[ad_1]

TimArbaev

This text is a part of a collection that gives an ongoing evaluation of the adjustments made to John Paulson’s 13F inventory portfolio on a quarterly foundation. It’s based mostly on Paulson’s regulatory 13F Type filed on 5/15/2024. Please go to our Monitoring John Paulson’s Paulson & Firm Portfolio collection to get an thought of his funding philosophy and our earlier replace for the fund’s strikes throughout This autumn 2023.

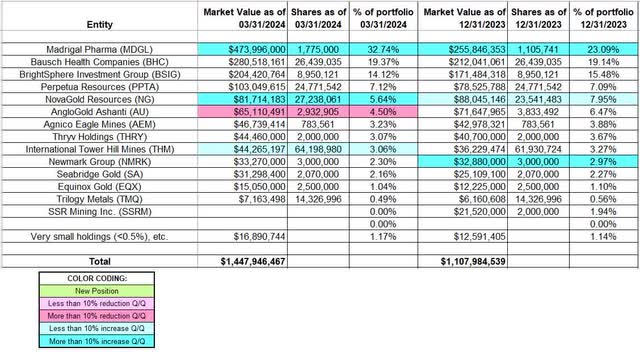

This quarter, Paulson’s 13F portfolio worth elevated from ~$1.11B to ~$1.45B. There are 18 13F securities within the portfolio, though solely 13 of them are considerably massive fairness holdings (greater than 0.5% of the 13F portfolio). The article is targeted on the bigger holdings. The highest 5 positions are Madrigal Pharma, Bausch Well being, Brightsphere Funding Group, Perpetua Sources, and NovaGold. They add as much as ~74% of the portfolio.

John Paulson is greatest identified for his extremely leveraged bets towards the real-estate bubble that netted him billions within the aftermath. To be taught extra about that, check-out the guide “The Biggest Commerce Ever”. In July 2020, Paulson introduced that they’re returning all exterior cash and are changing to a Household Workplace construction.

Word 1: In August 2021, Paulson known as a bubble in crypto (FBTC) (IBIT) (OTCQX:ETHE) saying “I might describe cryptocurrencies as a restricted provide of nothing.” However he’s not quick crypto due to its volatility.

Word 2: Paulson & Firm is understood to have an enormous place in Fannie/Freddie (OTCQB:FNMA) (OTCQB:FMCC) (OTCQB:FNMAS) (OTCQB:FMCKP) though the small print haven’t been disclosed.

Stake Disposals:

SSR Mining Inc. (SSRM): The 1.94% of the portfolio stake in SSRM noticed a ~140% stake enhance in This autumn 2021 at costs between ~$14.50 and ~$20. There was a ~35% promoting throughout This autumn 2022 at costs between ~$13 and ~$16.35. The disposal this quarter was at costs between ~$4 and ~$10.70. The inventory at present trades at $4.58.

Stake Will increase:

Madrigal Pharma (MDGL): MDGL is now the most important place by far at ~33% of the portfolio. It was established throughout Q2 2023 at costs between ~$204 and ~$312. The place was elevated by 43% within the subsequent quarter at costs between ~$146 and ~$226. The final quarter noticed a ~120% stake enhance at costs between ~$120 and ~$237. That was adopted by a ~60% enhance this quarter at costs between ~$171 and ~$283. The inventory at present trades at ~$277.

Word: They’ve a ~9% possession stake within the enterprise.

NovaGold Sources (NG): NG is a big (high 5) 5.64% of the portfolio long-term stake, established in 2010. Q2 2016 noticed a ~28% discount at costs between $5 and $6.50 and that was adopted with a ~13% promoting in This autumn 2016. Q1 2020 noticed a ~15% stake enhance at costs between $5.87 and $9.51 whereas the subsequent quarter noticed a ~12% trimming at costs between $7.40 and $12. The final two quarters noticed a ~23% enhance at costs between $2.28 and $3.80. The inventory is at present at $3.20.

Word: Paulson has a excessive cost-basis on NG and controls ~9% of the enterprise.

Worldwide Tower Hill Mines (THM): THM is a ~3% of the portfolio stake established within the 2013-2015 timeframe at a really low cost-basis. This autumn 2020 additionally noticed the acquisition of round 2.34M shares at ~$1.40. The inventory is now at $0.54. There was a minor ~4% enhance this quarter.

