[ad_1]

Merchants,

Prepare for an exciting week with some contemporary buying and selling concepts. On this replace, I’ll break down my thought course of and share my entry and exit plans for my high concepts.

Throughout my newest Inside Entry assembly, I reviewed my trades and executions from final week, together with my high trades and thought course of from Monday to Thursday. For these curious, that’s the one place I totally assessment my trades and executions.

Final week introduced some A+ alternatives, particularly with Tesla on Thursday and Friday, and the selloff within the semiconductor sector, significantly NVDA on Thursday, together with different high swing alternatives equivalent to IWM and XBI on Thursday—a fantastic week to assessment totally.

For the week forward, listed below are my high concepts as of proper now. After all, because the week progresses, new concepts and plans will even come into focus.

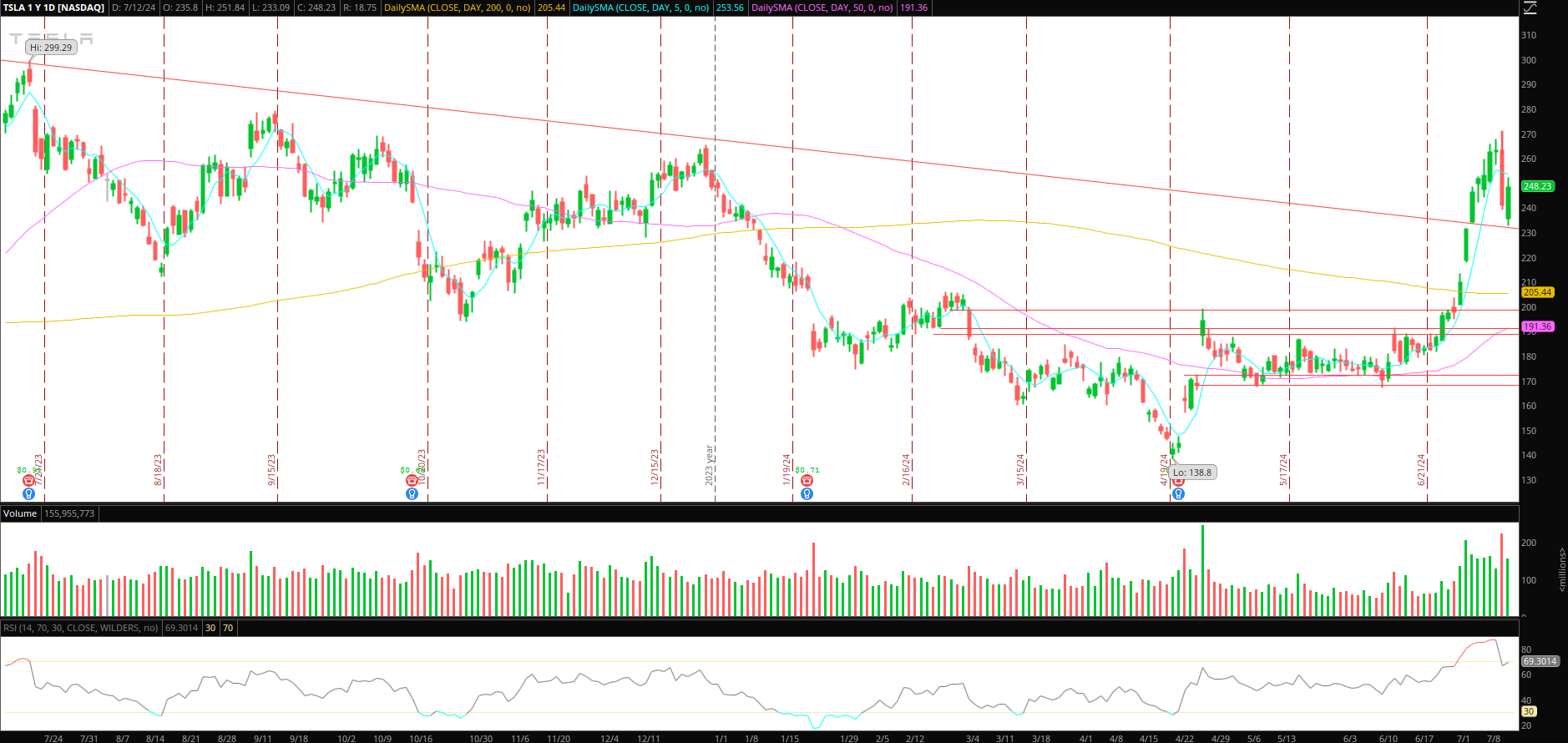

Tesla Greater Low Continuation and Extremes

In my view, Tesla supplied the highest alternatives final week and warrants a radical assessment. In case you haven’t already, I urge you to dissect the alternatives intimately. In case you want an thought of the right way to go about reviewing a setup intimately, take a look at Lance’s Twitter, as he has spoken on this subject intimately.

