[ad_1]

Luis Alvarez

Funding Thesis

2024 has confirmed to be a tricky 12 months for the buyer providers trade. With enter costs remaining so excessive, many firms have discovered it troublesome to totally capitalize on the post-pandemic demand resurgence. As such, most of those firms have missed on their earnings’ targets and plenty of shares have been performing poorly compared to the key indexes. That is precisely the case for Walgreens Boots Alliance (NASDAQ:WBA), which has seen a 55% YTD lower in its share value. Nevertheless, I count on WBA’s downtrend to proceed on account of a continuation of those robust market circumstances, antagonistic results from poor C-suite decision-making, and an impending maturity wall that the corporate will wrestle to take care of. My base case valuation for WBA is $8.35, which is a 30% {discount} from the present value.

Trade Overview

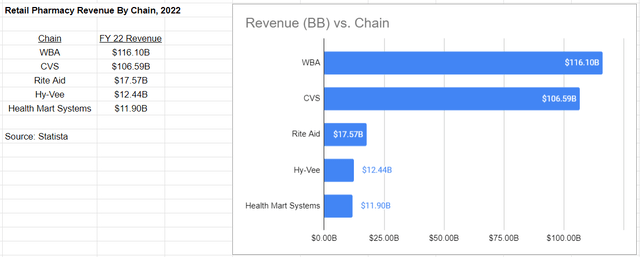

Within the drugstore trade, it’s extremely exhausting to ascertain a aggressive edge. It’s because in each drugstore across the nation, the merchandise being bought are nearly (if not totally) an identical, with solely minor variations past the energetic elements in every drug. There are alternatives to do gross sales promotions or advertising and marketing stunts to attempt to intensify variations, however due to this underlying truth, it’s not actually possible for drugstores to splurge on promoting. As a substitute, I’d argue {that a} drugstore’s edge is reliant on its picture of consistency and security – in spite of everything, the underside line is that regardless of the value is, nobody would purchase medicine from an individual or retailer they don’t belief. It’s due to this fact no shock that the US retail pharmacy market is a duopoly, with Walgreens and CVS being the 2 important opponents, as these two chains have the strongest model names within the nation. In 2023, each CVS and WBA did roughly $110B in home retail pharmacy gross sales, whereas the third-largest chain, Ceremony Help, solely did $17B for the 12 months. The extra generic {discount} and grocery store chains – Walmart, Kroger, and the like – do take a number of the market share, principally via in-house pharmacies and customary OTC merchandise like Tylenol and Benadryl. In the intervening time, their income share pales compared to CVS and WBA; nevertheless, this can be a altering pattern, which I’ll talk about in additional element.

2022 Retail Pharmacy Income by Chain (Statista)

A fast have a look at US retail gross sales exhibits an honest image for the general trade. The July sixteenth report confirmed a 0.0% change, which was a beat on the estimate of -0.3%. Moreover, for the previous few months, numbers have remained inside a 1% month-over-month change, exhibiting predictability within the US client market. That is additionally indicative of a way more secure client base, the precise reverse of the volatility we noticed within the months instantly after the pandemic. Even because the trade nonetheless faces some challenges, particularly round inflation and systematic break-ins, these numbers present that the market circumstances might be a lot worse than they’re now.

Firm Overview

Walgreens was established in 1901 in Chicago as a pharmacy chain, and the headquarters continues to be within the Chicago suburb of Deerfield. It’s at present the second-largest retail pharmacy chain within the US – as talked about, CVS is the opposite main chain available in the market. The corporate merged on the finish of 2014 with Alliance Boots to type Walgreens Boots Alliance; it beforehand purchased 45% of the corporate in 2012 and acquired the remainder by 2014. Walgreens is WBA’s US working arm, whereas Alliance Boots covers the worldwide facet. Retail pharmacy is the core of the enterprise, however Walgreens additionally has a healthcare arm through a majority acquisition of VillageMD in 2021. Globally, Boots operates retail pharmacies within the UK, Thailand, Eire, and Mexico beneath the Benavides model, in addition to the drug wholesale model GEHE AG in Germany.

