[ad_1]

The crypto market enters an important week, with the US CPI inflation figures in focus. As well as, the US Producer Worth Index (PPI) information, one other vital inflation metric thought of by the US Federal Reserve to determine their price lower plans, can be scheduled for this week. Notably, traders eagerly await this determine as Bitcoin in addition to the altcoins sector is gearing up for additional rally, doubtlessly hitting new data forward.

Crypto Market Awaits US CPI Inflation Figures

The crypto market has famous a powerful rally lately, with traders anticipating the rally to proceed forward. Now, with the strong Labor market, as evidenced by final week’s Job information, merchants are eagerly ready for the upcoming US CPI inflation figures. For context, the US added 227K jobs in November, up from the market expectations of 220K. Moreover, the US unemployment price additionally rose to 4.2% in November, up from 4.1% within the prior month.

Notably, the financial indicators are likely to affect the broader monetary market, not to mention the digital belongings area. Having mentioned that, inflation and different key figures play a key position in shaping the market sentiment.

Now, traders eagerly await the US Client Worth Index information, which is scheduled for Wednesday, December 11. In accordance with the market forecast, the inflation is predicted to come back in at 2.7%, as in comparison with 2.6% within the prior month. Concurrently, the Core CPI, which excludes meals and vitality costs, is predicted to chill down to three.2% from 3.3% famous in October. A warmer-than-anticipated inflation determine often ends in a waning risk-bet urge for food of the merchants.

Then again, the US PPI information, one other key metric to gauge inflationary strain, is scheduled for Thursday, December 12. The market individuals would additionally hold shut observe of those figures for readability on the present inflationary pressures within the nation. Notably, the market is anticipating the US PPI figures to stay unchanged from final month.

Will Bitcoin & Altcoins Proceed To Rally?

The crypto market, together with Bitcoin and the highest altcoins has famous a strong rally lately, indicating robust market confidence. Notably, BTC has lately soared previous the $100K mark, touching its ATH of $103,900 final week. Notably, the rally began as optimism soared towards pro-crypto rules within the US after Donald Trump’s election win.

Now, regardless of anticipation over sizzling US CPI inflation figures, the market anticipates the Bitcoin and altcoins rally to proceed forward. Though some analysts warned over short-term pullbacks throughout these bull part, the digital belongings are more likely to set new data forward.

As well as, historic information means that This autumn tends to be constructive for the monetary markets, particularly cryptocurrencies. It’s value noting that up to now, the crypto market additionally confirmed the same efficiency this 12 months as nicely. Contemplating that, the financial indicators should not more likely to weigh a lot on the traders’ sentiment forward.

What’s Subsequent For BTC & Different Crypto?

