[ad_1]

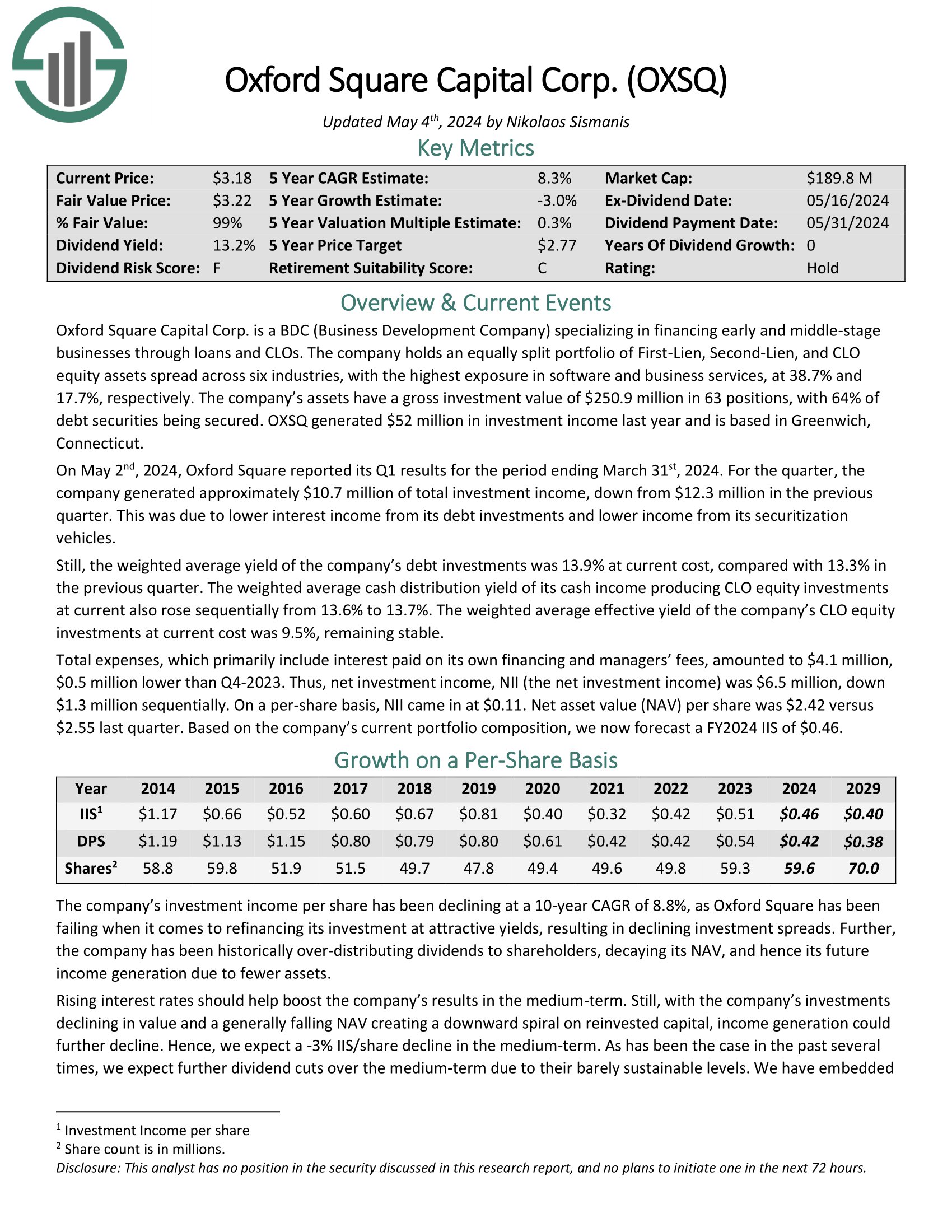

Oxford Sq. Capital Corp. is a BDC specializing in financing early and center–stage companies by means of loans and CLOs.

The firm holds an equally break up portfolio of First–Lien, Second–Lien, and CLO fairness assets unfold throughout a number of industries, with the best publicity in software program and enterprise providers.

Supply: Investor Presentation

On Might 2nd, 2024, Oxford Sq. reported its Q1 outcomes for the interval ending March thirty first, 2024. For the quarter, the corporate generated roughly $10.7 million of complete funding earnings, down from $12.3 million within the earlier quarter.

The weighted common money distribution yield of its money earnings producing CLO fairness investments at present additionally rose sequentially from 13.6% to 13.7%.

