[ad_1]

Time spreads are choices methods consisting of choices which have totally different expiration dates.

When individuals hear time unfold, the very first thing that involves thoughts is the calendar.

Contents

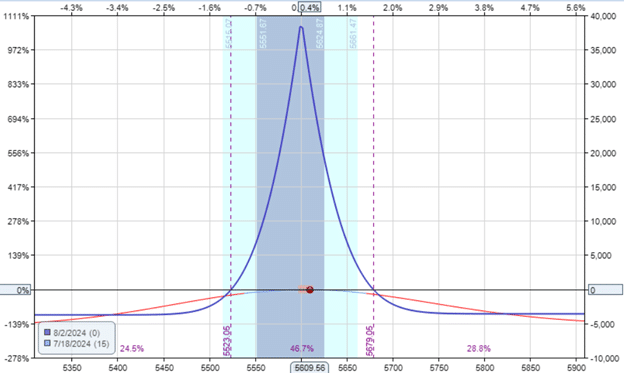

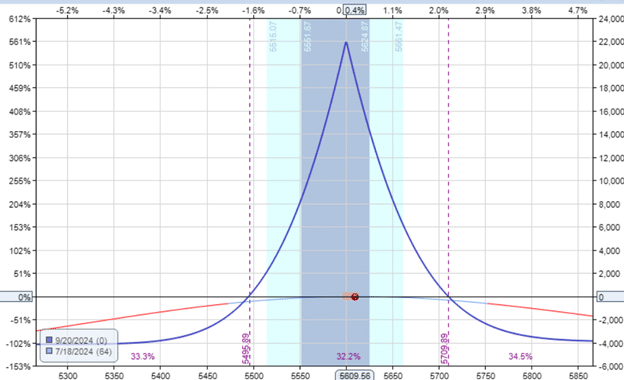

Let’s take a look at a calendar on the SPX index.

Date: July 18, 2024

Worth: SPX @ 5610

Promote twenty Aug 2 SPX 5600 put @ $45.90Buy twenty Aug 5 SPX 5600 put @ $47.70

Internet Debit: -$3600

The primary-order Greeks for this calendar are the Delta, theta, and Vega, as follows:

Delta: -1.4Theta: 460Vega: 864

They inform us how the P&L of the choice place will change as the value, time, and volatility change.

Gamma is one other choices Greek.

It’s a second-order Greek.

Second-order Greeks inform us the speed of change of the first-order Greeks.

Particularly, Gamma tells us Delta’s charge of change with respect to the value of the underlying asset.

How will the Delta of our place change as the value strikes up and down?

That’s what Gamma tells us.

Our calendar has a Gamma of -0.3.

The detrimental worth of Gamma signifies that as the value of SPX strikes up, the Delta will lower – that means that whether it is already detrimental, it is going to change into much more detrimental.

Effectively, that’s not good for our calendar.

Trying on the danger graph, as the value of SPX goes up, our P&L will go down.

That’s the results of our detrimental Delta.

What’s even worse is that as SPX goes up, the Delta will change into much more detrimental – making the place go in opposition to us much more.

That’s the downside with having a detrimental Delta.

When a place goes in opposition to us, it makes the place go in opposition to us much more.

The bigger the magnitude of Gamma, the extra this impact is.

Due to this fact, if we now have to have a detrimental Gamma (which is the case every time we would like constructive theta in a premium promoting technique), we would like the magnitude of that Gamma to be small.

As a substitute of a 20-lot calendar.

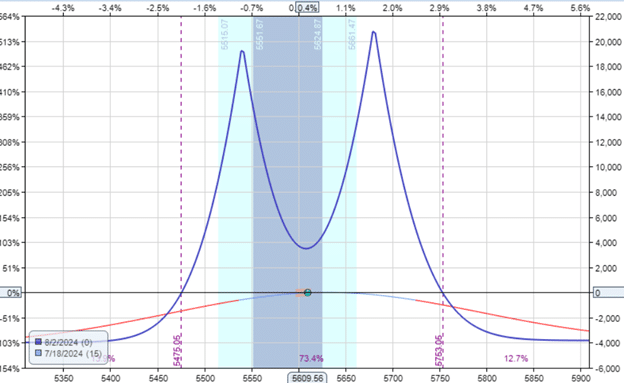

How about we break up that into two calendars?

