[ad_1]

D-Keine

It has been an eventful two months since I final up to date Unity Software program Inc. (NYSE:U) traders in mid-September. The debacle surrounding the corporate’s disastrous launch of its runtime payment led to the departure of its ex-CEO, John Riccitiello, from all management roles. The brand new workforce, beneath the management of Interim CEO James M. Whitehurst, clarified that the “income softness” attributed to the runtime payment introduction is “now largely behind the corporate.”

Regardless of that, the real-time 3D and gaming engine chief did not present steering for the fourth quarter or FQ4, resulting in a pointy selloff in U in early November 2023. Nonetheless, I assessed the collapse as a potential deck-clearing occasion, forcing peak pessimism and attracting dip patrons who pounded on the plunge in U.

Unity sellers have since misplaced important momentum, suggesting that the corporate can deal with an organizational reset, serving to it overcome its current challenges.

Whitehurst has laid out clearly in Unity’s third-quarter earnings scorecard that the corporate was too distracted beneath the earlier CEO. Such introspection is probably going appreciated by traders, anticipating administration to do the suitable factor, serving to the corporate to get again on monitor.

Whereas the corporate was targeted on bettering its profitability profile beneath Riccitiello, the quite a few M&As have led to a backlash amongst traders, as seen within the weak efficiency of U relative to its software program friends and the S&P 500 (SPX) (SPY). Accordingly, U posted a 1Y whole return of -14.3% because it struggles for traction. Due to this fact, the departure of Riccitiello is probably going welcomed by traders, though I count on U to stay within the penalty field for a while.

Administration harassed that the corporate would not anticipate important modifications to its adjusted EBITDA trajectory because it appears to shed much less/unprofitable enterprise segments. Additionally, the corporate will deal with chopping prices because it appears to streamline its operations to ship improved working leverage. Regardless of that, administration hasn’t offered concrete motion plans to traders. As well as, a scarcity of clear ahead steering suggests traders have possible included important uncertainties into its valuation as they await administration’s subsequent replace in early 2024.

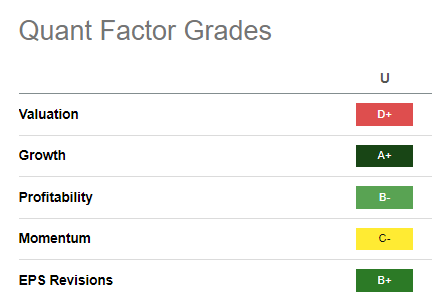

U Quant Grades (In search of Alpha)

U continues to be priced at a premium (“D+ valuation grade) for its best-in-class development potential (“A+” development grade). Due to this fact, I imagine a lot is at stake for Unity to ship its up to date methods to reignite its development methods whereas gaining focus to enhance its profitability.

Regardless of that, its constructive profitability metrics (“B-” grade) recommend Unity has some house to work on its execution except administration stuns traders with a sharply lowered adjusted EBITDA steering transferring forward. Whereas that continues to be a potential danger issue, the corporate’s assurance at its Q3 earnings name suggests it isn’t anticipated to be the bottom case, as Unity appears to shed much less or unprofitable alternatives.

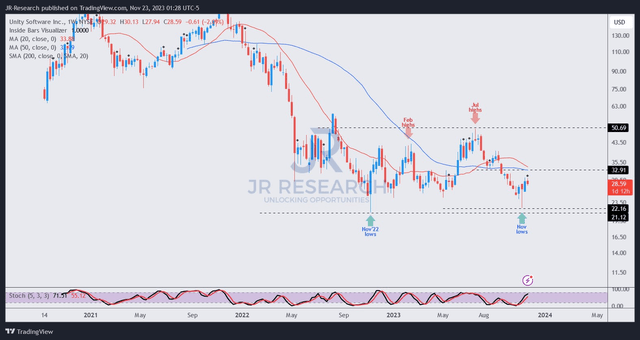

U worth chart (weekly) (TradingView)

Moreover, U’s worth motion suggests patrons returned aggressively in early November 2023 to defend in opposition to the collapse as sellers tried to power a capitulation.

Because of this, U’s November 2022 low ($21 degree) was held firmly by dip patrons, suggesting U would not appear prone to break additional beneath that degree.

Due to this fact, I assessed that a good higher alternative for traders trying so as to add U has arrived, because the reset that occurred in November ought to set the stage for U’s restoration. Buyers have possible baked in a pessimistic situation, reflecting the execution dangers from administration’s reset intentions. So long as Unity would not ship a a lot worse steering than anticipated, U’s $21 assist zone ought to maintain robustly.

Score: Upgraded to Robust Purchase.

Necessary word: Buyers are reminded to do their due diligence and never depend on the knowledge offered as monetary recommendation. Please at all times apply impartial considering and word that the score is just not supposed to time a particular entry/exit on the level of writing except in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a crucial hole in our view? Noticed one thing vital that we did not? Agree or disagree? Remark beneath with the intention of serving to everybody locally to study higher!

[ad_2]

Source link