Click on right here to obtain our most up-to-date Certain Evaluation report on OXSQ (preview of web page 1 of three proven beneath):

Low-cost Month-to-month Dividend Inventory #7: Most important Road Capital (MAIN)

Annual Valuation Return: 1.5%

Dividend Yield: 8.0%

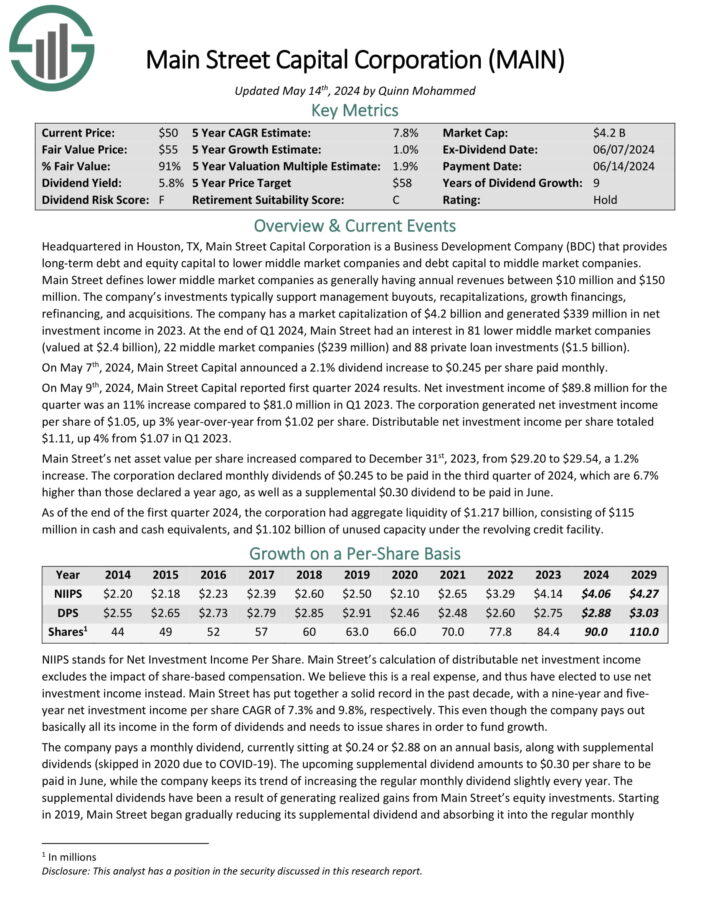

Most important Road Capital Company is a Enterprise Growth Firm (BDC) that gives long-term debt and fairness capital to decrease center market firms and debt capital to center market firms.

On the finish of Q1 2024, Most important Road had an curiosity in 81 decrease center market firms (valued at $2.4 billion), 22 center market firms ($239 million) and 88 non-public mortgage investments ($1.5 billion).

On Might seventh, 2024, Most important Road Capital introduced a 2.1% dividend enhance to $0.245 per share paid month-to-month. On Might ninth, 2024, Most important Road Capital reported first quarter 2024 outcomes. Internet funding earnings of $89.8 million for the quarter was an 11% enhance in comparison with $81.0 million in Q1 2023.

The company generated internet funding earnings per share of $1.05, up 3% year-over-year from $1.02 per share. Distributable internet funding earnings per share totaled $1.11, up 4% from $1.07 in Q1 2023.

Most important Road’s internet asset worth per share elevated in comparison with December thirty first, 2023, from $29.20 to $29.54, a 1.2% enhance.

Click on right here to obtain our most up-to-date Certain Evaluation report on MAIN (preview of web page 1 of three proven beneath):

Low-cost Month-to-month Dividend Inventory #6: AGNC Funding Corp. (AGNC)

Annual Valuation Return: 1.9%

Dividend Yield: 14.3%

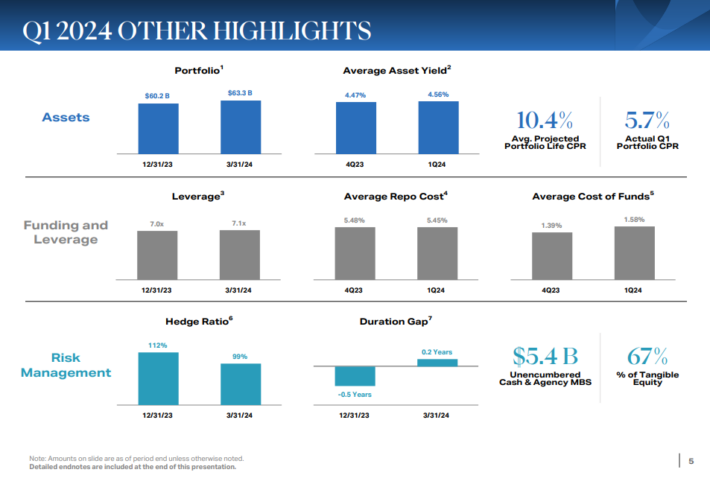

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–by means of securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

AGNC Funding’s first-quarter non-GAAP earnings continued their downward pattern amid the corporate’s operation in the next rate of interest atmosphere.

