[ad_1]

Breaking Down the Parts of MACD

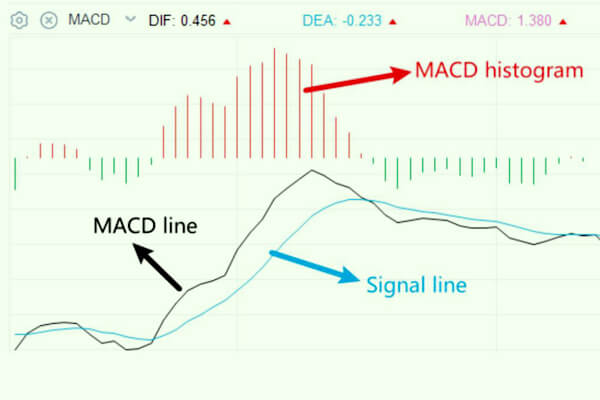

The MACD usually consists of three parts. The MACD line represents the 12-day Exponential Shifting Common (EMA) subtracted from the 26-day EMA. The second ingredient is the sign line, which is the 9-day EMA of the MACD. The ultimate part is the MACD histogram, indicating the disparity between the MACD line and the sign line.

Nonetheless, the parameters of the MACD line also can modify based mostly on the merchants’ choice. To distinguish these parts clearly, DIF constantly denotes the MACD line, whereas DEA all the time signifies the sign line.

The elemental idea of the MACD line is that the shorter-term EMA represents current value motion, whereas the longer-term one signifies previous exercise. Due to this fact, if there’s a vital hole between these two EMAs, the market is both trending upward or downward. Moreover, the MACD histogram, which fluctuates round a zero line, denotes the vigor of the pattern.

Evaluation of MACD Indicators

Crossovers

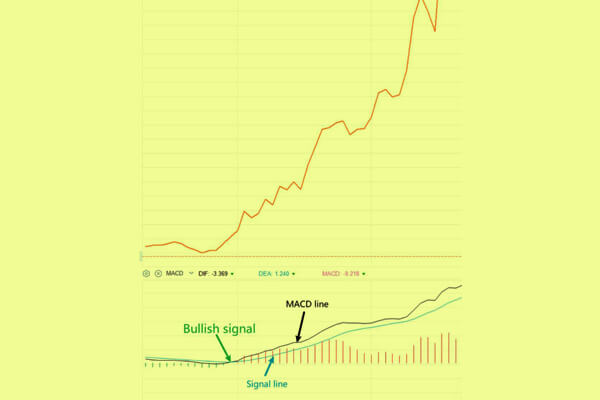

The intersections of the MACD line and the sign line can recommend a shift in value pattern. Some illustrations are offered within the upcoming graphs.A constructive sign is acknowledged when the MACD line strikes from beneath to above its sign line.

A bullish sign happens when the MACD line strikes up and crosses above the sign line.

A bearish sign happens when the MACD line strikes downward, crossing under the sign line after being above it.

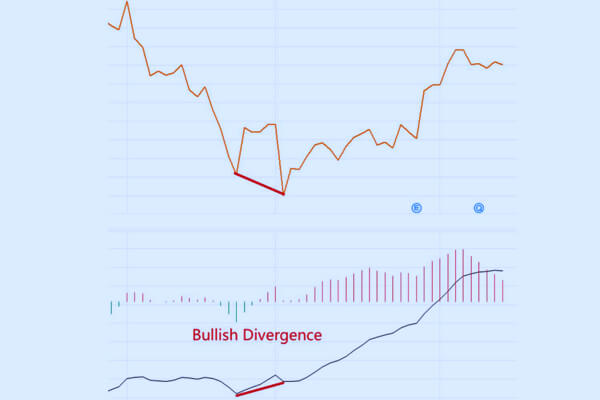

Divergence is displayed when the MACD line and the value exhibit contrasting traits. The divergence sign might recommend a possible shift in a pattern. For example, if the MACD line is transferring upward whereas the value kinds a decrease low, a bullish divergence takes place, indicating that the value motion might turn out to be constructive.

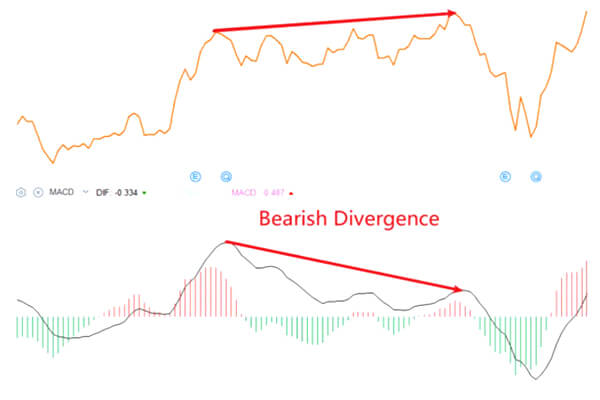

Then again, if the MACD line is transferring downward whereas the value reaches a better excessive, a bearish divergence emerges, suggesting that the value motion might turn out to be detrimental.

Zero-Cross Technique

When the MACD crosses from beneath to above the zero line, it’s thought to be a bullish indication. Merchants usually provoke lengthy positions when this occurs. Conversely, if it crosses from above to under the zero line, it’s seen as a bearish sign by merchants. On this case, merchants enter quick positions to capitalize on declining costs and rising downward momentum.

In each eventualities, the longer the histogram bars, the stronger the sign. When a robust sign is current, it’s extra possible—however not assured—that the value will persist within the trending route.

Disadvantages of MACD

Like all oscillator or indicator, the MACD has limitations and hazards.

Reversal Sign

Ineffectiveness of MACD in lateral markets

MACD doesn’t carry out successfully in lateral markets. When costs predominantly oscillate sideways inside a variety outlined by assist and resistance, MACD typically shifts towards the zero line because of the absence of an upward or downward pattern—the place the transferring common is handiest.

Lagging Indicators

Moreover, the MACD zero-cross acts as a lagging indicator because the value usually stays above the prior low earlier than the MACD crosses the road from beneath. This may end up in getting into an extended place later than you doubtlessly might have.

[ad_2]

Source link