[ad_1]

Merchants,

On this replace, I’ll share a number of of my prime concepts for the upcoming week.

Particularly, I’ll share the ‘why’ behind the potential commerce concept and my best entry and exit eventualities and targets.

So, let’s get proper into it.

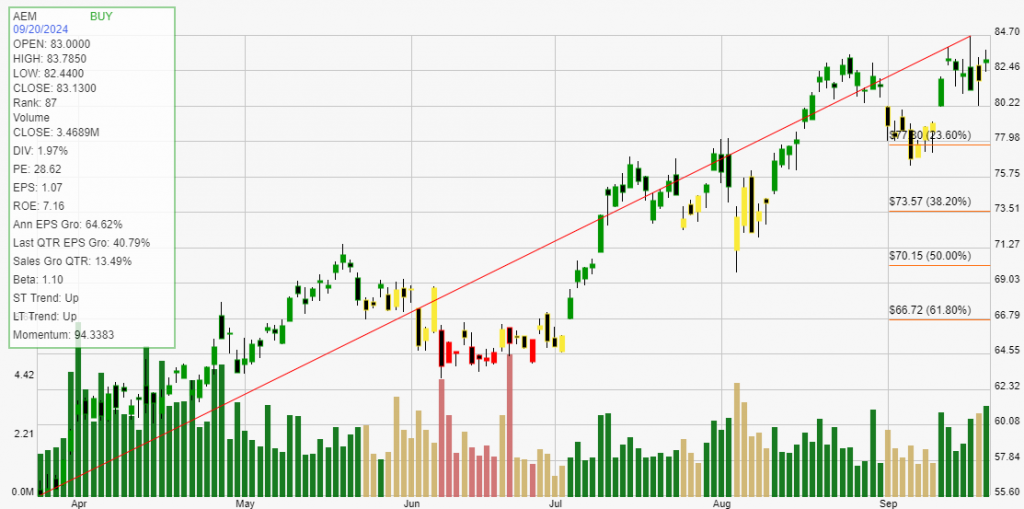

Actuality Test in LUNR

The Concept: Up nicely over 100% since breaking above its 200-day SMA in August. Nearing a turning level and momentum shift as shorts exhaust and value will get prolonged. I disagreed with this being categorized by many coming into Friday as an A+ quick alternative. Why? Merely put, the worth had not prolonged considerably sufficient to the purpose the place a big pullback turned the most certainly consequence. Ideally, the acute bearish sentiment will end in an A+ setup for the upcoming week.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

The Plan: I’d like to see the worth break above Friday’s excessive and skip, signaling shorts have lastly reached their threshold and line within the sand. As soon as that trade happens, typically signaled by an outlier quantity and value extension candle, after which engulfing transfer decrease, I’d be quick versus the excessive of the day, with assist of $8 and $6 as targets in thoughts. Alternatively, if LUNR fails under $9 and stays heavy below VWAP, I will likely be open to momentum scalps, however it could fall below a B class in that case.