Supply: Investor Presentation

The quarter’s earnings excluded an estimated “catch-up” premium amortization profit. Tangible internet ebook worth per widespread share elevated to $8.84, though the financial return on tangible widespread fairness declined.

Click on right here to obtain our most up-to-date Certain Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven beneath):

Low-cost Month-to-month Dividend Inventory #5: EPR Properties (EPR)

Annual Valuation Return: 3.4%

Dividend Yield: 7.5%

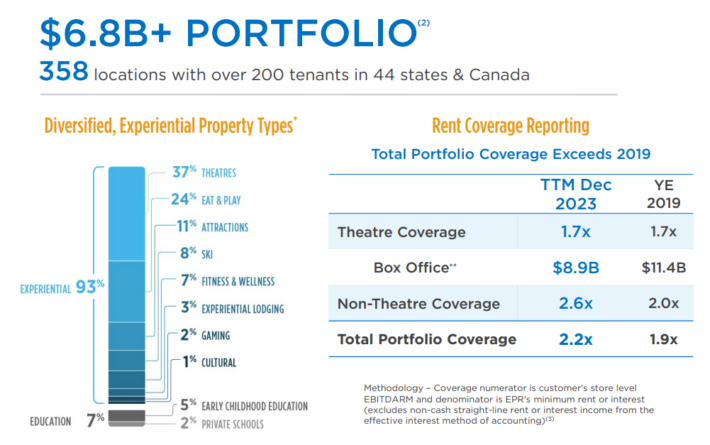

EPR Properties is a specialty actual property funding belief, or REIT, that invests in properties in particular market segments that require business information to function successfully.

It selects properties it believes have robust return potential in Leisure, Recreation, and Schooling. The portfolio consists of about $7 billion in investments throughout 350+ places in 44 states, together with over 200 tenants.

Supply: Investor Presentation

EPR posted first quarter earnings on Might 1st, 2024. The corporate posted adjusted funds-from-operations of $1.12 per share.

Within the year-ago interval, adjusted FFO-per-share was $1.30. Income was down 2.4% year-over-year to $167 million.

EPR enjoys excessive occupancy charges, which afford it pricing energy and better margins over time. Current outcomes appear to point that the worst is behind EPR, and the Regal restructuring is an enormous step ahead.

Click on right here to obtain our most up-to-date Certain Evaluation report on EPR (preview of web page 1 of three proven beneath):