There are two current developments that I want to point out on the outset, as they don’t seem to be strictly associated to valuation, in contrast to the factors I’ll point out later. Firstly, their CEO Tim Wentworth has solely been within the function since October 2023. He beforehand labored for Specific Scripts and later Cigna’s Evernorth Well being Companies, within the pharmacy profit administration house (basically back-office work for pharmacies) and healthcare house respectively. With intimate data of each areas and with each being core components of WBA’s enterprise mannequin, it made sense for the corporate to nominate him as CEO 9 months in the past. Secondly, Walgreens has been embroiled in lawsuits surrounding opioids, having been accused (amongst different firms) of considerably contributing to the present opioid disaster. Walgreens settled many of the lawsuits in 2022, agreeing to pay out $5.7 billion over 15 years to a number of states. On the 2023 firm revenue assertion, this confirmed up as a one-time $7.5B expense concerning authorized and regulatory accruals and settlements.

Key Drivers/Funding Catalysts

Continued Headwinds

To start out, there are indicators that the headwinds that WBA needed to face in 2022-2023 will clearly proceed from right here.

Market Share Issues

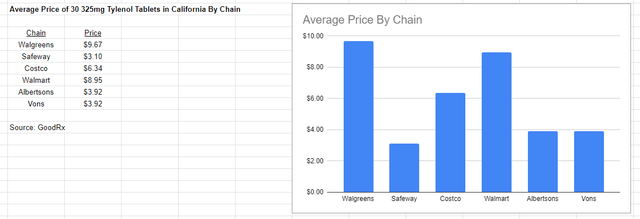

For the previous few years, opponents have been consuming away at Walgreens’ market share. It has develop into far simpler for individuals to do issues at dwelling – on-line buying is changing into the brand new norm, and there’s no scarcity of on-line pharmacies that ship medication instantly. On the similar time, {discount} shops like Walmart and Goal have been promoting frequent OTC medication themselves. Moreover making themselves a “one-stop store” for customers, the costs for medication are sometimes cheaper at these {discount} shops on account of economies of scale. Connected is a graph exhibiting the common California costs of a 30-pack of 325mg Tylenol tablets at Walgreens in addition to a number of {discount} retailer chains, proving the validity of this concept.

CA Common Value of Tylenol By Chain (GoodRx)

Walgreens is making an attempt to refashion themselves as a pseudo-discount retailer by promoting non-pharmacy objects and beginning supply, however this has failed because the connotation with shops like Walgreens and CVS is to drive in for pickup or buy. The pandemic was the exception to this as customers went out to drugstores instantly in emergencies (as a result of they had been the one shops that weren’t closed), after which normally purchased different issues whereas there – that is one factor that WBA vastly benefited from in 2021, because it didn’t see the identical income droop as most firms throughout that 12 months. Nevertheless, now that the pandemic has ended, Walgreens is beginning to really feel the ache as a result of this drive-in connotation has remained.

In-Retailer Expertise

Moreover, the in-store expertise for these chains has been fairly poor. With systematic break-in crimes on the rise in lots of cities, Walgreens has needed to discover the stability between making it too simple for criminals to steal issues and making it too exhausting for purchasers to purchase issues. Clients simply don’t like this new actuality, and shops are seeing a 10-25% discount in gross sales on account of frustration over locked merchandise.

Worldwide Phase

There may be one caveat in all of this, specifically that WBA’s worldwide phase has been performing fairly effectively. Nevertheless, the problem is that the US greenback has been transferring up on most foreign currency echange worldwide, together with the euro and Mexican peso. As such, as soon as worldwide revenue is transformed into USD, it’s not even that nice for the corporate. WBA’s worldwide gross sales phase noticed a 6.7% fixed forex gross sales acquire from 2022 to 2023, however as soon as this change price change is factored in, the gross sales acquire goes down to simply 1.7%.

Merely put, there are a lot of the explanation why prospects are selecting to not spend their cash at Walgreens, and the shoppers who do go are having worse experiences, and All of that is having a poor exhibiting at Walgreens shops themselves – the Yelp common ranking of 77,000 whole Walgreens evaluations is 2.2 stars, removed from the standard of service one would count on at a typical retail retailer. This poor efficiency additionally extends to the C-suite, as the corporate is trying to shut as a lot as 25% of its unprofitable shops over the following three years. This central concept is a very powerful takeaway for my bearish outlook on WBA inventory.