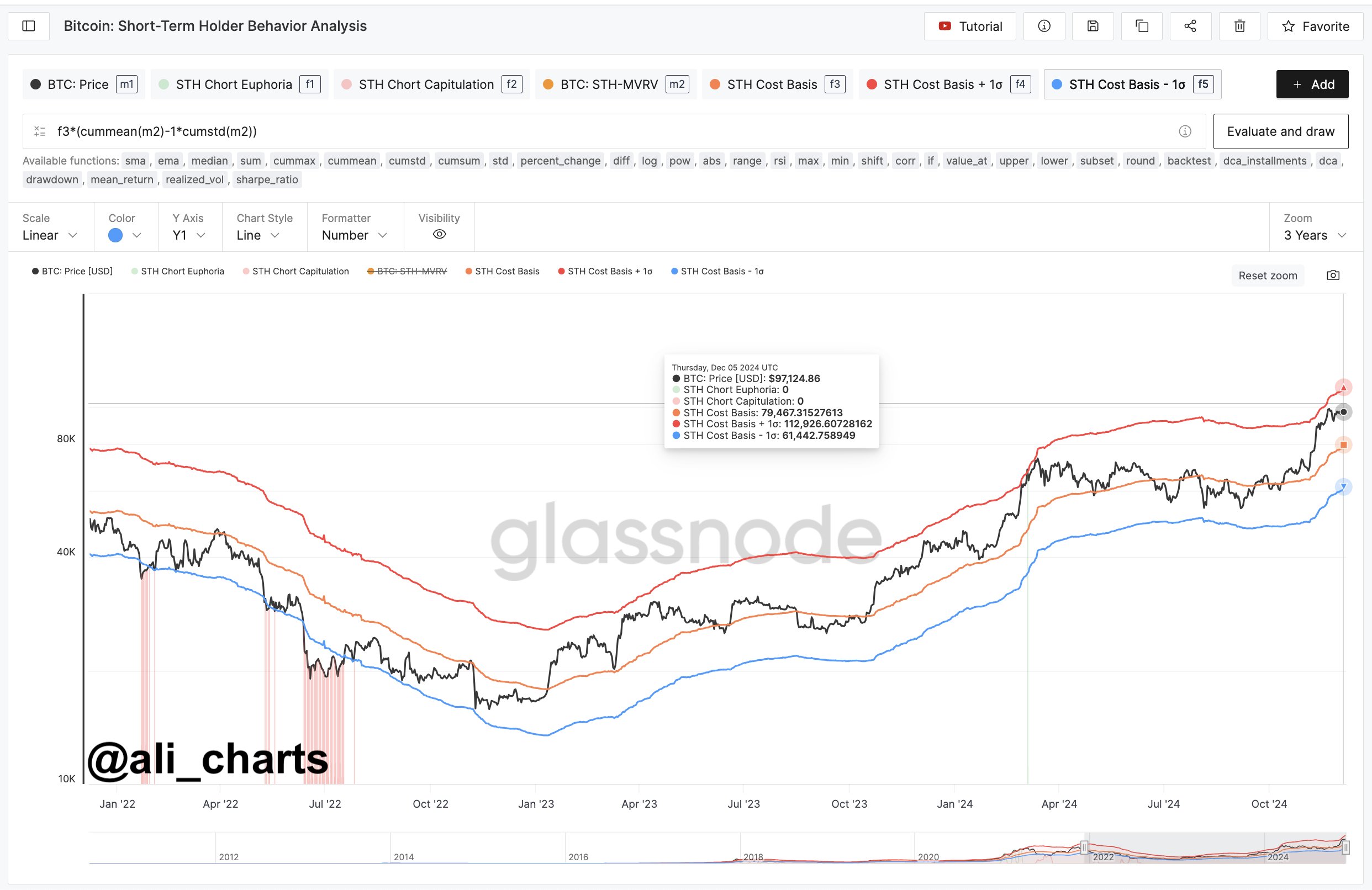

In a latest evaluation, prime crypto market analyst Ali Martinez mentioned that Bitcoin is poised to achieve $112,926, citing technical developments. This has sparked optimism amongst traders, particularly as BTC whales are on a shopping for spree in latest days.