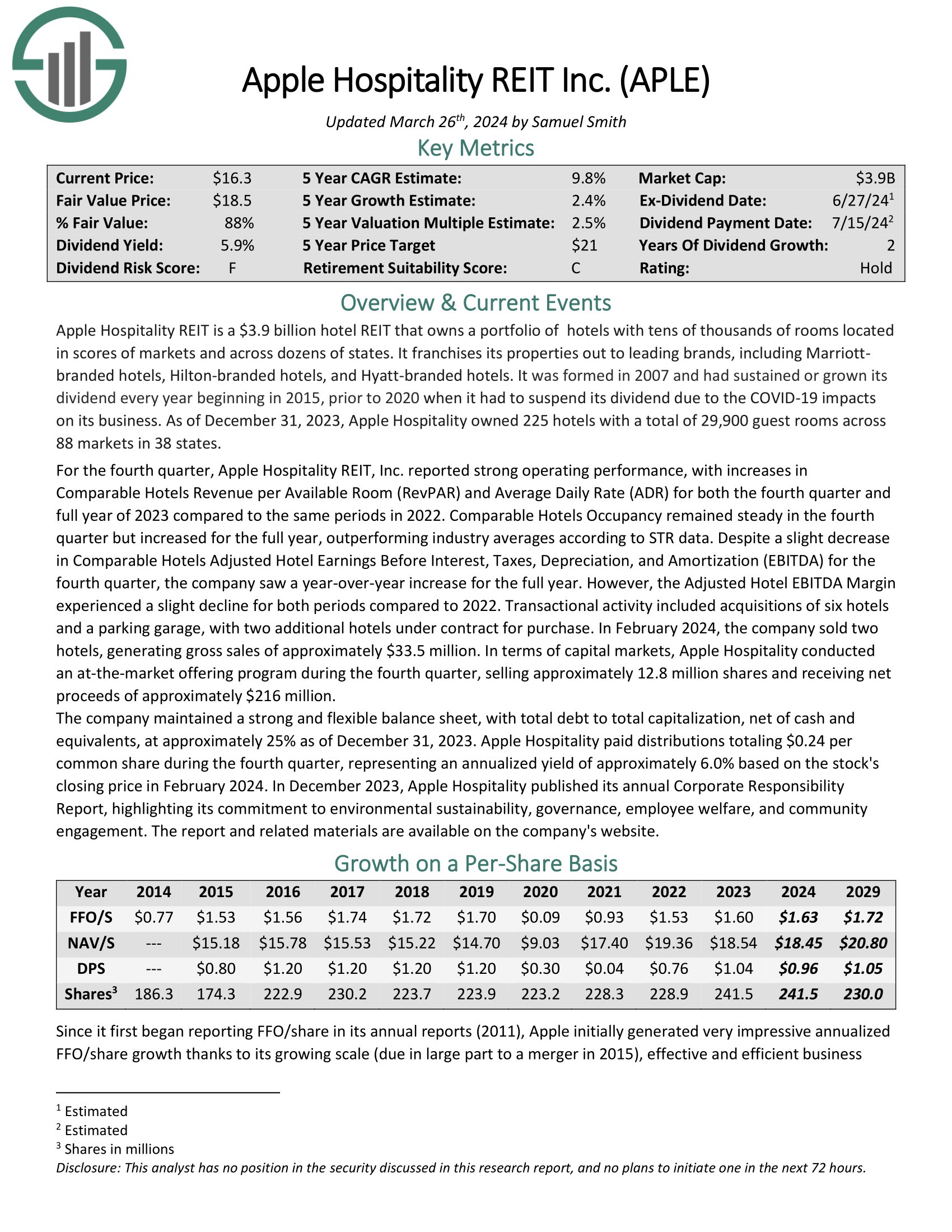

Low-cost Month-to-month Dividend Inventory #4: Prospect Capital (PSEC)

Annual Valuation Return: 3.8%

Dividend Yield: 13.1%

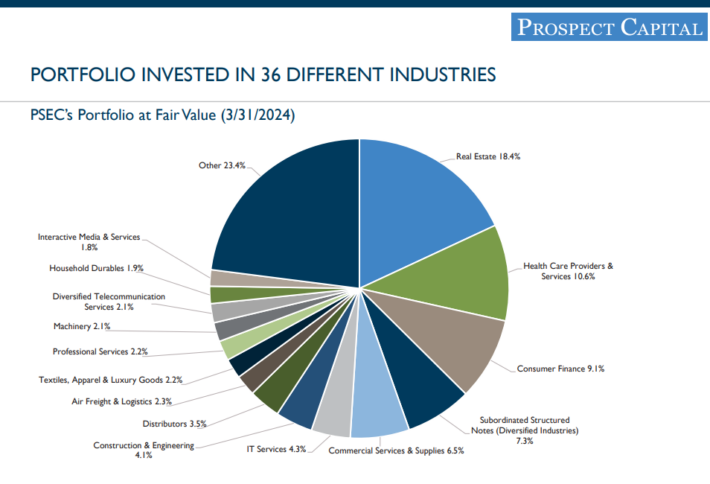

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives non-public debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Supply: Investor Presentation

Prospect posted third quarter earnings on Might eighth, 2024. Internet funding earnings got here to $94.4 million, off from just below $97 million within the December quarter, and down from $102.2 million a yr in the past.

As a share of complete internet funding earnings, curiosity earnings was 91%, barely decrease than prior quarters.

On a per-share foundation, NII got here to 23 cents, down from 24 cents within the December quarter, and down from 26 cents within the March interval a yr in the past.

