[ad_1]

I’ve seen many perfect-fitting curves within the market promoting EAs, lots of which begin with a small deposit and find yourself at an astronomical quantity. Whereas it appears to be like interesting on paper, it additionally raises questions like:

How life like is it? If it is actual, would not the writer be too wealthy to advertise his product? Why wouldn’t it be obtainable for me to buy?

There is a harsh actuality about backtesting on MetaTrader:

A worthwhile backtesting curve does not equal to a worthwhile technique!

There are a number of pitfalls in backtesting, and sometimes you’ll be able to’t belief what you see. I’ll unveil some key components that newbies normally fall into.

The Accuracy of the Backtest

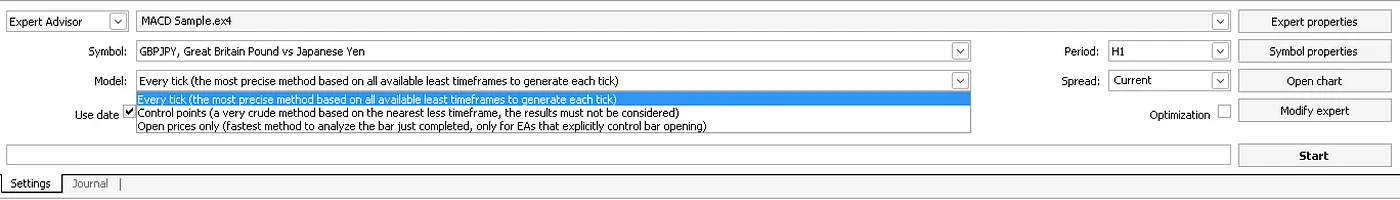

Most quant technique testers present a number of totally different ranges of modeling accuracy. An MT4 instance beneath

It helps 3 varieties

Management Factors: A quicker, much less detailed methodology that approximates tick information utilizing management factors inside a bar. It makes use of the excessive, low, and shut costs to estimate intermediate actions. Open Costs Solely: This methodology solely considers the open value of every bar to judge trades, ignoring intraday value actions. Each Tick: That is essentially the most exact and detailed backtesting choice. It makes use of each tick information, simulating every particular person value motion inside a bar.

Based mostly in your buying and selling technique set off, in case your technique is delicate to the worth change, you need to use tick-level information, whereas for much less delicate methods, management level can be utilized.

Totally different accuracy ranges for a similar technique can generally produce vastly totally different outcomes. Except the technique is deliberately designed to work with non-tick degree information, backtesting ought to at all times use tick information in case your technique is constructed for actual buying and selling.

