[ad_1]

Hey Merchants,

Prepare for an thrilling week forward with some contemporary buying and selling concepts. On this replace, I’ll break down my thought course of and share my entry and exit methods for my high concepts, that are set for important directional strikes.

In my newest Inside Entry assembly, I detailed my precise trades and executions, and final week’s watchlist was spot on. A number of names made spectacular strikes and supplied nice alternatives.

Now, listed here are just a few of my high concepts for the upcoming week:

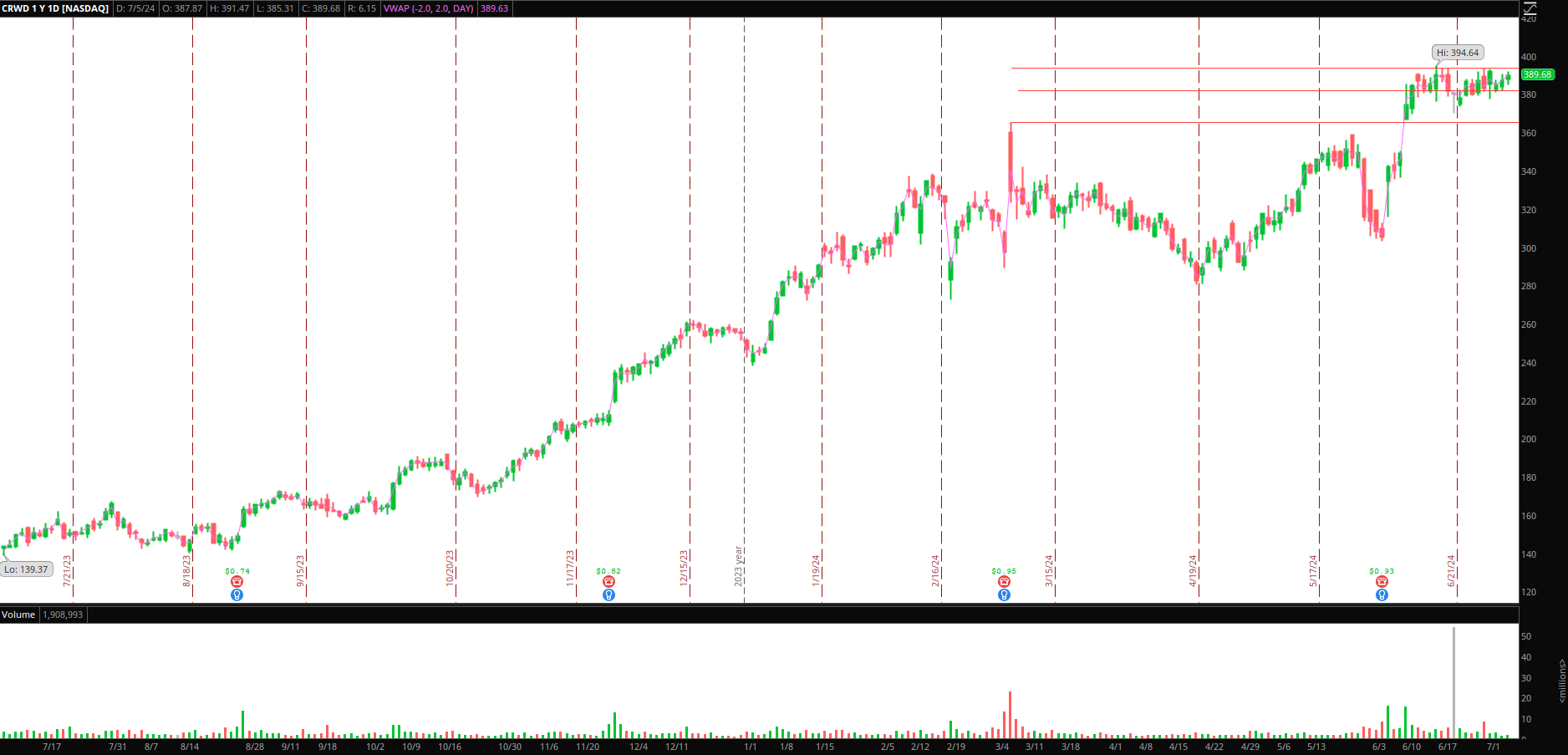

Consolidation Breakout in CRWD

The cyber trade has formed up favorably in latest weeks, with the Cyber ETF having two lovely legs up in latest months, together with many names inside the sector which are properly set for upside.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements equivalent to liquidity, slippage and commissions.

CRWD is my high thought out of all of them. From a technical perspective, it ticks the packing containers I search for in a swing setup. The inventory is holding above earlier resistance, properly above rising shifting averages, providing a skewed danger reward with a transparent breakout and inflection level and a better timeframe uptrend to assist the general momentum, worth, and quantity contraction earlier than a breakout, alignment throughout a number of timeframes, and numerous different checks.

Right here’s my plan:

I’ve a small starter within the identify, however I’m solely seeking to put danger on as soon as the inventory breaks above resistance. As soon as it clears $394, I’ll get the dimensions I would like, with a cease both on the day’s low or the earlier larger low, relying on the setup. I’m seeking to seize a number of ATRs, and due to this fact, I’ll be trailing my cease on the 15-minute timeframe, larger lows, and scaling into 1 – 2 ATR strikes over numerous days.

