[ad_1]

Merchants,

I look ahead to sharing my ideas and high concepts with you for the upcoming week.

Proper earlier than I accomplish that, right here’s a fast be aware. As I’ve outlined in nice element in my previous few Inside Entry conferences, the one place I evaluate my trades every week, I needed to see the market and important sectors consolidate for a swing surroundings to grow to be favorable once more. Such worth motion would enhance the risk-reward and, along with the next low and base being developed, reset particular charts and setups, enabling consolidation directional swing alternatives. That’s now the main target this week.

Beginning with my large-cap swing concepts, all of which share the same setup.

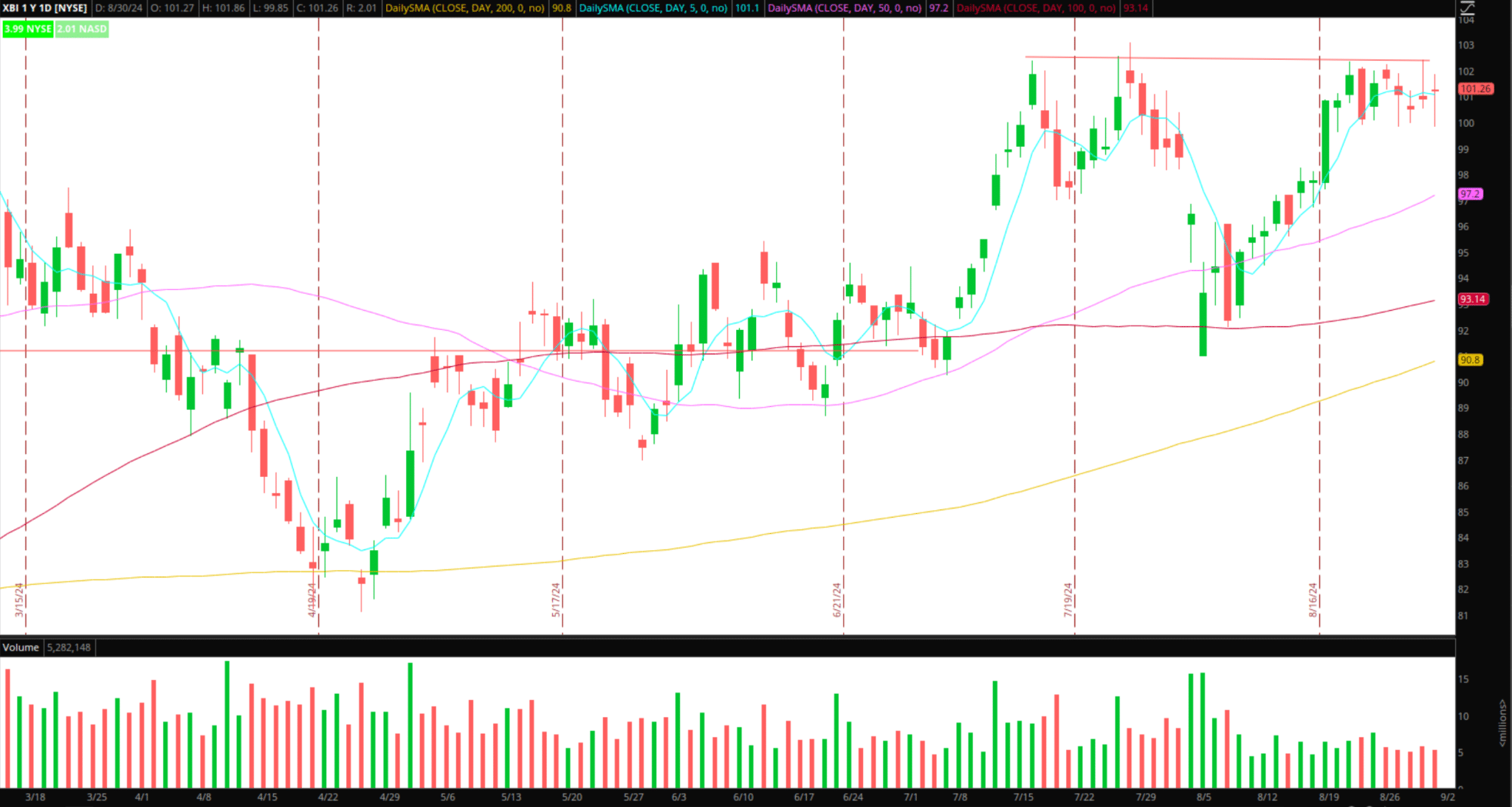

Consolidation Breakout in Biotechs (XBI) / (IBB)

The Concept: After V-bottoming and displaying relative energy, the sector has now hung out going sideways, organising a extra favorable danger: reward sample. The sector continues to consolidate close to 52-week highs and resistance close to $102. Particularly, this setup shines by throughout a number of timeframes.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

The Plan: I’m in search of a breakout in each quantity and worth above $102 throughout a number of timeframes. If the inventory breaks above $102 and spends time above, I’ll look to provoke a protracted place with a cease on the day’s low. After that, I’m trying to piece out of the place at 1 ATR / the 52-week excessive. After that, I’ll path my cease utilizing 5-minute larger lows, concentrating on a multi-day momentum continuation commerce, piecing out of the place because it makes vital larger highs intraday.