Modeling High quality

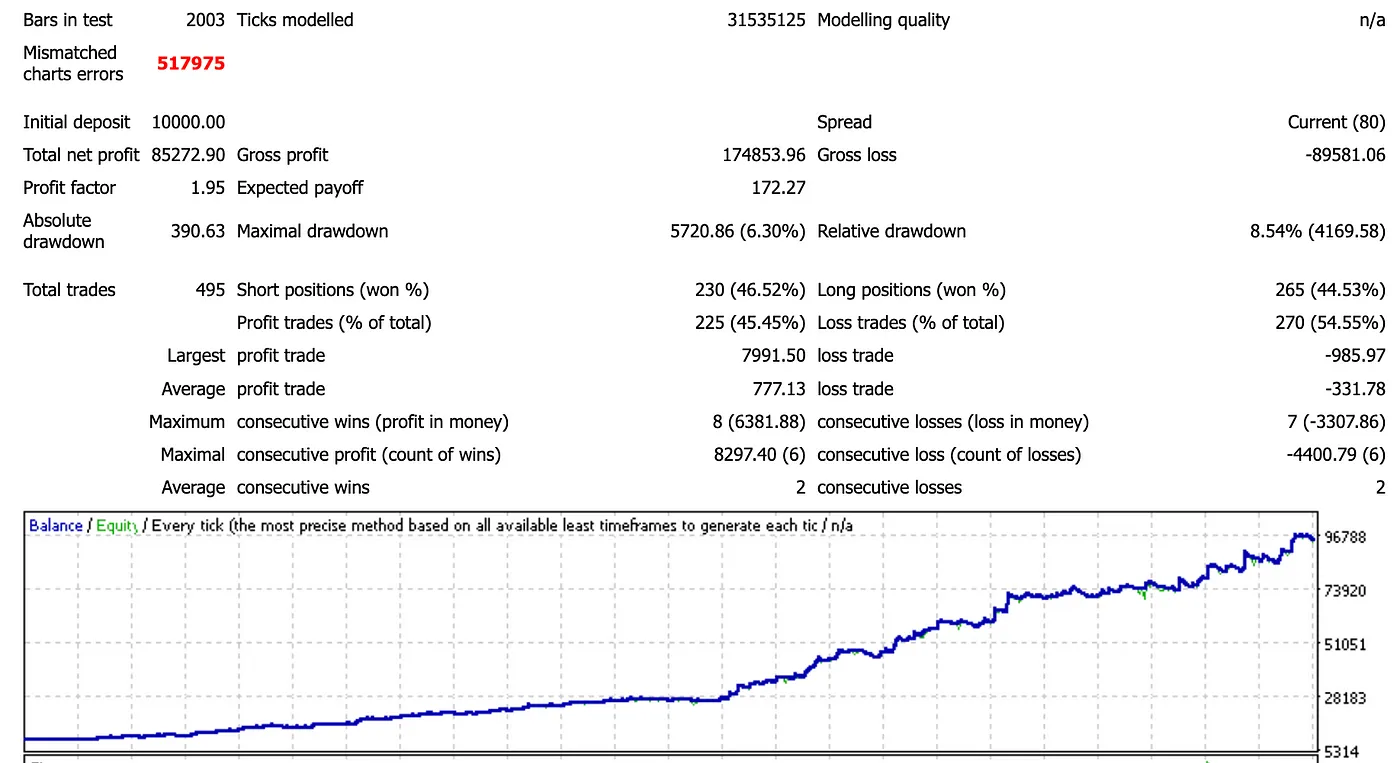

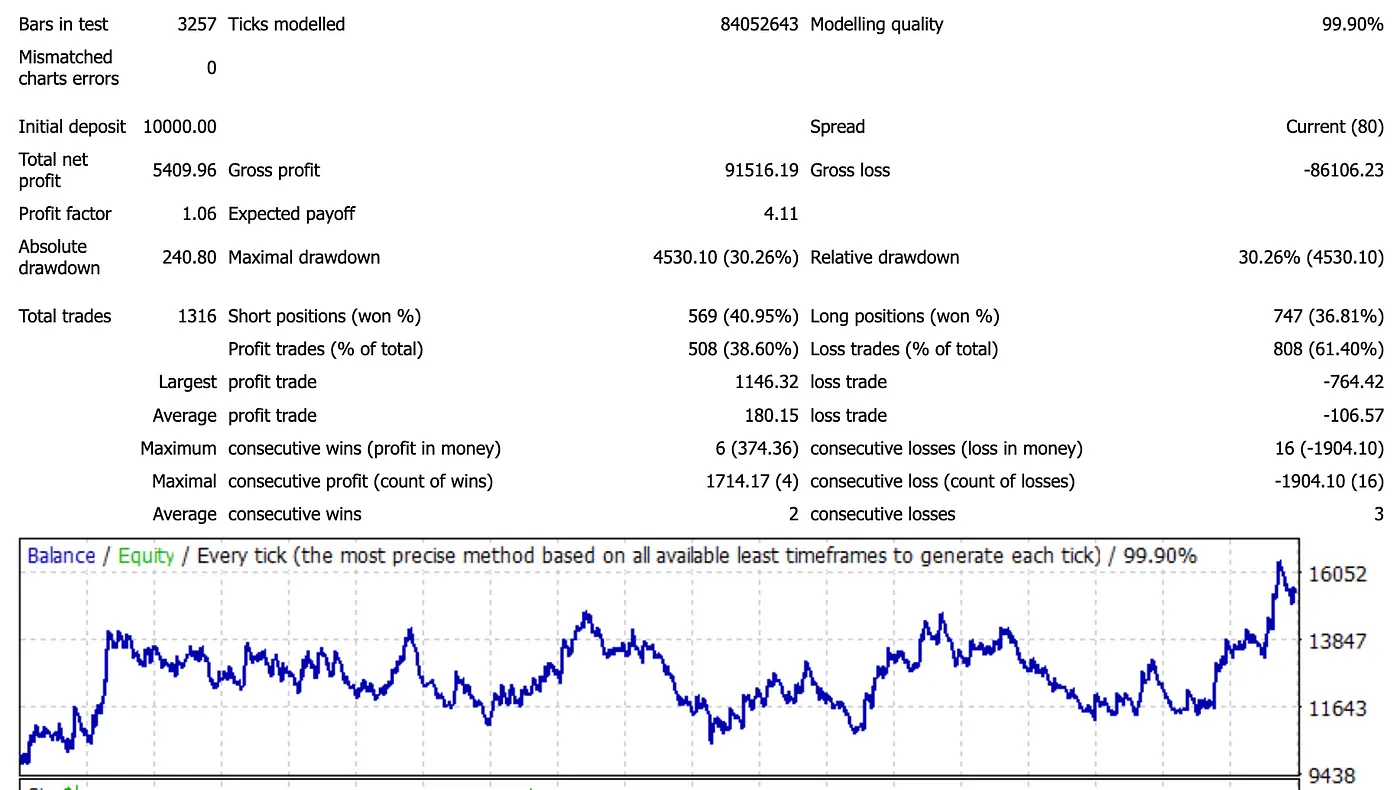

To start with the significance of modeling high quality, let’s take a look at an instance backtest consequence beneath

Isn’t this backtest consequence good? The steadiness curve retains rising over the entire interval with nearly no drawdowns. Now verify one other one,

These two stories look completely totally different, do not they? What if I let you know these two are utilizing the identical technique with the very same parameters? Can you determine what’s gone improper?

The important thing distinction is on the prime proper nook Modelling high quality, the primary graph has a high quality n/a , whereas the second has a 99.9% high quality.

Most backtesting platforms supply minute-level information as their highest granularity. For any lacking information, simulation algorithms are sometimes used to interpolate value actions. The modeling high quality largely displays how a lot of the backtest depends on actual minute-level information. The upper the modeling high quality, the extra dependable the testing outcomes, and the nearer they replicate precise efficiency in a dwell buying and selling atmosphere.

Rule of thumb: A superb backtesting consequence ought to have a modeling high quality of over 90%. Attaining increased ranges of accuracy sometimes requires premium information, as superior information high quality comes at an extra price.

Value, Value, and Value

Value could be very essential within the backtest. If buying and selling had been free, even the only methods may carry out nicely in real-world circumstances. Nevertheless, for energetic buying and selling methods, the distinction between profitability earlier than and after accounting for prices might be vital, usually figuring out whether or not a technique is viable in observe.

The overall sorts of prices that should be thought of are

Fee: The cost on open and shut a commerce. It usually pertains to your place dimension. Swap: The price of holding a place in a single day. Whereas this price can generally be optimistic, for many trend-following methods, this price can contribute considerably to profitability. Execution price: Put in different phrases, slippage price. For market orders, if you place a commerce at $71, you would possibly find yourself shopping for/promoting the place at $71.1 or $70.9, which implies some revenue might be taken by the slippage. Unfold price: Some brokers have implicit expenses on the unfold. It’s good to relate to the charge compositions to grasp how is it charged. Ticket charge: Some brokers additionally cost a hard and fast charge when opening a ticket.