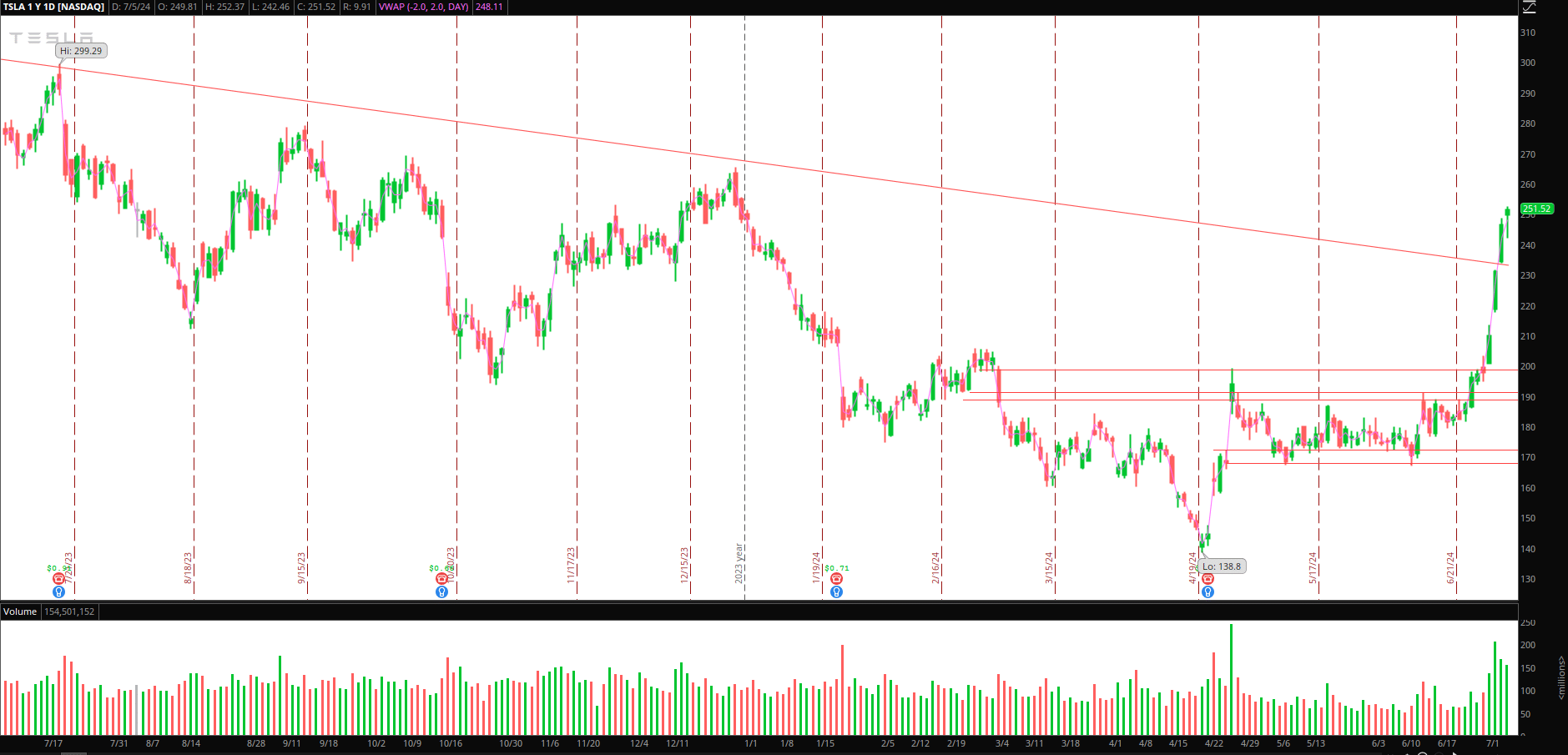

Extremes in TSLA

By extremes, I imply any outlier transfer that presents an thrilling reversion alternative. For instance, if TSLA had one other important push towards $260+ with out pulling again and consolidating, it will have me occupied with a short-term imply reversion alternative.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements equivalent to liquidity, slippage and commissions.

Nevertheless, if the inventory pulls again considerably, sub $240, I’m on the lookout for a short-term backside to be confirmed, some sideways motion, and a breakout for one more leg larger after the numerous breakout.

It’s a two-sided tape, and I’ll watch this intently within the upcoming week(s). Ideally, $260+ this week is for an A+ imply reversion alternative, adopted by a bounce commerce to the lengthy aspect.

Extra Concepts For the Upcoming Week:

Decrease Excessive / Bottom in SIRI: Good pump job and squeeze in SIRI these previous few weeks. It lastly prolonged and broke its buying and selling character on Thursday / Friday. If this fails to reclaim $4 on a push, I’ll quick versus the day’s excessive and maintain for as much as two days, concentrating on a transfer again towards $3.

OPTT and QLGN Pops to Brief: Each names have alerts set for a pop again towards multi-day VWAP and potential provide/failure areas for a full-day + quick place versus the excessive.

Continuation in AMZN: Dips proceed to get purchased as AMZN trades at new highs. I’m sticking with the development on this.

Stalking SMH Decrease-Excessive: We’re coming again into a serious potential provide zone. I’m watching SMH / the sector intently for a possible bull-trap affirmation and decrease excessive. If that confirms, I’ll place quick versus the day’s excessive for a multi-day swing quick.

Essential Disclosures

[ad_2]

Source link