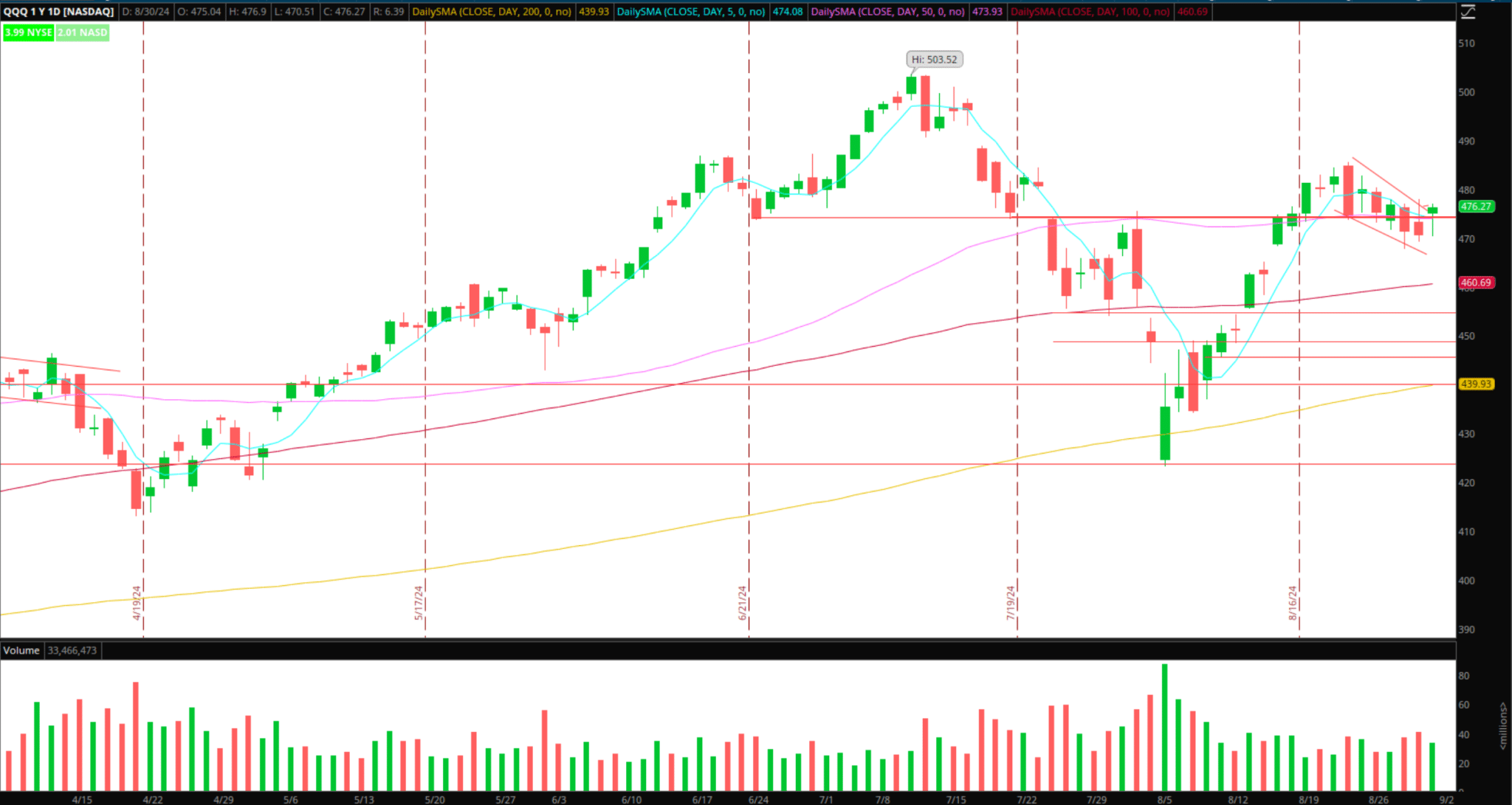

Consolidation Breakout in Tech (QQQ) / (SMH)

The Concept: Some relative weak point in tech and semis. Nonetheless, we may see rotation stream again into this space. A superb risk-reward sample now exists, with a transparent breakout space in each QQQ and semis (SMH and SOXL).

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

The Plan: For QQQ, much like semis, I’m in search of a break above Friday’s excessive and maintain intraday, confirming consumers are firmly in management. After that, I would look to get lengthy if market internals stay favorable, with a cease on the low of the day and the same exit technique to XBI when it comes to ATR and a 5-minute timeframe path.