As an instance the significance of price, should you purchase one lot dimension of USDJPY, which is $100,000, a slippage of 0.001 would lead to an additional price of 0.001 x 100,000 = $100, and the swap can vary from $1 ~ 10 primarily based in your holding interval, the overall price is not-negligible evaluate to your revenue.

Sadly, most backtesting instruments don’t consider the true buying and selling price. The best way we observe is to make use of backtesting to generate trades and constructed our personal simulation system to include actual buying and selling prices into the system.

On-line Efficiency

Lastly, upon getting the whole lot in place, it’s important to have a dependable system for deploying and monitoring your trades. It’s essential to do not forget that backtesting doesn’t totally seize future efficiency. Solely in an actual buying and selling atmosphere are you able to actually validate the profitability of your technique.

On MQL, even for indicators or EA with buying and selling efficiency monitoring, there’s nonetheless a number of pitfalls you might want to be careful:

Martingale or Grid Methods

The way it Works: Martingale and grid methods are widespread in automated buying and selling and are designed to extend place sizes in response to losses, aiming to recoup losses on the subsequent profitable commerce. Why It Reveals Excessive Win Charges: These methods can usually keep a really excessive win charge and clean revenue curve within the brief time period as a result of they’re structured to keep away from realizing losses till needed. Nevertheless, they have an inclination to danger vital drawdowns when market developments don’t reverse, probably wiping out complete accounts in excessive instances. Indicators to Look For: Verify if the technique makes use of place doubling or provides positions incrementally with out clear cease losses. Take a look at the historic drawdown proportion on the Alerts web page—it might reveal if the technique’s true danger tolerance is excessive regardless of a excessive win charge.

