributions quarterly. GAM’s previous efficiency is stable, particularly the long-term efficiency. In some methods, this fund is a proxy for the S&P 500 Index when it comes to capital appreciation with the advantage of vital revenue, although variable from 12 months to 12 months.

“If historical past is any information, the fund’s distributions, on common, exceed 6%, and something above 6% ought to be handled as a bonus. General, Basic American Buyers Co. Inc. is a good fund for buy-and-hold revenue buyers who don’t want very excessive revenue and would quite make investments for long-term capital appreciation.”

Click on to enlarge

“I final visited CRISPR Therapeutics (CRSP) in January. Recall that CRISPR’s Casgevy is a gene remedy product focusing on transfusion-dependent beta-thalassemia [TDT] and sickle cell illness [SCD]. Casgevy was accredited within the U.S. in December 2023.”General, I’m keen to improve my suggestion from “promote” to “maintain” primarily based on latest valuation adjustment and the corporate’s prudent administration of working bills, which has prolonged their money runway till there may be extra certainty about their market prospects. Nonetheless, potential and present buyers want to pay attention to the speculative nature of investments like CRISPR. This can be an appropriate alternative for a barbell portfolio.”

Click on to enlarge

“Amidst depressed sentiment, the administration staff of Enovix (ENVX) fired on all cylinders within the first quarter of 2024. Key milestones for manufacturing have been reached and Enovix is on monitor to provide and ship its first samples with the EX-1M expertise within the second quarter of 2024 and for Fab2 to be prepared for manufacturing within the second half of 2024.

“Whereas there may be a number of excellent news to have a good time after this earnings report, Enovix nonetheless has numerous execution to get proper earlier than it turns into a number one battery firm. For now, the corporate has managed to construct a product that’s superior to others out there available in the market, construct a manufacturing facility that’s succesful to constructing samples first, after which at scale, and entice the most important smartphone gamers curiosity in sampling these batteries.”

Click on to enlarge

“Voyager Therapeutics, Inc. (VYGR) is a biotechnology firm within the scientific stage, which is targeted on growing novel therapies, largely gene-based therapies, for the therapy of circumstances that alter the nervous system comparable to Alzheimer’s illness (“AD”), amyotrophic lateral sclerosis (“ALS”), Friedreich’s Ataxia, Huntington’s illness (“HD”), Parkinson’s illness (“PD”), amongst others.

“I imagine Voyager Therapeutics, Inc. has supplied sufficient progress of their pipeline to justify the score improve. Not solely have they submitted the VY-TAU01’s IND forward of schedule, but additionally the FDA has granted clearance quickly, which I contemplate a superb signal. The beginning of the scientific trials is a stage that buyers, together with me, have been ready for. So, I’m more than happy to see that it took lower than one month from receiving FDA clearance to the beginning of the trial.”

Click on to enlarge

“Adams Pure Assets Fund (PEO) is a closed finish fund that primarily invests in vitality and pure useful resource shares. This fund is at the moment buying and selling at a 14% low cost to internet asset worth. This fund has been a stable performer with good points of simply over 13% up to now 12 months. I imagine this fund is a perfect approach to put money into among the largest and hottest vitality shares. Plus, you are able to do so whereas proudly owning only one fund, and get all the advantages and lowered dangers that include the diversification that this fund offers.

“I see PEO as a perfect approach to put money into the vitality sector and get diversification and an above-average distribution yield. With long-term vitality demand prone to stay sturdy resulting from inhabitants development, a rising center class in lots of rising market economies, and from the numerous energy wants with AI and different new industries, I view PEO as a robust purchase, particularly on pullbacks.”

Click on to enlarge

“Since my preliminary evaluation of POET Applied sciences Inc. (POET), through which I initiated a BUY score on the inventory, the corporate has skilled a constructive change in notion resulting from a YouTube video from “Ticker Image: YOU”. The video already obtained about 150,000 views and named POET as a probably massive winner within the scorching AI gear market, which led to an explosion in curiosity and buying and selling quantity for the inventory.

“In the meantime, POET raised vital money at this elevated stage for CAD3.07 and CAD2.90, which is 122% and 110% above the pre-video share value and about triple the pricing of the earlier share issuance earlier this 12 months. This capital elevate mitigates probably the most related threat for the corporate in my eyes. Moreover, POET lately achieved an necessary design win from Foxconn Interconnect Expertise within the AI market, which additional validates its expertise and offers the corporate with a robust companion for commercialization. I due to this fact improve my score on POET to a Sturdy Purchase amid the lowered financing threat and improved business views. I do that regardless of the elevated value stage, as to me, the corporate nonetheless has quite a lot of potential.”

The Different 5 Match For Point out

Uranium Royalty: The Most cost-effective Setup In Its Historical past

“We charge Uranium Royalty a maintain whereas noting that valuation appears higher and buyers might make some cash if uranium costs reassert their power.”

Click on to enlarge

Halliburton: Draw back Danger Rising

“Halliburton’s inventory might seem comparatively cheap, however its margins are unlikely to be maintained at present ranges.”

Click on to enlarge

Clover Well being: New Enterprise Mannequin Is A Recreation Changer

“I’m score Clover Well being as a purchase with a value goal of $2.45, implying 120% upside from present ranges.”

Click on to enlarge

Upcoming Pivotal HELIOS-B Knowledge Looms Massive For Alnylam’s Valuation

“Alnylam Prescribed drugs, Inc. is about to launch scientific information from its HELIOS-B examine in late June/early July, and this may have a major affect on the corporate’s share value.”

Click on to enlarge

Roivant Sciences: Executing On Enormous Buyback Program With Extra To Come

“Roivant Sciences’ inventory is undervalued with a market cap of $8.37 billion and $6 billion in money.”

Click on to enlarge

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link