Further sectors/areas of curiosity with the same setup after consolidating = XHB (homebuilders) and small-caps (IWM / TNA).

Pops to Quick in Small-Caps

BNRG: Incredible momentum mover on Friday, on distinctive quantity. After the retracement off the excessive and week shut, the main target will now be on shorting a push into a possible zone of resistance. If the inventory pops towards its 2-day VWAP / $2 and fails, I’ll search for an intraday brief concentrating on $1.5 – low $1s.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

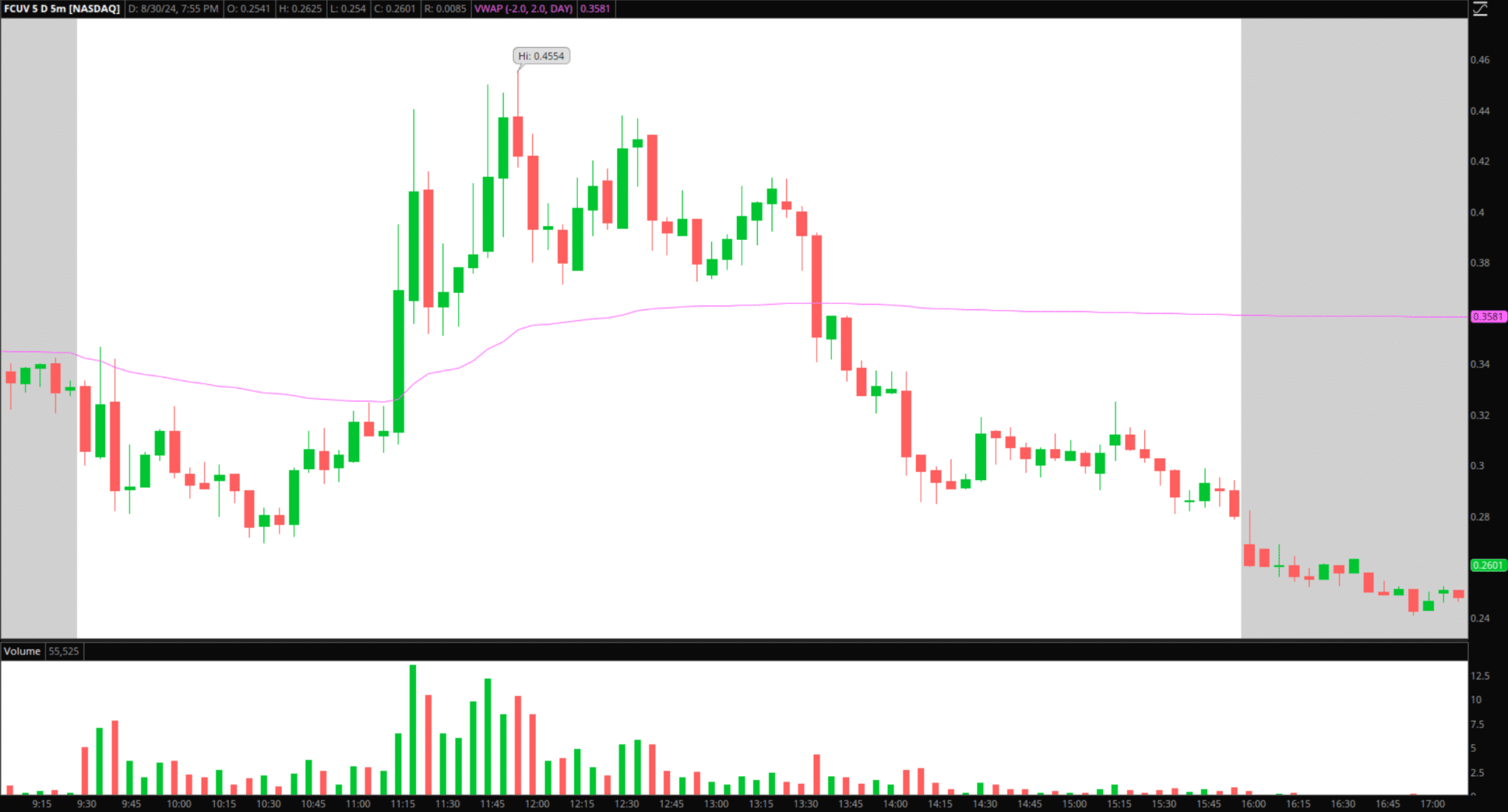

FCUV: Just like BNRG, vital retracement off the excessive and weak shut. Due to this fact, I’ll set alerts for a pop-back towards its 2-day VWAP. If the inventory fails to reclaim this zone, I’ll look to get brief versus the day’s excessive, concentrating on a retracement towards the lows from the AHs on Friday.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the impression, if any, of sure market components comparable to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures

[ad_2]

Source link