[ad_1]

onurdongel

Western Midstream (NYSE:WES) reported some sizable positive factors in earnings for the second quarter of 2024. Evidently, the outcomes and the widespread unit worth had been adequate for Occidental Petroleum (OXY) to register to promote some items (click on on August 12 announcement). Usually, when the principle controlling entity desires to promote, that may be a bearish sign as a result of an insider is indicating to the general public that the insider is getting a superb worth for the inventory. Nevertheless, Occidental has lengthy wished to liquidate not less than a few of its holdings in Western Midstream. Regardless that that’s now taking place, Occidental will nonetheless be working the midstream for the foreseeable future. Which means the turnaround is more likely to proceed.

Earnings Abstract

The final article reported a greater than 50% enhance within the distribution. On the time, there was some fear in regards to the tightness of the distribution to the remaining free money movement. However that has diminished with the newest earnings report.

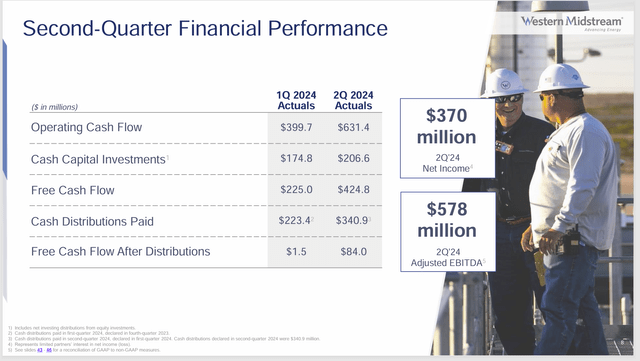

Western Midstream Companions Second Quarter Monetary Abstract 2024 (Western Midstream Companions Second Quarter 2024 Earnings Convention Name Slides)

As proven above, (click on on the second quarter slides) the second quarter outcomes climbed fairly a bit larger than the primary quarter outcomes. Evidently, the comparability to the earlier fiscal 12 months was fairly good as nicely.

The partnership is now an funding grade partnership, which makes this funding concept one of many larger high quality concepts within the midstream a part of the business.

Leverage danger has been lowered significantly, and the partnership now works carefully with Occidental Petroleum (which is likely one of the extra extremely regarded operators within the business).

Whereas enhancements have develop into obvious from the sizable distribution enhance, there’s doubtless extra to this story going ahead. Occidental is a tough driving, detail-oriented outfit. There may be each probability that this may develop into a progress and earnings play as the long run unfolds.

Steerage

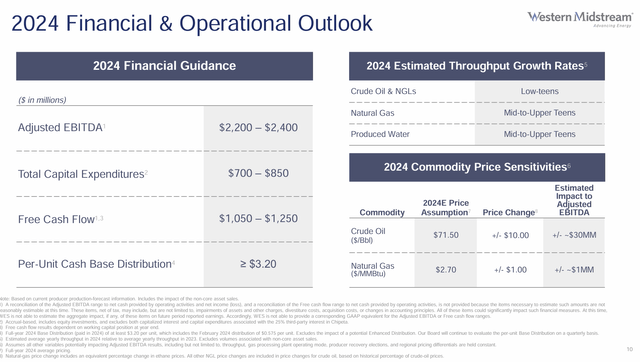

The steering for the fiscal 12 months exhibits progress within the teenagers.

Western Midstream Fiscal 12 months Steerage Abstract (Western Midstream Companions Second Quarter 2024 Earnings Convention Name Slides)

That is more likely to set up a future progress price sample of quantity progress within the low double digits for a while to come back. There’ll doubtless be an opportunistic acquisition alongside the way in which.

Occidental is regularly establishing a really completely different future from when Anadarko ran this midstream prior to now.

Historical past

Again on August 8, 2019, there was an announcement on the web site beneath information about Occidental taking up administration of the midstream after it closed on the acquisition of Anadarko.

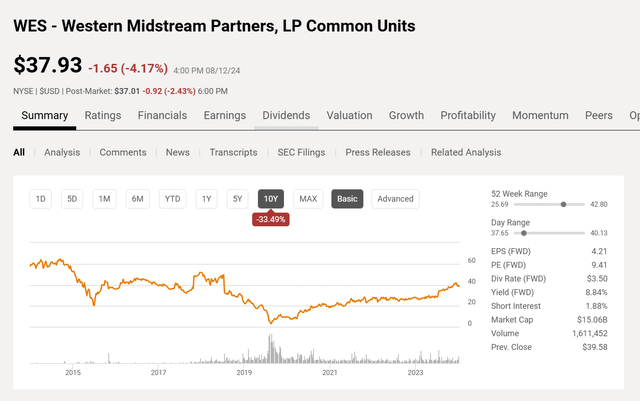

Western Midstream Widespread Unit Worth Historical past And Key Valuation Measure (Looking for Alpha Web site August 12, 2024)

Again when Occidental gained management of the midstream, the widespread unit worth was within the $20’s vary. As proven above, it went far decrease as a result of covid challenges earlier than the value restoration started. However now, Occidental has a roughly 50% achieve in worth of the general public items held.