Maturity Wall

Secondly, WBA is at present going through a looming debt drawback. The corporate has $9B in whole debt, and $4B of that’s due in 2026. For some firms, this is able to not be an issue. Nevertheless, the corporate solely made $344 million within the final quarter, and has solely paid down $100 million of its debt in that point span, per the 3Q earnings report. Collectors have realized this; WBA was not too long ago given junk scores from S&P and Moody’s, with a unfavorable outlook for the longer term. At the same time as refinancing will assist the corporate with deferring fee, these scores will make it exhausting – if not unattainable – for Walgreens to get an excellent rate of interest. Moreover, any refinancing is not going to do something to enhance WBA’s underlying place. As mentioned, the money stream issues which were plaguing WBA will stick round for the foreseeable future, and even when the corporate can do away with the 2026 maturity wall, it might solely achieve this by growing its debt fee later, amplifying WBA’s money stream issues much more. Due to this, it appears to me that refinancing would merely kick the can down the street.

Adversarial Repercussions of Choices

Lastly, the repercussions of a number of C-suite choices prior to now few years are beginning to actually harm the corporate. Though these choices might need been made in good religion, they’ve solely brought about the corporate to wrestle extra. The VillageMD majority acquisition is an effective instance of this. WBA acquired it in 2021, however the holding has nonetheless failed to interrupt even after 3 years of operations. This phase was supposed to interrupt even by the tip of this fiscal 12 months per 4Q 2023 steerage, however as a result of it has misplaced $151 million YTD in 2024, it’s extremely unlikely that this may happen. The shop sell-leaseback coverage is one other instance of this – the corporate was capable of harvest the tax advantages and provide you with some additional money, however there are solely so many shops that may be leased again. Walgreens solely owns 5% of its shops at this level, whereas its lease funds are solely rising bigger in consequence. Lastly, it may be argued that the key opioid settlement is one other of those repercussions – though this can’t simply be pinned on the selections of some individuals, it has however a bit again on the corporate.

Observe on Additional Opioid Lawsuits

At the same time as the massive settlement made headlines, there are nonetheless loads of authorized actions happening at present towards the corporate, and Walgreens continues to be coping with opioid lawsuits proper now. Many of the excellent circumstances have been collected right into a multidistrict lawsuit within the Northern District of Ohio, of which Walgreens is among the named defendants. A decide there already discovered for the plaintiffs within the 2022 bellwether case County of Lake, Ohio v. Purdue Pharma et al. Individually, Walgreens is among the named defendants in two different circumstances in Maryland and Florida, that are each of their respective state courts. Each circumstances had been settled as a part of the 2020 Purdue Pharma settlement (this isn’t the identical settlement outlined within the firm overview), however are transferring via the trial course of once more after the Supreme Courtroom struck that down earlier this 12 months. The verdicts on these circumstances are years out. Nevertheless, if the ruling within the bellwether case holds true for all of those circumstances, Walgreens will most likely be ordered to shell out extra abatement funds.

To conclude, all of those results might need been comparatively meaningless in a distinct world – for instance, if an organization had a powerful sufficient revenue margin to simply repay a big authorized settlement, it could be akin to a velocity bump whereby the corporate’s operations may be impacted momentarily, however in the long term it doesn’t imply an excessive amount of. Nevertheless, Walgreens is completely different as a result of the market circumstances proper now are so robust. As soon as the headwinds are factored in, the extra impact of those choices has brought about WBA’s place to deteriorate considerably, and its inventory value has declined in consequence – 55% year-to-date and 60% within the final 12 months on the time of writing. Moreover, due to the continued results of those choices, I don’t count on this value decline to decelerate anytime quickly.