Now, it’s essential to keep in mind that we’re simply over every week out from Tesla’s earnings. However what I like about final week’s motion, coming into this week is how Tesla discovered help proper at its larger timeframes earlier resistance on Friday, clearly exhibiting consumers firmly in management regardless of Thursday’s fast selloff.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

So, right here’s my plan:

Whereas I’m open to quick scalps in Tesla, particularly if we go ‘straight’ towards $255 – $260, my major focus will probably be for the next low on a pullback, close to $240 – $235. I’d like to see the inventory expertise a morning wash into this zone of demand and ensure the next low within the low $240s versus Friday’s low for entry and intraday VWAP reclaim as a possible add spot. After that, I will probably be on the lookout for $250 as a primary goal to take income and path my cease utilizing larger lows on the 5 to 15-minute timeframe, relying on the value motion. In the end, I’d be on the lookout for a multi-day swing focusing on an exit above Friday’s excessive, close to mid $250s.

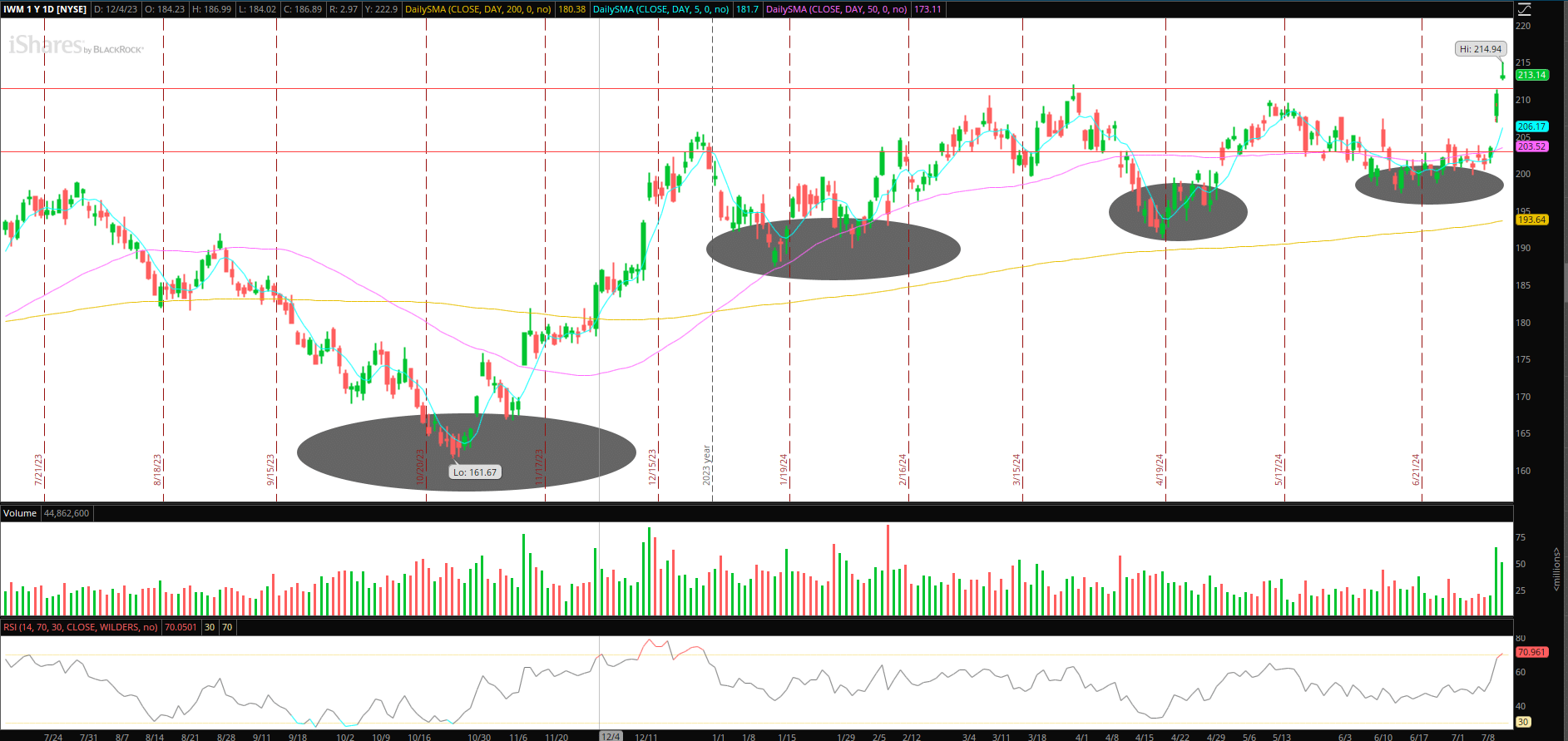

Small Caps (IWM) and Biotech (IBB) Continuation

Small caps and biotechs skilled a notable character shift and in-flow following the inflation information on Thursday.