Quick-Time period Sign and Excessive-Frequency Buying and selling (HFT)

The way it Works: Some methods generate excessive profitability by frequent small trades, counting on short-term value actions. Excessive-frequency buying and selling usually produces small however constant earnings and might be programmed to shut trades rapidly to keep away from lengthy publicity to danger. Why It Reveals Excessive Efficiency: HFT methods can produce excessive win charges and low drawdowns in sure market circumstances as a result of they capitalize on minute value modifications. Nevertheless, they require wonderful execution speeds and will carry out poorly in high-slippage or low-liquidity environments. Indicators to Look For: Verify the typical commerce length and the frequency of trades. If the trades shut in seconds or minutes, the technique is probably going high-frequency, which can carry out inconsistently if market circumstances change.

Unregulated Brokers with Manipulated Spreads and Slippage

How It Works: Shady brokers can artificially regulate spreads, slippage, or execution costs to make it seem as if a technique performs higher than it truly does. They might supply abnormally low spreads or zero slippage in demo or take a look at environments whereas charging increased spreads in dwell buying and selling. Why It Reveals Excessive Efficiency: By lowering buying and selling prices in backtests or demo accounts, these brokers make high-frequency or scalping methods look extra worthwhile than they might be in a dwell atmosphere. Merchants who go dwell would possibly face a lot worse execution, which eats into earnings and will increase losses. Indicators to Search for: Verify Dealer Regulation: Use methods or indicators from brokers regulated by respected authorities just like the FCA (UK), ASIC (Australia), CySEC (Cyprus), or different well-regarded regulators. Regulated brokers usually tend to observe truthful buying and selling practices. Evaluate Sign Efficiency Throughout Brokers: Look for a similar technique or sign throughout totally different brokers to see if efficiency is constant. If a technique solely performs nicely on one unregulated dealer, it’s a crimson flag.

Rule of thumb: There are not any good buying and selling methods with each excessive win charges and low danger (low variance and low drawdown). If a technique has a >50% win charge, it is probably a negative-skew technique that ought to have a revenue issue < 1.0. Conversely, a technique with a < 50% win charge ought to have the next reward-to-risk ratio and a revenue issue > 1.0.

How We Do Backtesting at @Lookatus

At @Lookatus, backtesting is simply the start line of our technique improvement course of. Whereas we use MetaTrader’s technique tester to substantiate directional correctness, we acknowledge its limitations. To make sure the robustness of our methods, we conduct a sequence of rigorous evaluations in an offline simulation system. Here is how we refine our course of:

Threat Analysis: We completely assess the technique’s danger profile, together with deviations and drawdowns, to grasp its stability beneath varied market circumstances.

Buying and selling Pace and Frequency Evaluation: We consider whether or not the extra trades generated by the technique justify the related prices and contribute meaningfully to profitability.

Instrument Suitability and Correlation Evaluation: By analyzing which devices greatest align with the technique, we guarantee diversification and goal to attenuate general portfolio danger.

Buying and selling Value Evaluation: We account for all potential buying and selling prices, together with commissions, swaps, unfold prices, and execution prices, to find out the web profitability of the technique.

Reside Testing in Actual Buying and selling Environments: Lastly, we deploy the technique in an actual buying and selling atmosphere to judge system reliability and measure precise buying and selling efficiency beneath dwell market circumstances.

Abstract

In abstract, backtesting can present insights into a technique’s potential however is usually fraught with pitfalls that may mislead merchants. For life like evaluations:

Use essentially the most correct information obtainable, like tick-level modeling for delicate methods. Prioritize excessive modeling high quality (>90%) to make sure the reliability of outcomes. Account for real-world buying and selling prices, reminiscent of commissions, swaps, slippage, and spreads. Be cautious with methods counting on Martingale, grid, or high-frequency strategies, as they usually masks dangers with excessive win charges. Validate methods by regulated brokers and evaluate performances in dwell environments to mitigate the consequences of manipulated backtests.

Actual-world validation is the last word take a look at of a technique’s viability, as even essentially the most promising backtests might falter in dwell buying and selling as a consequence of unaccounted components.

About Us

We’re @lookatus, a devoted workforce of merchants and engineers dedicated to creating REAL worthwhile, systematic buying and selling options. With a powerful basis in quantitative evaluation and cutting-edge know-how, our mission is to ship dependable, data-driven buying and selling methods that capitalize on market alternatives with precision and consistency. Past constructing superior instruments, we’re enthusiastic about empowering merchants by sensible training, equipping them with actual, actionable insights to navigate markets intelligently and efficiently.

Contact us at: haylookatus@gmail.com

[ad_2]

Source link