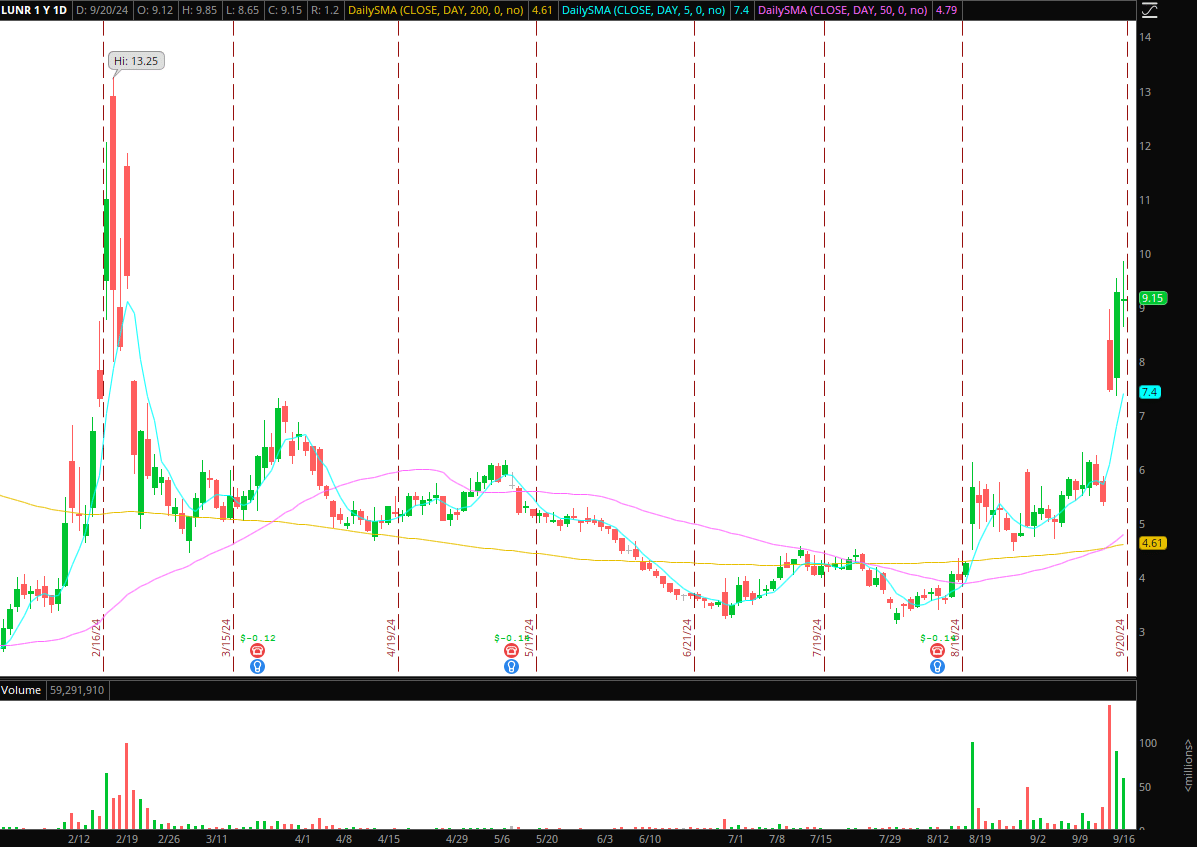

Bounce Continuation in SMMT

The Concept: Total, unbelievable, doubtlessly essentially altering information that resulted within the runup in SMMT, which has now been adopted by a measured pullback and reset at greater costs. I’m in search of a leg greater if the momentum is to proceed.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

The Plan: Ideally, one other day consolidating under its 5-day SMA. Nonetheless, if the inventory washes under $24 and shortly reclaims, confirming the next low, I will likely be able to lengthy following a maintain close to/above Friday’s excessive. Ought to the relative energy and value motion unfold as deliberate and supply an entry, I’ll goal an ATR up transfer as goal 1, adopted by a transfer towards $30 as the top goal.