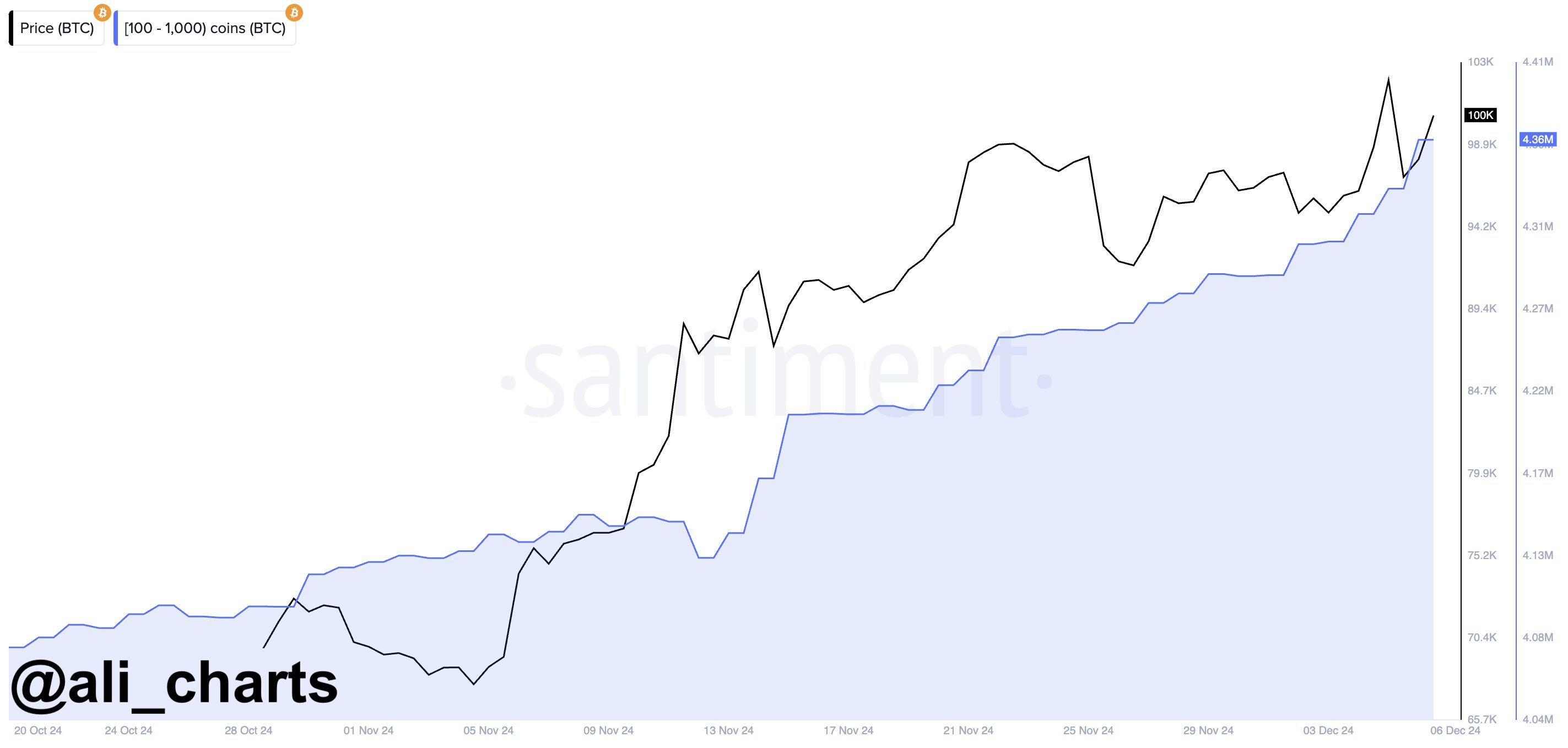

Martinez additionally mentioned in one other publish that “Bitcoin whale accumulation goes parabolic.” He famous that lately the whales have bought 20,000 BTC, value round $2 billion. As well as, the hovering retail curiosity additionally hints towards an extra rally forward. Notably, Marathon Digital (MARA) has accelerated its BTC shopping for technique, gaining traders’ consideration.

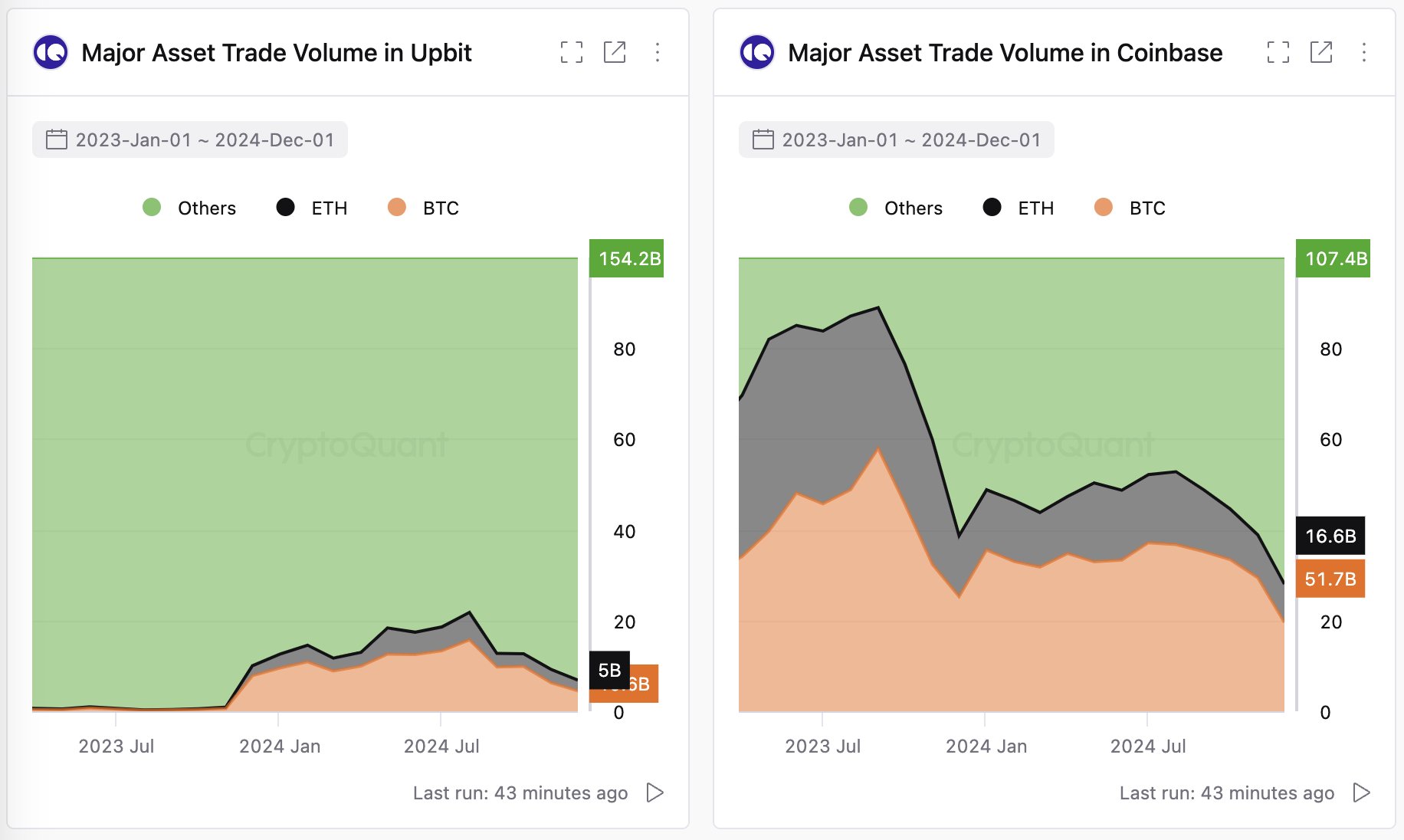

Thus far, the altcoins have additionally adopted Bitcoin’s run in direction of the north. Speaking concerning the altcoin season, CryptoQuant CEO and Founder Ki Younger Ju confirmed confidence within the altcoin market, citing the crypto buying and selling pattern in South Korea. In a latest X publish, he said:

“South Korea: The world’s second-largest crypto market, the place 93% of trades are altcoins and solely 4% are Bitcoin. Each season is alt season.”

Disclaimer: The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link