Ten contracts on the put facet and ten contracts on the decision facet like this:

Promote ten Aug 2 SPX 5540 put @ $27.25Buy ten Aug 5 SPX 5540 put @ $29.15Sell ten Aug 2 SPX 5680 name @ $29.95Buy ten Aug 5 SPX 5680 name @ $31.95

Internet Debit: $3900

Delta: 2.95Theta: 427Vega: 847Gamma: -0.28

The Gamma on this double-calendar is barely decrease at -0.28.

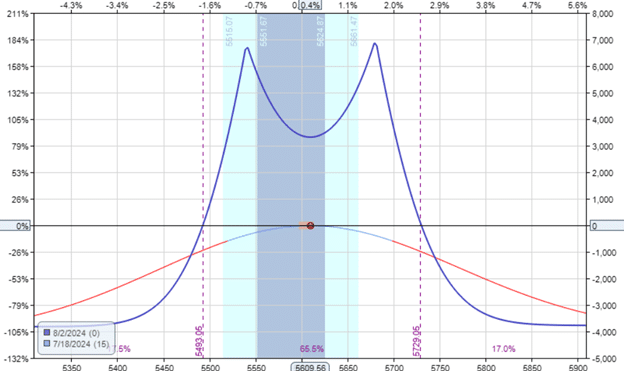

If we transfer the lengthy strikes additional away from the cash, we get a double diagonal like this:

Purchase three Aug 5 SPX 5520 put @ $24.65Sell three Aug 2 SPX 5540 put @ $27.25Sell three Aug 2 SPX 5680 name @ $29.95Buy three Aug 5 SPX 5700 name @ $25.20

Internet Debit: -$3795

We’ve lowered the contract to a few to get the capital invested to be considerably much like the earlier examples.

The Greeks for the double diagonal are:

Delta: -0.12Theta: 174Vega: 81.2Gamma: -0.14

Its Gamma is decrease nonetheless at -0.14.

Free Coated Name Course

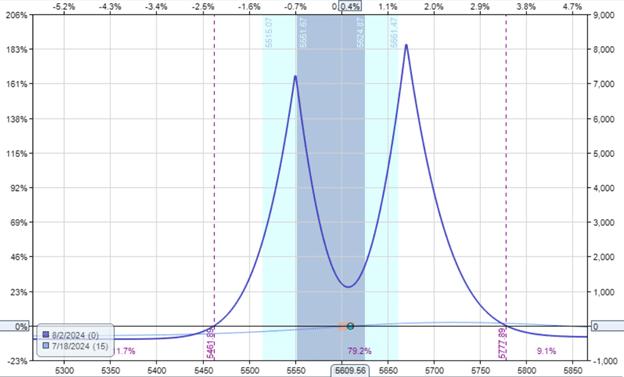

One other approach to do the double diagonal is to have the lengthy choices nearer to the cash than the quick choices.

Promote 4 Aug 2 SPX 5550 put @ $29.75Buy 4 Aug 5 SPX 5560 put @ $34.35Buy 4 Aug 5 SPX 5660 name @ $39.95Sell 4 Aug 2 SPX 5670 name @ $33.65

Internet Debit: -$4360

Despite the fact that the capital invested on this instance at $4360 is bigger than the earlier examples, the Gamma is the bottom at -0.1

Delta: 1.61Theta: 154Vega: 431

Gamma: -0.10

These fast examples appear to point out that double diagonals have decrease Gamma and much more so if we transfer the lengthy strikes nearer to the cash.

When you think about that lengthy choices have constructive Gamma, it is sensible that choice buildings that give them extra prominence may have much less detrimental Gamma.

Does that imply that double diagonals at all times have smaller Gamma than calendars?

No.

By altering the expiration dates, I can simply make a calendar with a decrease Gamma than the double diagonal. As in:

Promote seven Sep 20 SPX 5600 @ $89.45Buy seven Spe 30 SPX 5600 @ $95.05

Internet Debit: -$3920

Delta: 0.63Theta: 45Vega: 492Gamma: -0.06

Does that imply that double diagonals are inherently higher than calendars, and double calendars are higher than single calendars?

No.

For each profit you get, there’s a drawback.

Scroll again by the article and take a look at the theta of every instance.

Whenever you get a smaller Gamma (benefit), you additionally get a smaller theta (drawback).

These fast examples present that Gamma and theta are intimately associated.

We hope you loved this text on the kind of time spreads with the bottom Gamma.

If in case you have any questions, please ship an e-mail or depart a remark under.

Commerce protected!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who usually are not conversant in alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link