Valuation

Assumptions

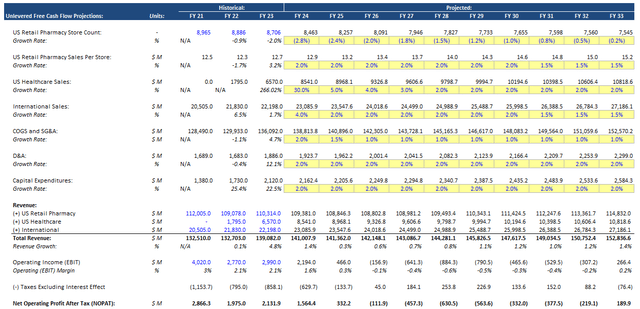

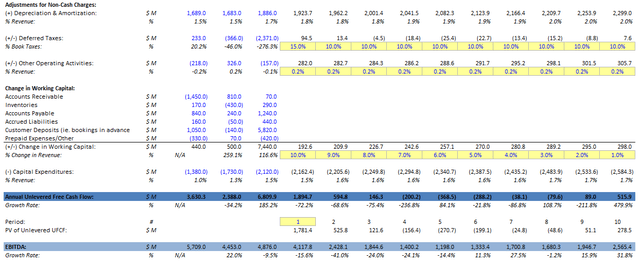

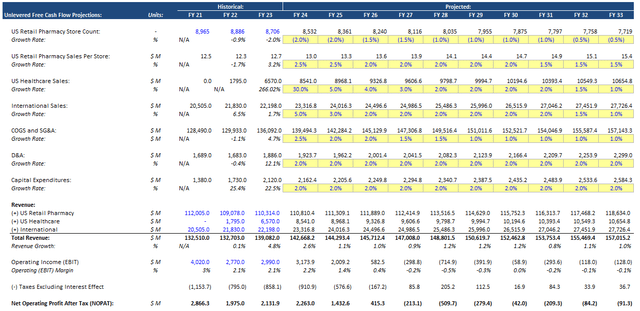

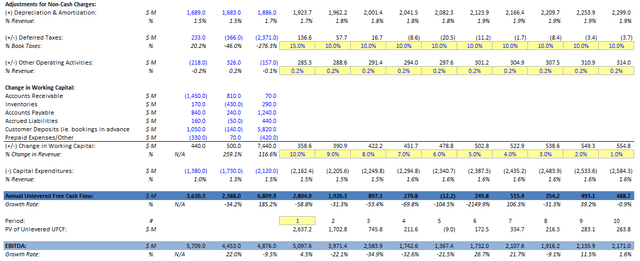

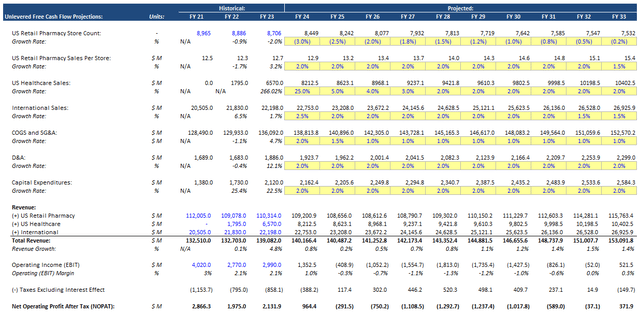

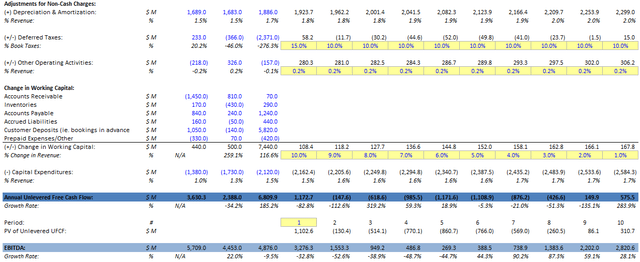

Earlier than I talk about my mannequin, I want to speak about its assumptions. Assumptions for the DCF are rooted in administration projections, both by taking actual steerage or matching the final pattern. For instance, the 30% healthcare income enhance matches firm steerage of $8.5B for the 2024 fiscal 12 months, and this can be a cheap prediction regardless as this phase has achieved $6.2B within the first three quarters of the 12 months. That is relevant for many of the mannequin – nevertheless, there are some objects I want to point out individually.

The US retail pharmacy phase is modeled on a per-store foundation. Nevertheless, this isn’t achieved for the opposite income segments as a result of it could be very exhausting to consolidate estimates of various nations’ development trajectories, and these income segments make up a lot much less of the enterprise anyhow. Bills like COGS and SG&A are assumed as a single quantity for the entire firm as a result of the corporate doesn’t report these numbers by income phase.

