[ad_1]

I assumed I heard all of it – from Jade Lizards to Damaged Coronary heart Butterflies, to ZEBRAs, to Christmas bushes.

Till one nice day, I heard the point out of the Razzle Dazzle choice commerce on YouTube.

You must hand it to Scot Ruble of Stratagem Commerce for developing with artistic names for his choices methods, a few of which embrace “ViPars,” “Newton’s Cradle,” and “Dragonfly.”

We’re not right here to speak about these.

We’re right here immediately to speak about his Razzle Dazzle commerce.

The dictionary defines razzle-dazzle as “noisy, showy, and thrilling exercise and show designed to draw and impress.”

Sounds very very similar to a circus.

Does the commerce stay as much as its title? Let’s see.

As a result of the aforementioned YouTube was in podcast model, there are not any visuals of the commerce.

At 36 minutes into the speak, Scot described an instance of the commerce in phrases for which skilled choices merchants can mentally visualize.

Nevertheless, some visuals will certainly assist.

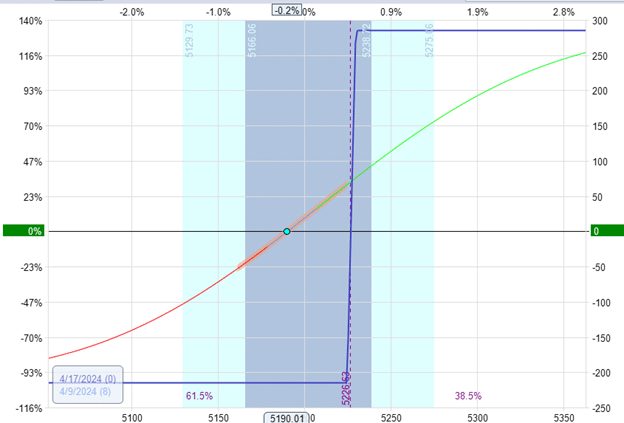

So, we’ll attempt to roughly mannequin his instance commerce in OptionNet Explorer.

Suppose a dealer is bullish on the SPX and buys a bull name unfold every week out in time.

Commerce Particulars

Date: April 9, 2024

Worth: SPX @ 5190

Purchase one April 17 SPX 5225 callSell one April 17 SPX 5230 name

Debit: -$215

Delta: 1.86Theta: -6.29Vega: 4.34

The issue with this unfold is that it has damaging time decay (see the damaging theta).

So, if SPX doesn’t transfer, the commerce will lose cash.

To carry out the “razzle dazzle,” the dealer will promote every day far out-of-the-money bear name credit score spreads to gather some credit.

Do this for a number of days, and one would have collected sufficient to finance the price of the bull name unfold considerably.

One would possibly even be capable to promote sufficient to get the bull name unfold at no cost.

There’s a threat, in fact.

It’s doable that SPX can shoot up via the bear name unfold and take a most loss on the credit score unfold.

The dealer can use mitigation techniques akin to rolling up or out in time.

Nevertheless, that assumes the dealer watches the market on the zero-DTE credit score unfold.

If the dealer doesn’t wish to watch intraday, simply use longer-term expirations, akin to a month-long bull name unfold and promoting weekly bear name credit score spreads.

The idea is similar if the dealer is bearish.

They’d purchase bear put spreads and promote smaller, out-of-the-money, shorter-term bull put spreads to assist finance the principle commerce.

As a result of promoting credit score spreads has a optimistic theta, it additionally negates the impact of the damaging theta of the principle commerce.

Free Lined Name Course

It’s good to have a directional commerce technique at any time when the market exhibits robust directionality.

The Razzle Dazzle choice technique is a directional technique the place the lengthy unfold is the first driver.

The shorter-duration, far-out-of-the-money credit score spreads assist finance the lengthy unfold and provides sufficient optimistic theta to offset the damaging theta of the lengthy unfold.

The important thing to its success is, in fact, its administration and the studying of the market. How a lot credit score spreads to promote?

How shut?

When to roll or exit them?

The administration of the credit score spreads adjusts the quantity of directionality of the lengthy unfold.

The dealer shifts the danger from the debit unfold to the credit score spreads and vice versa.

In different phrases, the danger might be shifted from the long run to the shorter time period or vice versa.

The Razzle Dazzle makes use of the earnings of 0-DTE credit score spreads to finance a directional debit unfold.

If merchants are good at 0-DTE buying and selling, they will get free debit spreads to invest on path with out threat.

If a dealer is dangerous at 0-DTE buying and selling, the losses from the credit score spreads are offset by the positive aspects from the debit unfold.

We hope you loved this text on the Razzie Dazzle choice technique.

When you have any questions, please ship an e mail or depart a remark beneath.

Commerce protected!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who should not aware of change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link