IWM took out a major space of resistance, one which has held agency for a number of years, and likewise in IBB / biotechs.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

So, going ahead, in IWM and IBB, I can’t look to chase power or highs however reasonably monitor each for a pullback into prior resistance. I’d prefer to see consumers step up and switch prior resistance into help, indicating and additional confirming the foremost momentum shift. Ideally, the pullback is adopted by a day or two of relaxation and consolidation, organising an entry on a multi-day breakout for a leg larger and continuation.

Key ranges I’m watching within the IWM for help: $212, 211

Key ranges I’m watching within the IBB for help: $144, $143

Further Concepts:

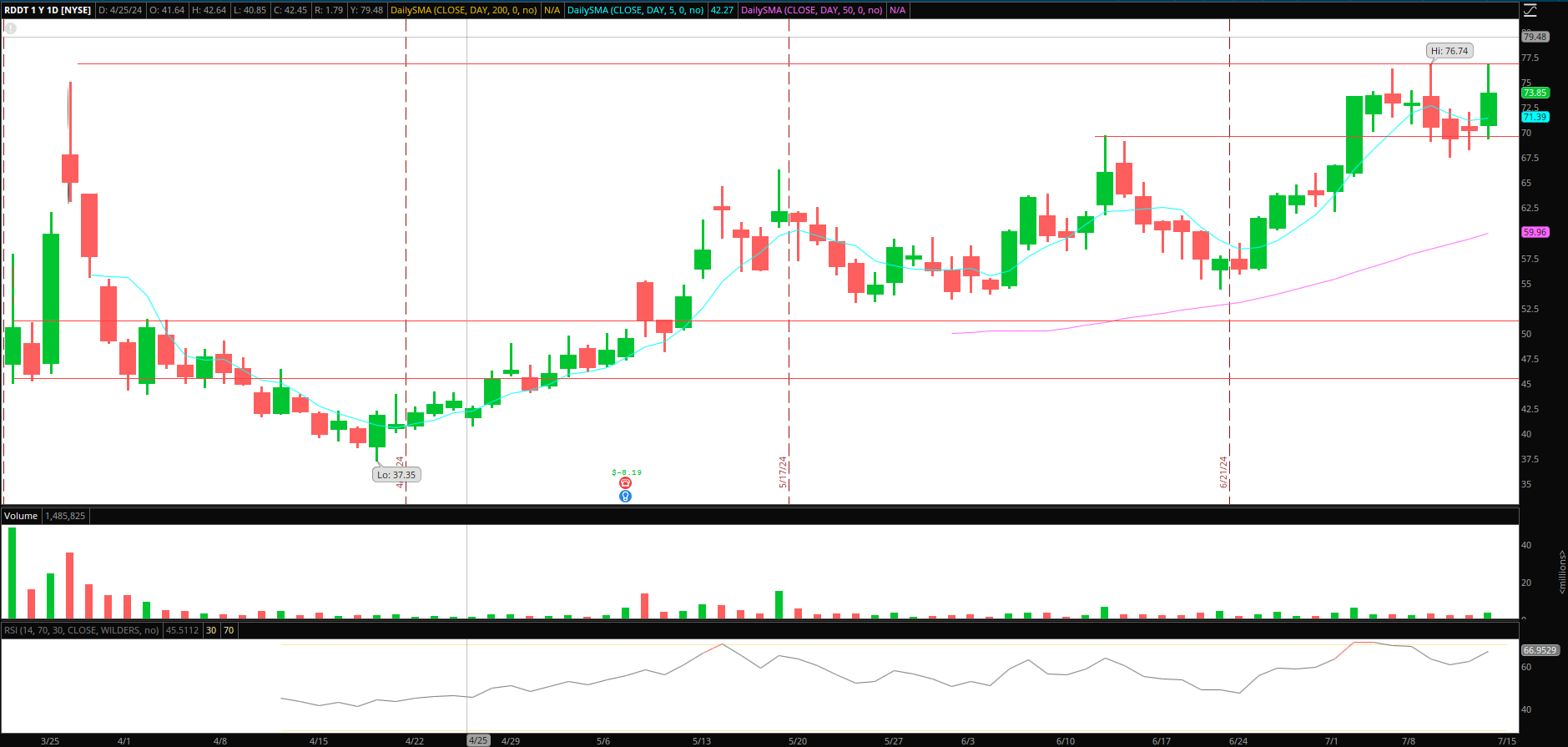

Reddit: The day by day chart exhibits a fantastic setup for a continuation larger. Given the inventory’s vary and liquidity, it’s essential to notice the way it trades, so I adjusted my dimension and threat. Friday’s 2-day vary break supplied a fantastic lengthy entry; nevertheless, I didn’t act on it.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

I’ll look ahead to the next low to substantiate early subsequent week for attainable entry, with a large cease on lowered dimension. Alternatively, I’m additionally waiting for additional compression in worth and a breakout over its highs for a momentum commerce, so long as quantity is current.

