[ad_1]

Gary and Jay write in Your First Dwelling, “Markets go up and down. The fact is there’s by no means actually an ideal market—simply the market you’re coping with if you’re shopping for your private home.” Mirroring this quote, the market in 2024 and 2023 has given consumers challenges – and alternatives.

June is Nationwide Homeownership Month, and it’s a great time to test in on the challenges and alternatives that consumers are coping with. To assist your self turn out to be the economist of alternative on your shoppers, listed here are some key takeaways from the Nationwide Affiliation of Realtors ® (NAR) annual Dwelling Consumers and Sellers Report. In order for you bonus factors, you can too test on our recap from final 12 months right here.

First-Time Consumers

Low stock and excessive rates of interest have roughly stabilized, with some new development serving to ease each value factors and availability. The result’s extra first-time consumers efficiently bought up to now 12 months.

First-Time Consumers Have been 32 % of Total Consumers in 2023, Up from 26 % in 2022A glimmer of excellent information is that extra individuals are coming into their homeownership journey. This previous 12 months’s enhance is welcome: 2022 had the bottom quantity of first-time residence consumers since NAR began amassing knowledge in 1981. Nonetheless, the typical for many of NAR’s information is 38 %, so this market remains to be decrease than historic norms.

A Typical First-Time Purchaser Is In regards to the Identical Age: Mid-ThirtiesThe common age of a first-time purchaser was reported to be 35 years previous, down from 36 years previous final 12 months. The mixture of scholar mortgage debt and excessive value of residing means delaying homeownership till financial savings may be constructed up.

The Pleasure of Homeownership Stays StrongOver half of first-time consumers (60 %) reported that the first motive for buying a house was the need to personal a house of their very own.

Repeat Consumers

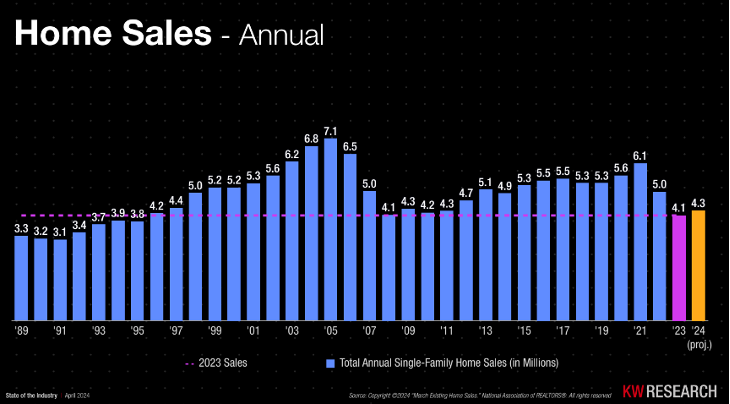

In 2023, there have been a recorded 4.1 million residence gross sales, which is among the lowest numbers in latest historical past. This quantity is identical because it was in 2008, when the Nice Recession, an financial downturn that started in late 2007 and lasted till 2009, was starting to happen. Economists are projecting 4.3 million residence gross sales in 2024, about the identical because the interval instantly following the recession, from 2009-2011. And, because the previous graph illustrates, gross sales are trending up.

Homes Earlier than Authorized SpousesLast 12 months noticed the bottom proportion of first-time consumers who had been married {couples} in over ten years with solely 9 % of consumers being wed. Nonetheless, married {couples} accounted for the biggest proportion (59 %) of latest consumers. Single females stay sturdy as 19 % of latest consumers.

Persevering with Presence of Multi-Generational HousingAs the cost-of-living will increase with inflation, many households are discovering shopping for energy and stability in buying properties past fast households. Fourteen % of residence consumers bought a multi-generational residence, planning to maintain getting older dad and mom and youngsters whereas pooling sources. This quantity has held regular from final 12 months.

For residence consumers wading into the altering market tides and making strikes, some fascinating developments emerged:

Individuals Are Transferring to Keep away from RenovationsForty-five % of most up-to-date consumers who bought new properties had been seeking to keep away from renovations and issues with plumbing or electrical energy.

Lower in Dwelling PricesWith the markets softening in areas, traditionally excessive residence costs are coming down in some markets. Transfer-up consumers reported that 38 % of them bought their new properties due to higher costs.

Pace to Lead MattersIn what appears to be an evergreen development, being top-of-mind stays crucial. A outstanding 71 % of consumers interviewed just one actual property agent throughout their residence search.

The dream of homeownership is alive and nicely, and a difficult market implies that actual property brokers will have the ability to present higher steering and repair. As the true property trade retains its eyes on rates of interest, brokers would do nicely to maintain their ears to their native markets. By protecting in contact with challenges which may matter most to your space, you’ll have the ability to assist consumers navigate their subsequent huge transfer.

In search of extra homeownership sources?

Head over to the Your First Dwelling webpage for freebies, together with info on tips on how to construct out your actual property dream workforce and on your shoppers, a useful resource on tips on how to decide their homeownership standards. Additionally, try Win Large with Seminars: Your First Dwelling for an entire seminar bundle together with customizable shows, a social advertising plan, e mail templates, checklists, and extra!

[ad_2]

Source link