The tax price of 28% is taken from pre-COVID as current years are fairly unusual with taxes – the tax price for FY 2023 was unfavorable (i.e. a tax profit) on account of WBA decreasing its valuation allowance to offset capital good points for the 12 months, in addition to “inner authorized entity restructuring and one-off tax advantages associated to a measurement change in prior 12 months tax positions.” I believed it is best to make use of numbers from a extra regular interval.

Lastly, I’ve not accounted for uncommon bills within the mannequin as a result of they’re fairly merely unpredictable. I believe there’s a chance that a few of these bills could happen, particularly since there are nonetheless a number of opioid-related fits that WBA is concerned with, as mentioned beforehand; nevertheless, it simply doesn’t make sense to attempt to predict these occasions. Regardless, if these uncommon bills do occur, then it is going to drag down WBA’s web revenue like what occurred in 2023 – this may solely be useful to a brief place.

Base Case

Creator’s Calculation Creator’s Calculation Creator’s Calculation Creator’s Calculation

On to the bottom case itself. On this state of affairs, the numbers play out basically as administration expects. Over time, the corporate closes unprofitable shops earlier than reaching a kind of steady-state after 10 years. On the similar time, bills stay simply as excessive, considerably reducing into WBA’s income like they’re doing proper now. Income per retailer development price stays excessive initially to cowl the shoppers going to completely different shops, however finally tapers as prospects run out of Walgreens shops near them. The healthcare and worldwide segments each see robust development general, however it doesn’t matter an excessive amount of as a result of retail phase’s struggles. With this set of assumptions, I’ve the corporate reaching unfavorable EBIT by 2026, which occurs to coincide with the $4B maturity wall mentioned beforehand.

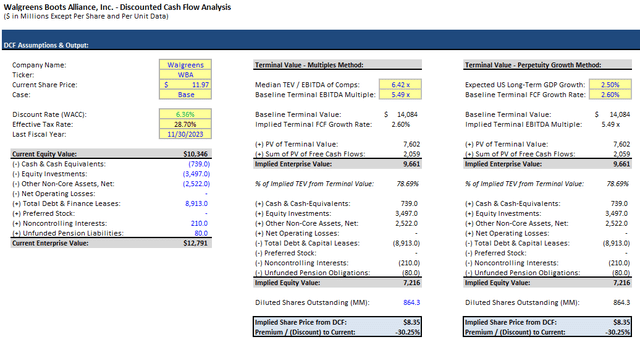

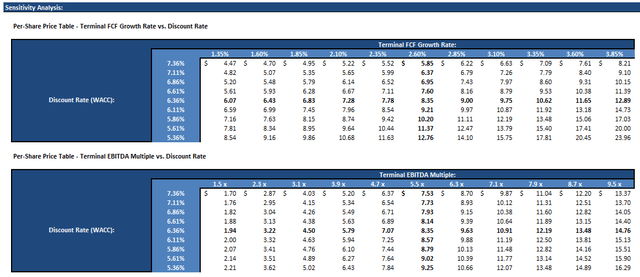

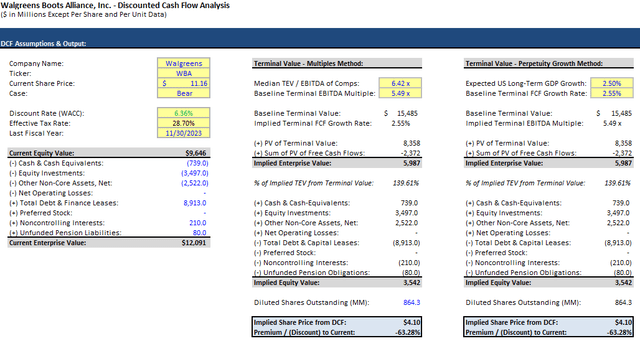

Given the {discount} price of 6.36%, I’ve estimated the honest worth of WBA shares to be $8.35, which means a 30% draw back from the present value. Moreover, as a result of assumptions outlined above, I really feel that I’ve given the WBA numerous slack numbers-wise, so this base case may be very cheap in my guide.