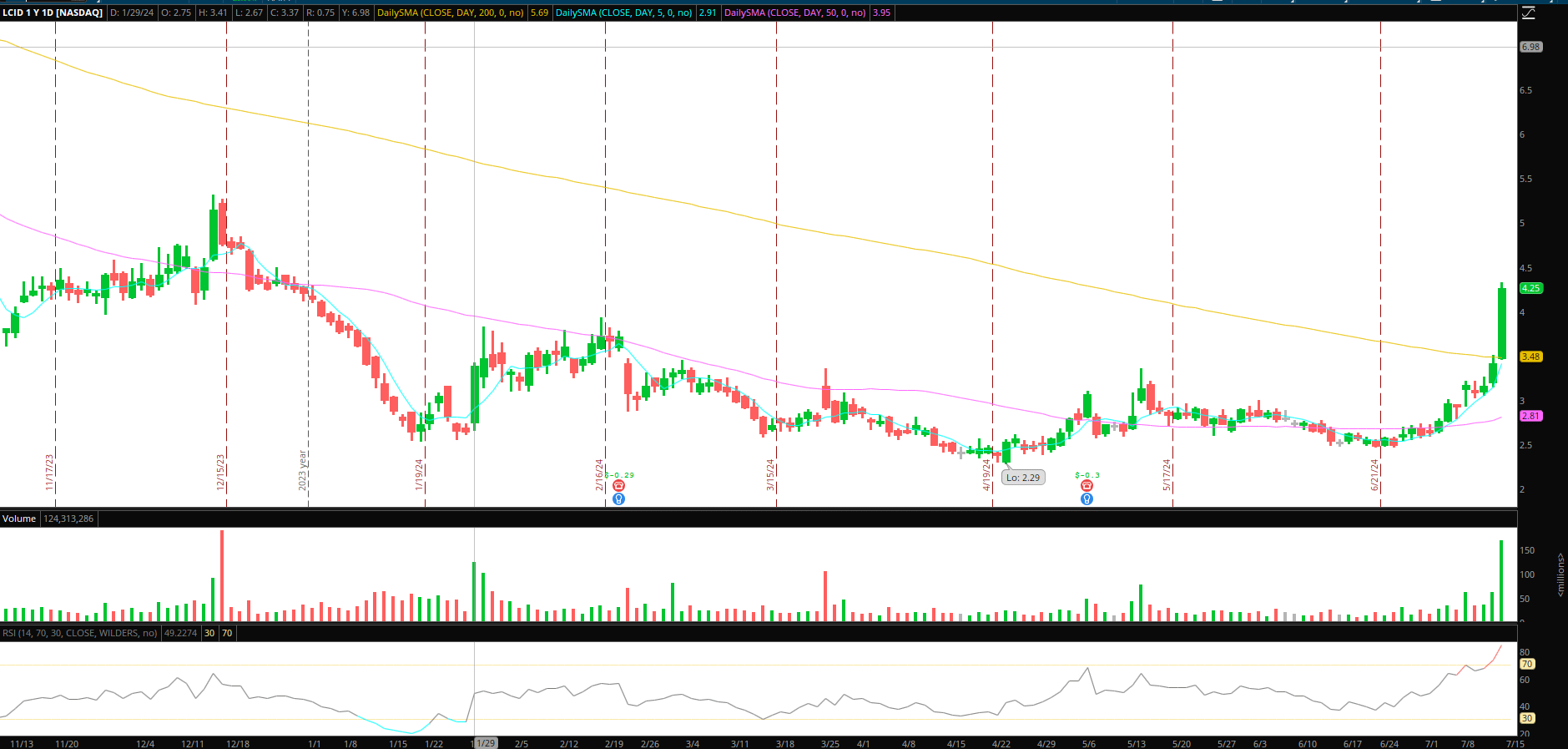

Lucid: It was a fantastic mover on Friday, and it was good to see its vary and quantity lastly increase and squeeze out some shorts. This will probably be on shut watch going ahead for a brief swing. Ideally, this may lure and push nearer to $5, however I’ll be looking out for exhaustion and a failed transfer above Friday’s excessive / uptrend break / VWAP snap for a brief entry if it fails to have legs larger. I’ve the same plan in RIVN.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements equivalent to liquidity, slippage and commissions.

Necessary Disclosures

[ad_2]

Source link