NAV declined from $9.48 within the March quarter final yr to $8.99, however up barely from $8.92 within the December quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on PSEC (preview of web page 1 of three proven beneath):

Low-cost Month-to-month Dividend Inventory #3: Apple Hospitality REIT (APLE)

Annual Valuation Return: 4.3%

Dividend Yield: 6.4%

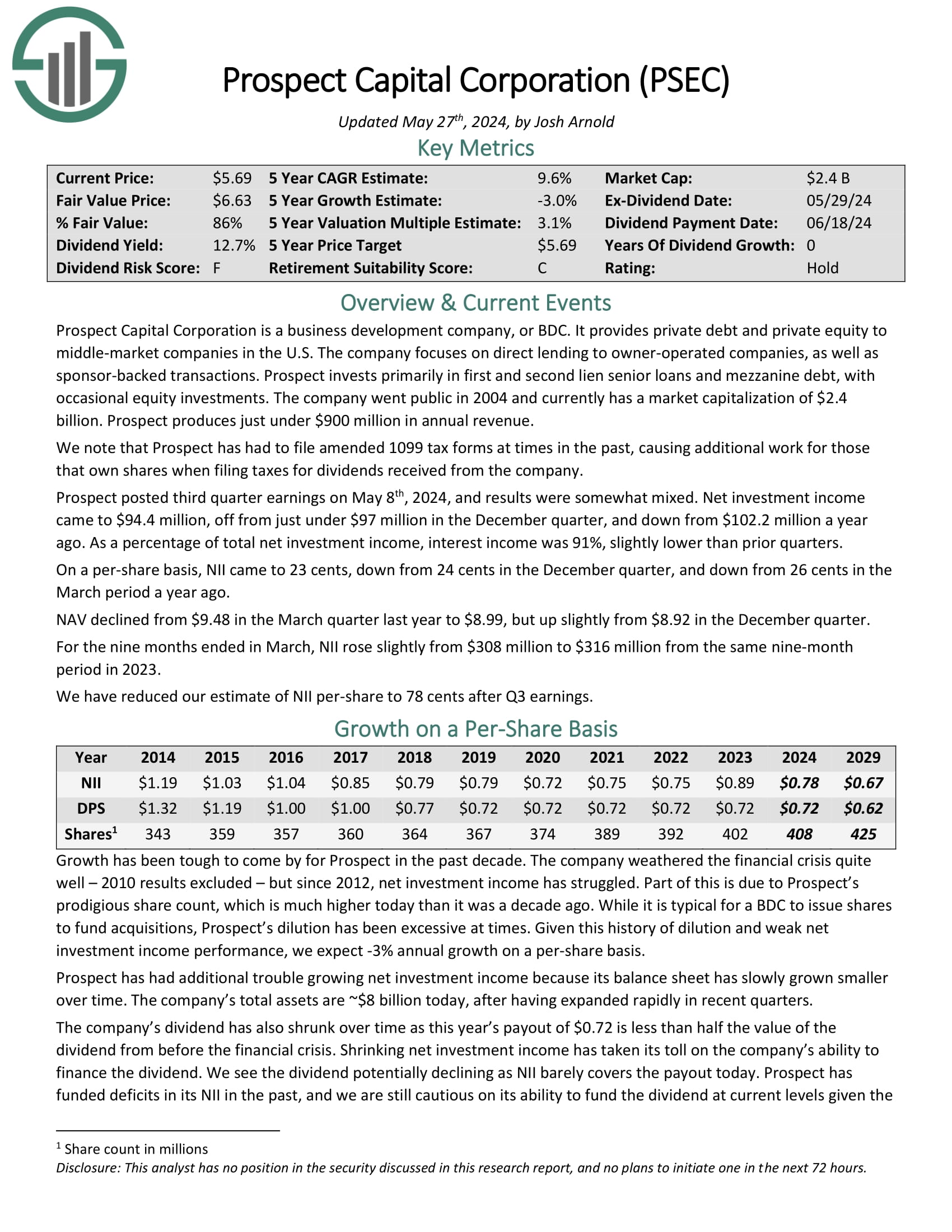

Apple Hospitality REIT is a lodge REIT that owns a portfolio of motels with tens of 1000’s of rooms positioned throughout dozens of states.

It franchises its properties out to main manufacturers, together with Marriottbranded motels, Hilton-branded motels, and Hyatt-branded motels.

As of December 31, 2023, Apple Hospitality owned 225 motels with a complete of 29,900 visitor rooms throughout 88 markets in 38 states.

Supply: Investor Presentation

For the fourth quarter, Apple Hospitality REIT, Inc. reported robust working efficiency, with will increase in Comparable Accommodations Income per Out there Room (RevPAR) and Common Day by day Charge (ADR) for each the fourth quarter and full yr of 2023 in comparison with the identical durations in 2022.

Comparable Accommodations Occupancy remained regular within the fourth quarter however elevated for the total yr, outperforming business averages based on STR information.