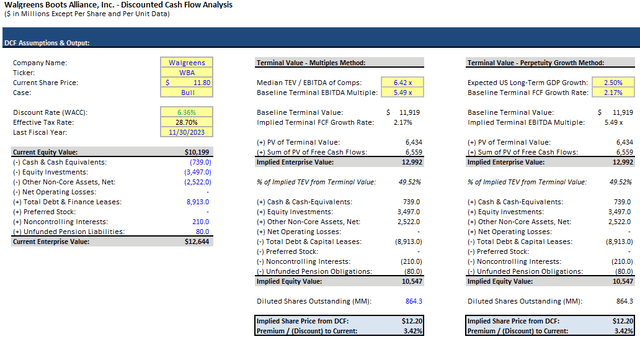

Bull Case

Creator’s Calculation Creator’s Calculation Creator’s Calculation Creator’s Calculation

Subsequent is my bull case. On this state of affairs, the corporate can capitalize on decrease prices and elevated revenues pushed by extra client spending and higher market circumstances – as such, far fewer shops are closed down, and the corporate is ready to begin discovering its footing once more. Moreover, the opposite income segments do higher than anticipated, at the same time as they do taper into the longer term as typical. Though the corporate will nonetheless see issues with optimistic EBIT, the distinction is that on this bullish case, WBA’s money stream base is far stronger as a result of it retains far more retail infrastructure to drive gross sales or increase money by liquidating a few of these belongings. Firm administration can then use this stronger place as a kind of basis to begin planning across the debt burden, and WBA has a a lot larger chance of post-2026 restoration in consequence.

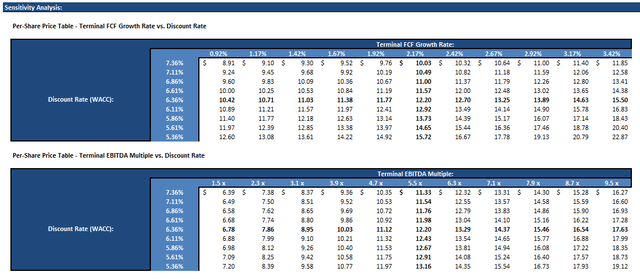

On this case, WBA shares are valued at $12.20 per share, implying a ten% upside potential. If this elevated demand kind of state of affairs had been to truly play out, I believe this can be a cheap valuation, particularly on condition that the principle trigger for the Q3 earnings slide was income weak spot. Nevertheless, as mentioned beforehand, I don’t assume that is doubtless for the WBA.

Bear Case

Creator’s Calculation Creator’s Calculation Creator’s Calculation Creator’s Calculation

Lastly, I’ll talk about my bear case – that is basically the worst-case state of affairs for the corporate. On this state of affairs, extra shops are closed than within the base case, however the income development per retailer stays the identical as prospects select competing chains as an alternative. On the similar time, different income segments drastically miss their targets whereas prices keep excessive on account of higher-for-longer inflation. My valuation of WBA on this case is $4.10, implying a 60% draw back. That is clearly a really excessive case, however a extra reasonable model of that is effectively inside attain for WBA if the circumstances are proper and if there’s one other uncommon expense for the corporate to take care of. By the identical token, a number of the sensitivity evaluation per-share values are within the negatives, which is theoretically unattainable; to me, this merely signifies a chapter occasion and a near-zero share worth, which might theoretically be the best-case state of affairs for a brief. A watershed mannequin and related misery pitch can be wanted for valuations and such in a while, however since WBA’s liquidity continues to be secure proper now, I don’t need to contact on this matter but.

Dangers And Mitigants

One danger of observe is that of a viral drug that might trigger retail gross sales to skyrocket. A current instance of that is Ozempic, which went viral final 12 months as a weight-loss drug. Nevertheless, I don’t assume this may impression WBA as a lot due to the way it was – and nonetheless is – far simpler for a client to purchase the drug on-line. It additionally merely is smart that to ensure that a client to purchase the identical drug at Walgreens, they must do a considerable quantity of additional work in comparison with merely shopping for it on-line or through a telephone name. I believe that if there ever was one other Ozempic, the same state of affairs would eventuate, and WBA wouldn’t see a lot profit.