Word: Paulson has a ~32% possession stake in Worldwide Tower Hill Mines.

Stake Decreases:

AngloGold Ashanti (AU): AU is a 4.50% place. It’s a long-term stake that has been within the portfolio since 2009. Current exercise follows. H1 2020 noticed a ~45% discount at costs between $14 and $30. That was adopted with a ~14% promoting in This autumn 2020. Q3 2022 noticed one other one-third promoting at costs between ~$12 and ~$16. That was adopted with an ~80% discount within the subsequent quarter at costs between ~$12.25 and ~$19.75. The stake was rebuilt throughout Q1 2023 at costs between ~$17 and ~$24. This quarter noticed a ~25% promoting at costs between ~$16 and ~$23. The inventory is at present at $22.67.

Saved Regular:

Bausch Well being Firms (BHC): BHC place was elevated by nearly 300% in Q1 2015 at costs between $143 and $205 and one other ~340% the next quarter at costs between $197 and $242. This autumn 2015 additionally noticed a ~50% enhance at costs between $70 and $182. The aggressive shopping for towards falling costs continued in Q2 2016: ~44% enhance at costs between $19 and $36. Q2 2020 noticed one other ~25% stake enhance at ~$16.50 per share. The inventory at present trades at $6.43, and the stake is now the second-largest place within the portfolio at ~19%.

BrightSphere Funding Group (BSIG): BSIG is at present the third largest 13F stake at 14.12% of the portfolio. It was inbuilt This autumn 2018 at costs between $10 and $13.30. Q1 2019 noticed an enormous ~285% stake enhance at costs between $11 and $14.25. There was a ~55% discount in This autumn 2021 at ~$31.50 per share as they participated in a fixed-tender-offer by the corporate. The inventory at present trades at $21.78.

Word: Paulson’s possession stake in BSIG is ~20%.

Perpetua Sources (PPTA): The ~7% PPTA stake was bought in This autumn 2020 at costs between ~$6 and ~$11. There was a ~18% stake enhance in Q3 2021 at costs between ~$4.75 and ~$7.70. The inventory at present trades at $6.75.

Word: Paulson & Firm has a one-third possession stake within the enterprise.

Agnico Eagle Mines (AEM): The three.23% AEM place took place because of Agnico’s acquisition of Kirkland Lake Gold in an all-stock deal (0.7935 shares of AEM for every share held) that closed final January. Paulson & Firm had a 1.303M share stake in Kirkland Lake Gold, for which they obtained these shares. There was a ~270% stake enhance throughout This autumn 2022 at costs between ~$40 and ~$53.50. Q1 2023 noticed an ~80% discount at costs between ~$45 and ~$58. AEM at present trades at $64.25.

Thryv Holdings (THRY): The three.07% THRY stake was established in This autumn 2020 at costs between ~$8 and ~$14. Q1 2021 noticed a ~12% trimming at $27 per share. The following two quarters noticed one other ~25% promoting at costs between ~$27 and ~$41.50. The inventory at present trades at $18.87. There was a minor ~7% trimming throughout This autumn 2022.

Word: Paulson & Firm has a 5.8% possession stake within the enterprise.

Newmark Group (NMRK): The two.30% NMRK stake noticed a ~135% stake enhance within the final quarter at costs between ~$5.25 and ~$11.15. The inventory at present trades at $10.12.

Seabridge Gold (SA): The two.16% SA place noticed a ~125% enhance in This autumn 2020 at costs between ~$17 and ~$21. There was a roughly one-third enhance in Q2 2021 at costs between ~$16.15 and ~$19.75. It at present trades under these ranges at $14.37.

Equinox Gold (EQX), Trilogy Metals (TMQ), and Tellurian Inc. (TELL): These small (lower than ~1% of the portfolio every) stakes had been stored regular this quarter.

The spreadsheet under highlights adjustments to Paulson’s US inventory holdings in Q1 2024:

John Paulson – Paulson & Co Portfolio – Q1 2024 13F Report Q/Q Comparability (John Vincent (creator))

Supply: John Vincent. Knowledge constructed from Paulson & Firm’s 13F filings for This autumn 2023 and Q1 2024.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link