Click on right here to obtain our most up-to-date Certain Evaluation report on APLE (preview of web page 1 of three proven beneath):

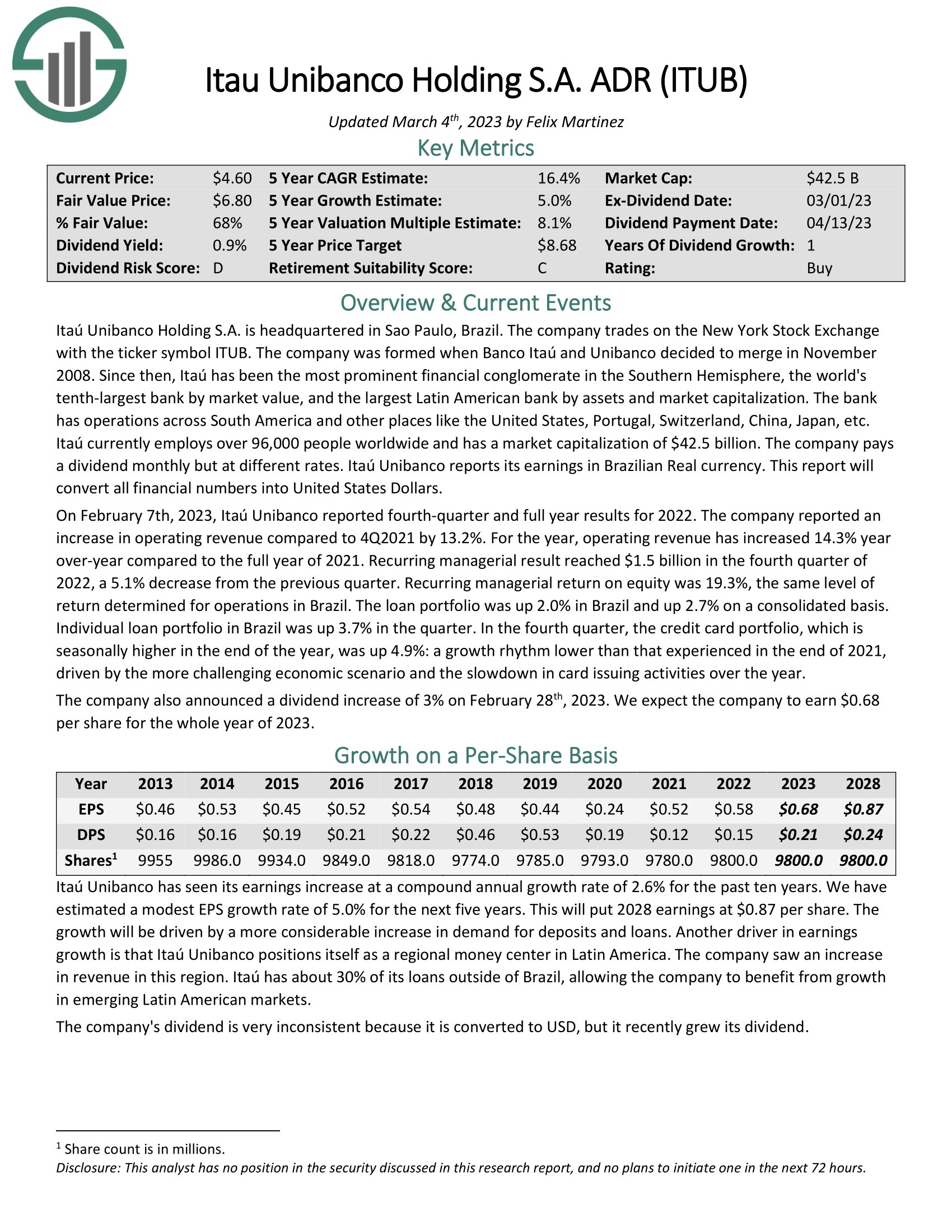

Low-cost Month-to-month Dividend Inventory #2: Itaú Unibanco (ITUB)