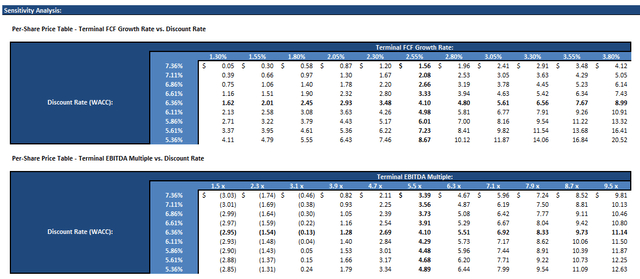

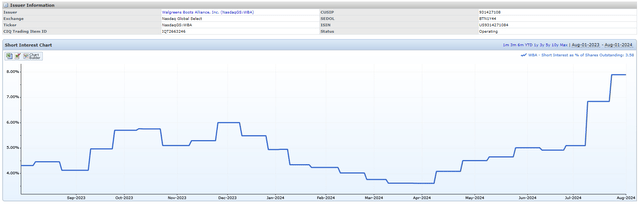

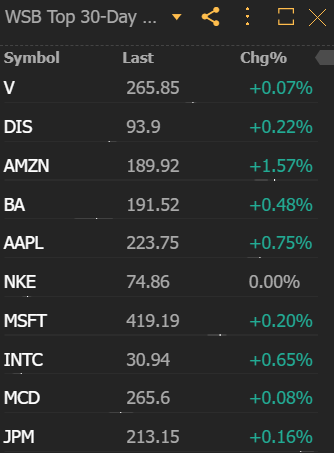

One other danger is that of a meme stock-style brief squeeze. Quick curiosity in WBA has been on the rise over the previous few months (proven under), and WBA does have parallels with GME, AMC, and so forth – all of those are struggling firms with considerably outdated enterprise fashions and ample debt, with rising brief curiosity besides. There’s a chance that one other 2021 GME-type of rally might occur with WBA. Nevertheless, this isn’t a inventory that’s on many retail merchants’ watchlists. Connected is a chart detailing the variety of instances WBA was talked about on r/wallstreetbets – after being talked about 58 instances on the day of the Q3 earnings report, WBA has had nearly no mentions on the subreddit. Additionally hooked up is a watchlist detailing the highest shares within the 30 days earlier than the time of writing; it’s clear r/wallstreetbets has been far more involved about these different firms, none of which have something to do with the drug or medical trade. As such, firms like WBA have been skipped by most of those squeeze-oriented retail merchants, and I don’t see how there shall be sufficient quantity to truly execute a squeeze on WBA inventory.

1Y WBA Quick Curiosity (S&P Capital IQ)

WBA WSB Mentions Historical past (TrendSpider) WSB Prime 30-Day Mentions (TrendSpider)

Lastly, there’s a danger that because the economic system continues to get better and the Fed cuts charges, the optimistic results will lengthen to WBA, inflicting its gross sales to extend and its prices to stay secure within the brief time period. This might permit the corporate to stabilize by stopping retailer closures, whereas additionally giving it a base to start paying down its 2026 maturity wall. Nevertheless, I don’t assume these developments will have an effect on WBA as a lot, seeing because the underlying enterprise will nonetheless face headwinds into subsequent 12 months as mentioned. Even when the broader economic system turns into higher for customers, I don’t count on it to considerably have an effect on gross sales as a result of a drugstore might be the final place {that a} client will select to spend their cash. Moreover, even when the Fed’s price cuts will assist WBA with their debt burden, it is not going to enhance WBA’s underlying place and can solely enhance their money stream stress in a while, as mentioned. Because the enterprise may have a tough time attending to optimistic EPS anyhow, price cuts is not going to assist WBA as a lot as an organization with a transparent technique to pay. (My earlier article on Carnival Corp is an effective instance of this kind of firm.)

Conclusion

To conclude, I count on WBA to be in a tricky place by the tip of the 12 months on account of market circumstances, repercussions of previous choices, and with a large debt burden. As such, I’m recommending a promote on WBA with a goal of $8.35. There are dangers surrounding one-off “virality” occasions and broad financial energy, however these will not be prone to have an effect on WBA all an excessive amount of, making this a lovely firm for buyers to brief.

[ad_2]

Source link