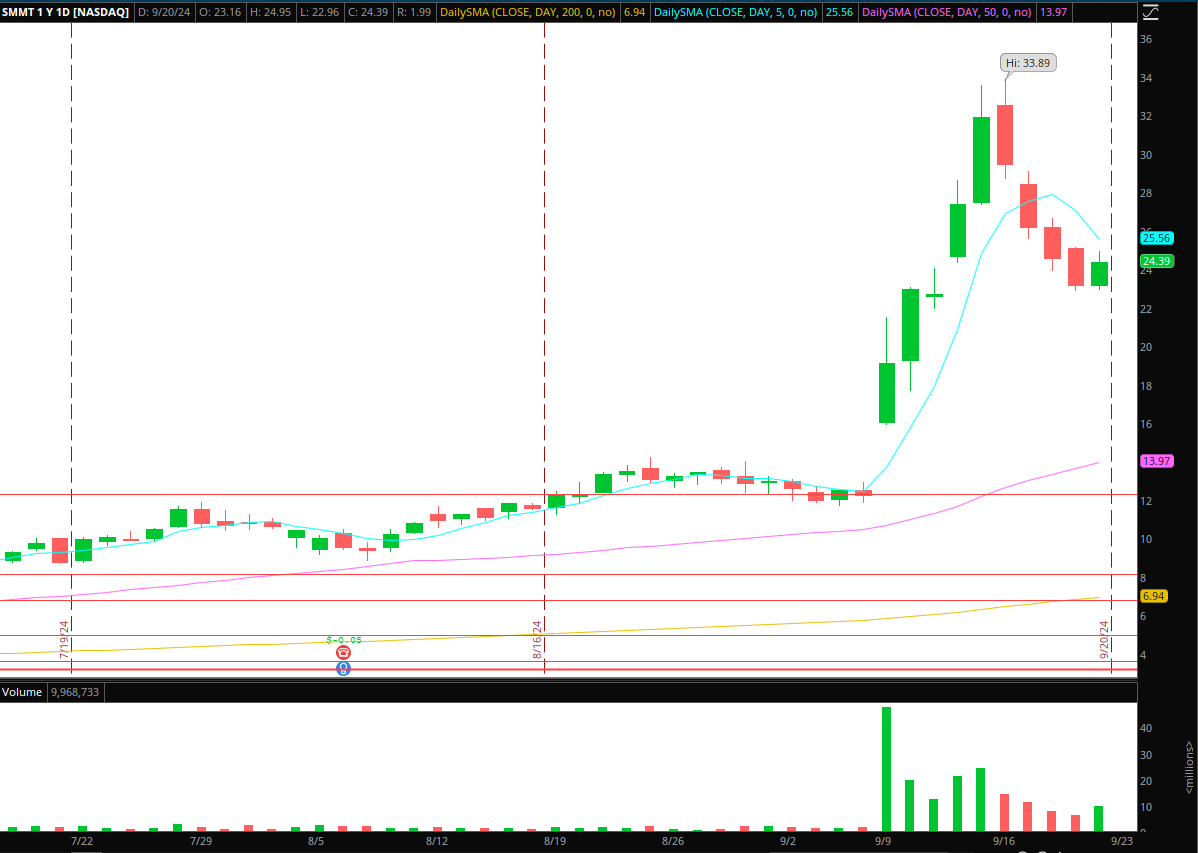

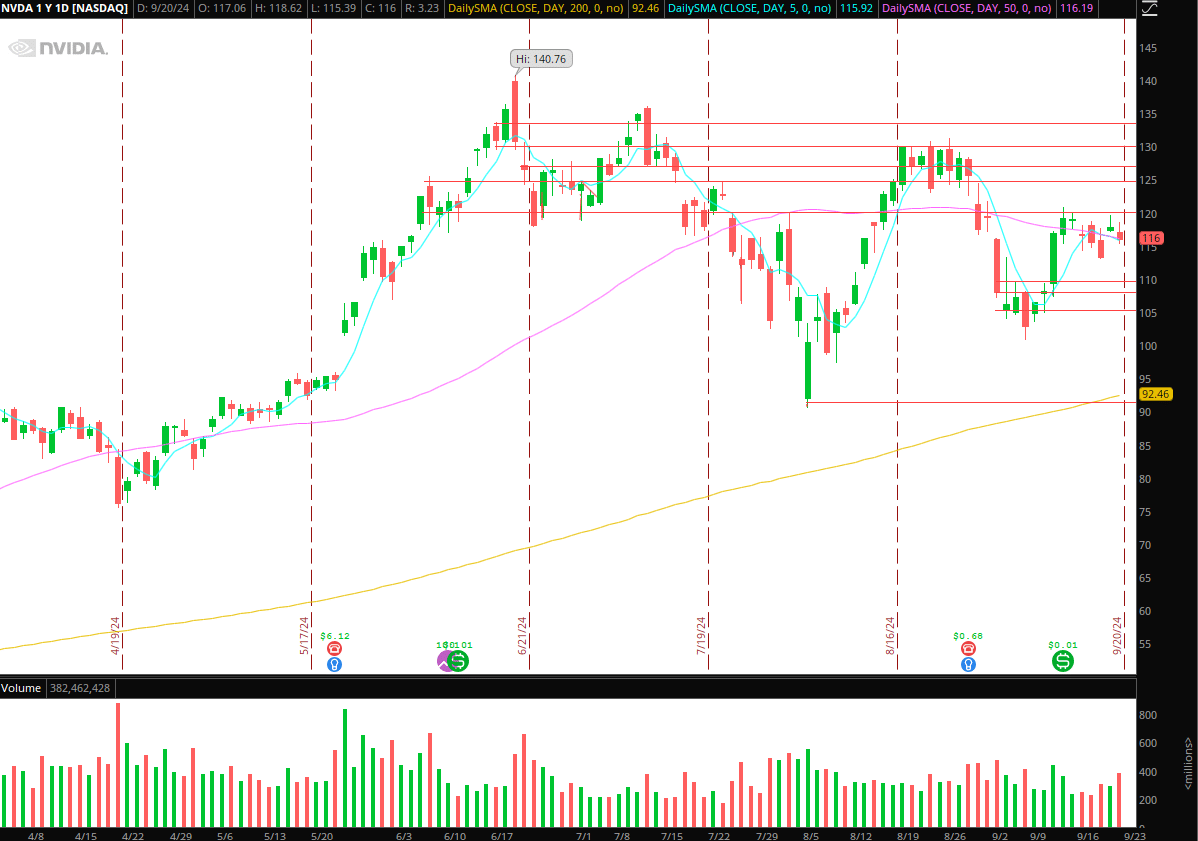

Tightening Motion in NVDA

The Concept: Easy, reactive concept in NVDA, contemplating its tightening vary at its 50-day SMA. The contraction in vary permits for a skewed R: R if the vary continues to contract earlier than choosing a route.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