As of December 31, 2023, Occidental held (i) 185,181,578 of our widespread items, representing a 47.7% restricted companion curiosity in us, (ii) via its possession of the final companion, 9,060,641 normal companion items, representing a 2.3% normal companion curiosity in us, and (iii) a 2.0% restricted companion curiosity in WES Working via its possession of WGRAH, which is mirrored as a noncontrolling curiosity inside our consolidated monetary statements. As of December 31, 2023, Occidental held 48.8% of our excellent widespread items “

This comes from the annual report of the midstream firm for fiscal 12 months 2023. The most recent announcement to promote some widespread items that Occidental owns is hardly going to vary the management scenario proven above. Even after the sale, Occidental will nonetheless personal a considerable variety of widespread items and can nonetheless have a considerable curiosity in seeing the worth of these items climb.

An announcement on the Looking for Alpha web site exhibits a sale that may doubtless be round 20 million shares. However the market will doubtless soak up the extra shares after just a few months, whereas Occidental will doubtless retain roughly 160 million shares. Even for Occidental, that may be a vital quantity that may have administration’s consideration.

A facet concern is that this was bought together with Anadarko. These widespread items proven above are price roughly $6.5 billion or very roughly one-third of the unique buy worth, which is a large soar from when the acquisition closed. Clearly, Occidental will not be solely doing nicely for the widespread unit holders, however additionally it is in a position to present the advantages of the acquisition of Anadarko.

That doesn’t embody any distributions paid. Occidental has a price foundation when the Anadarko acquisition closed. That doubtless signifies that Occidental now has a distribution yield in extra of 10% yearly on its value foundation of the items. This can be a actual bonanza for Occidental shareholders.

Extra Capital Appreciation Forward

The entire midstream business stays depressed in worth although the business now not raises capital for every mission.

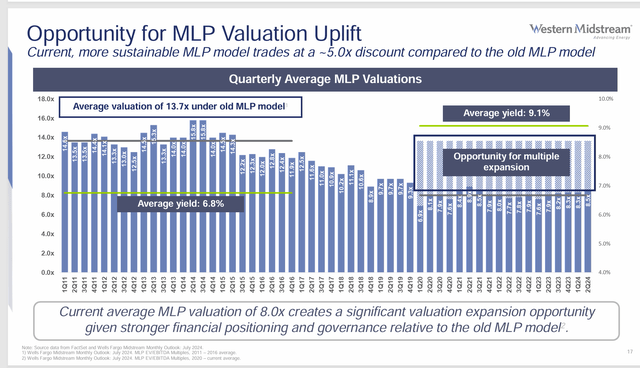

Western Midstream Companions Midstream Valuation Historical past (Western Midstream Companions Company Presentation Second Quarter 2024)

The midstream business really had a better valuation when the business was elevating capital (by promoting widespread items) for every main mission, and had larger leverage again then.

For the reason that capital and debt markets have “cracked down” on previous practices and insisted upon decrease debt and self-financing of future tasks, the reward has been a decrease valuation.

However the present “doghouse valuation” of the business is unlikely to final as a result of, general, the business is way stronger than it was earlier than and really will doubtless develop quicker with out the periodic dilution that widespread unit holders got here to count on prior to now. In the end, the market ought to respect the appreciable monetary enchancment of the business. Even the distribution protection has improved.

Abstract

Western Midstream is now much better run beneath Occidental, with a a lot brighter historical past. But, the market values the achievement of funding grade ranking of the debt and decrease debt ranges lower than the scenario earlier than Occidental took over.

Within the meantime, Occidental seems to be heading Western Midstream in the direction of a progress and earnings technique. This by itself is more likely to guarantee buyers a complete return within the teenagers, even when the valuation stays on the low finish of the historic vary.

Not solely that, however on the present worth, the distribution alone represents what many buyers report as a complete return over time. The corporate does concern a Ok-1. Due to this fact, buyers are suggested to seek the advice of their favourite tax skilled on all of the “ins and outs” of a Ok-1 scenario earlier than they make investments. For people who perceive the tax implications and settle for them, it is a sturdy purchase consideration.

Further returns are doubtless if the market returns the business to valuation ranges of the previous. Western Midstream can develop significantly quicker than Occidental Petroleum as a result of it doesn’t service something near all of Occidental’s operations. That scenario is more likely to persist for years to come back. Further progress is feasible ought to the partnership resolve to diversify away from Occidental in some unspecified time in the future.

Dangers

The midstream a part of the business is mostly relegated to the most secure a part of the business. Earnings is often protected by long-term take or pay contracts. Due to this fact, earnings don’t comply with the upstream cycle, despite the fact that the widespread unit worth typically does. There are security dangers if the protection program falls aside. However Occidental has a really excessive security precedence and a really efficient security program. This can be a welcome departure from a number of the issues taking place with Anadarko.

With a captive midstream like this one, the danger is often the standing of the dad or mum firm. Occidental is in good condition and funding grade itself. Due to this fact, a take-under is way much less of a danger than it’s when the dad or mum firm is financially pressured.

The lack of key personnel might have a cloth impact on the corporate’s future outlook.

[ad_2]

Source link