Annual Valuation Return: 6.6

Dividend Yield: 4.6%

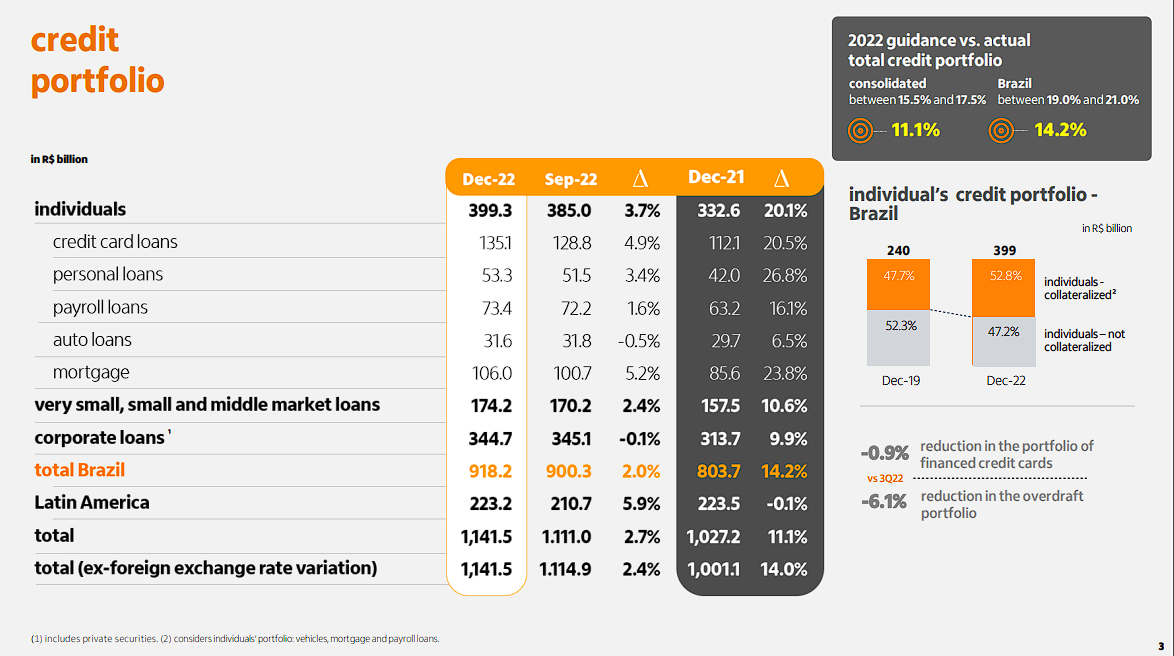

Itaú Unibanco is a really massive financial institution that’s headquartered in Brazil. ITUB is a large-cap inventory with a market capitalization above $44 billion.

Itaú Unibanco conducts enterprise in additional than a dozen international locations all over the world, however the core of its enterprise is in Brazil. It has important operations in different Latin American international locations and choose companies in Europe and the US.

Its scale is big in relation to different Latin American banks. Itaú is the biggest monetary conglomerate within the Southern Hemisphere, the world’s tenth–largest financial institution by market worth, and the biggest Latin American financial institution by property and market capitalization.

Supply: Investor Presentation

It’s not unusual for banks like Itaú Unibanco to attempt to cater to each sort of client and enterprise, identical to main US banks have accomplished by providing a spread of providers akin to deposits, loans, insurance coverage merchandise, fairness investing, and extra, to be able to entice clients. What units Itaú Unibanco aside is its concentrate on rising economies akin to Brazil. Nonetheless, rising markets have struggled for a few years. It is a trigger for concern as financial development is essential for a financial institution’s enlargement, and with out it, Itaú Unibanco could face challenges in producing revenue enlargement.

Concerning its dividend, Itaú Unibanco has a conservative method. The financial institution pays out dividends to shareholders primarily based on its projected earnings and losses, with the objective being the flexibility to proceed to pay the dividend underneath varied financial situations. Together with offering its latest quarterly outcomes, the corporate additionally barely elevated its month-to-month dividend from $0.0033 per share to $0.0034 per share. Nonetheless, the yield is kind of low at 0.83%. Thus, Itaú Unibanco isn’t a pure earnings inventory by any means, as its yield is just too small to be enticing to most earnings traders.

Click on right here to obtain our most up-to-date Certain Evaluation report on ITUB (preview of web page 1 of three proven beneath):