The Plan: Reactive commerce. If the vary continues to contract, adopted by a breakout above resistance, I will likely be lengthy on the breakout. Momentum entry on the breakout, with a cease under the breakout stage or earlier greater low, relying on the intraday setup. After that, a commerce like this will likely be managed extra intraday-focused, with a 5-min greater low path and taking income on extensions on greater highs, with $125 in thoughts.

Bonus Mentions From Final Week’s Watchlist:

MU: It continues to form up its double backside. Identical ideas and plans from final week.

GOOGL: Stunning continuation and bounce, as mentioned in nice element in my most up-to-date Inside Entry assembly. Stays a spotlight for a pullback/consolidation, providing a chance to provoke a brand new place or add to an current long-swing place.

XBI: A prime focus of mine to any extent further, given the 50bps lower, how delicate the sector is to rates of interest, and its multi-year base and consolidation. It’s failed on a number of makes an attempt to carry over $102 and $103s, so I’m sitting again for now and simply conserving it on my radar in case that modifications and we see patrons step up and break this pout over the 52-week excessive.

Pops to Brief in Small-Cap Shares

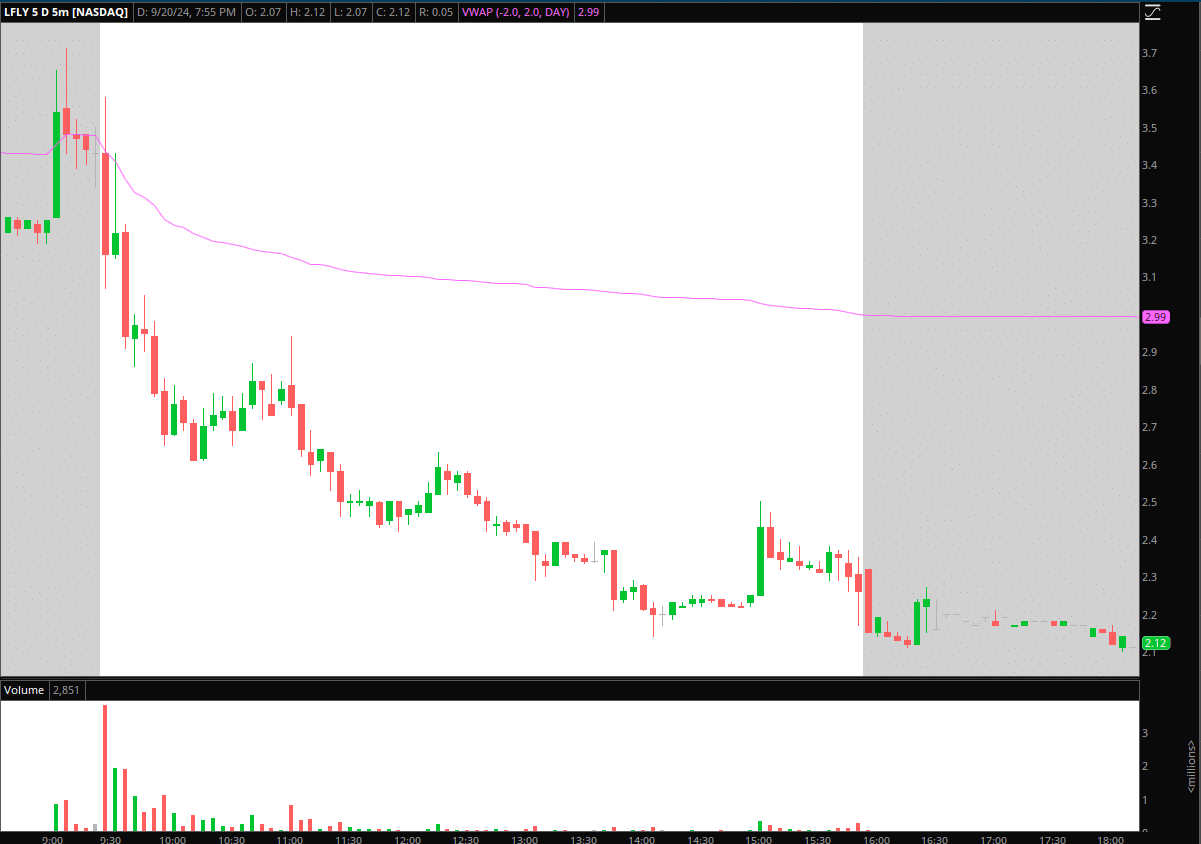

LFLY: It’s unlikely, but when it may possibly push again towards $2.8 – $3 and fail on Monday, I will likely be occupied with a brief versus the excessive of the day for a transfer again towards $2.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

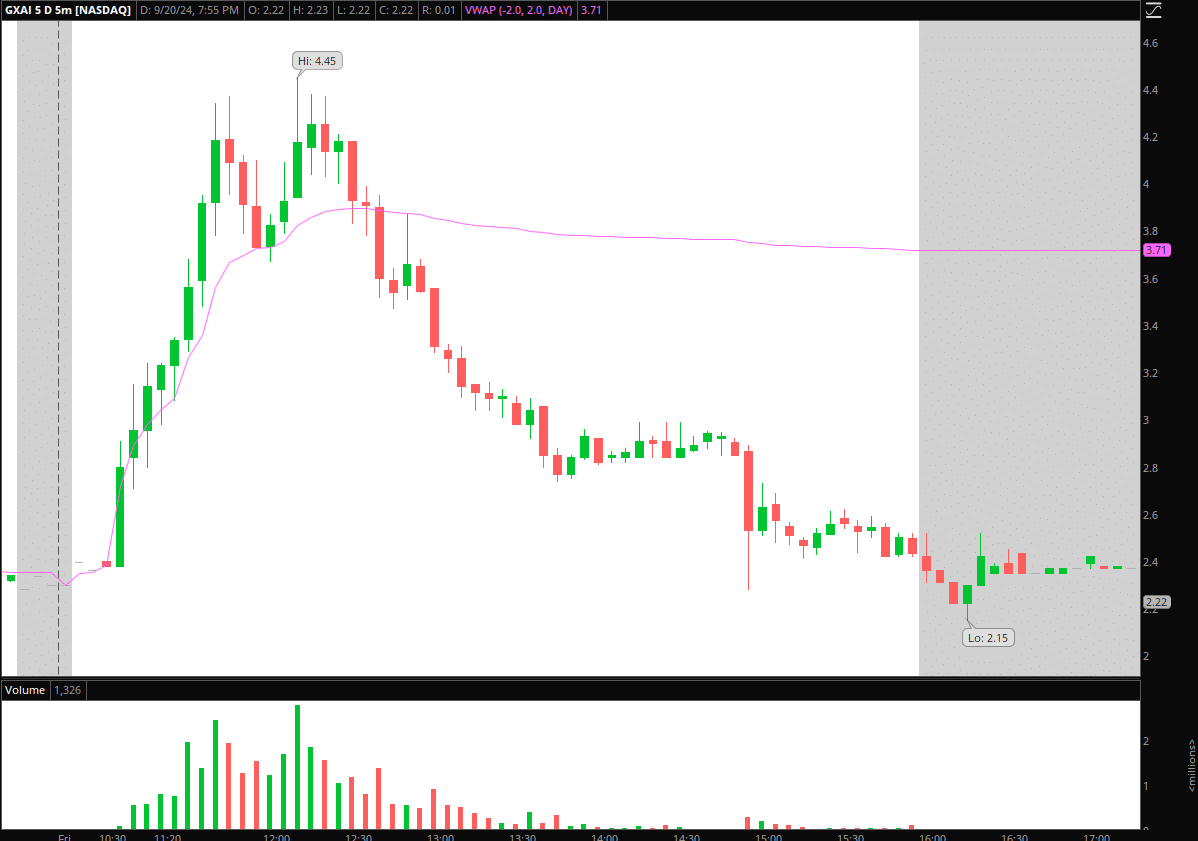

GXAI: Equally, if GXAI can endure a secondary pump and squeeze on Monday, I will likely be occupied with a brief over $3, nearer to its creating 2-day VWAP.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures

[ad_2]

Source link