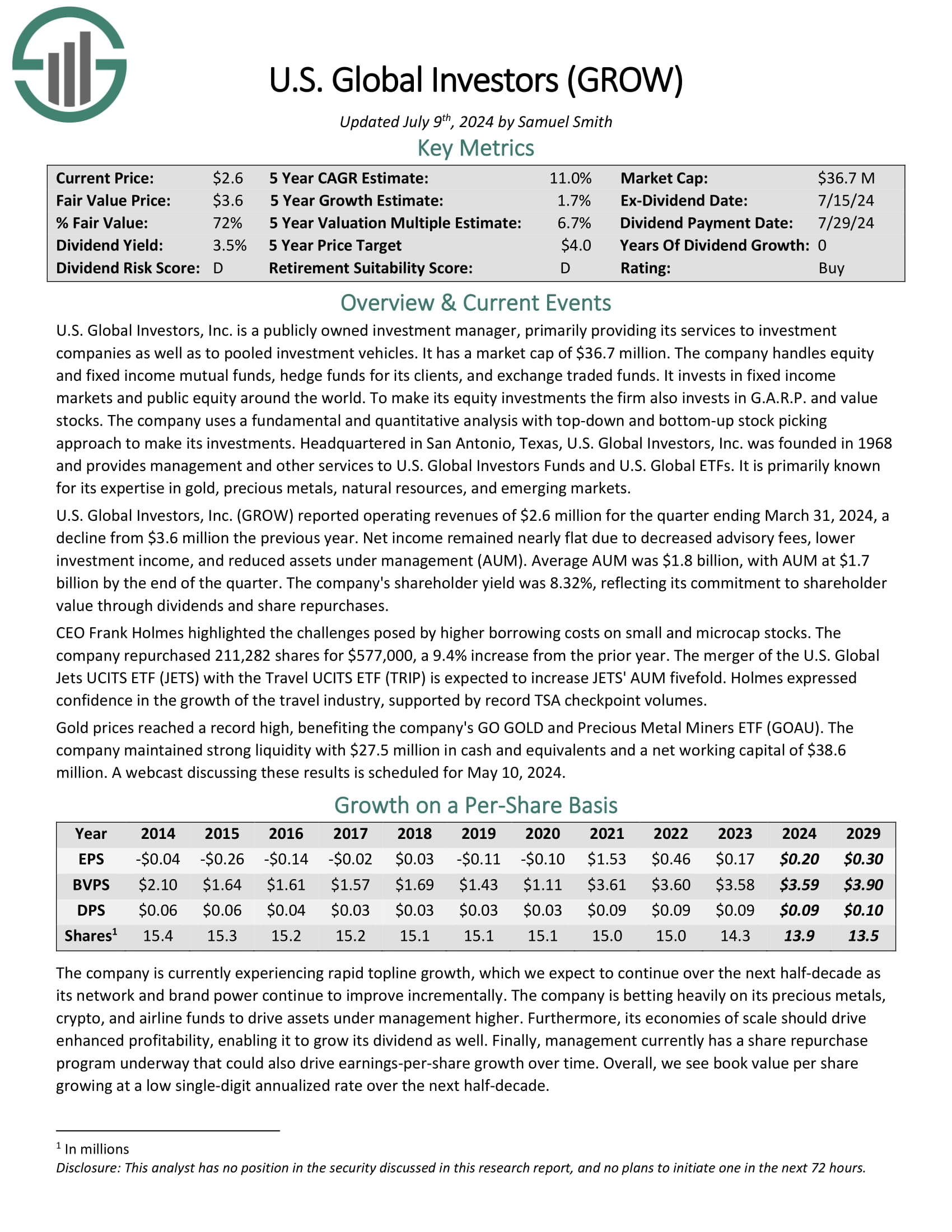

Low-cost Month-to-month Dividend Inventory #1: U.S. International Traders (GROW)

Annual Valuation Return: 4.6

Dividend Yield: 18.7%

U.S. International Traders started greater than 50 years in the past as an funding membership. Right now, it’s a publicly-traded registered funding advisor that appears to supply funding alternatives in area of interest markets all over the world. The corporate gives sector-specific exchange-traded funds and mutual funds, in addition to an curiosity in cryptocurrencies.

U.S. International Traders reported working revenues of $2.6 million for the quarter ending March 31, 2024, a decline from $3.6 million the earlier yr. Internet earnings remained practically flat resulting from decreased advisory charges, decrease funding earnings, and lowered property underneath administration (AUM).

Common AUM was $1.8 billion, with AUM at $1.7 billion by the top of the quarter. The corporate’s shareholder yield was 8.32%, reflecting its dedication to shareholder worth by means of dividends and share repurchases.

Click on right here to obtain our most up-to-date Certain Evaluation report on GROW (preview of web page 1 of three proven beneath):

Ultimate Ideas

Though month-to-month dividend shares could seem interesting for producing a gradual earnings stream, it’s essential to remember that not all dividend shares are created equal.

Every inventory carries its personal set of dangers, and the larger the chance, the extra possible it’s that shares will seem undervalued.

Traders ought to scrutinize a budget valuation of month-to-month dividend shares. However, our record can function a wonderful place to begin for traders looking for potential alternatives for undervalued investments within the realm of month-to-month dividend shares.

Don’t miss the assets beneath for extra month-to-month dividend inventory investing analysis.

And see the assets beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

[ad_2]

Source link